SunTrust 2013 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

Notes to Consolidated Financial Statements, continued

148

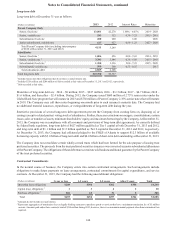

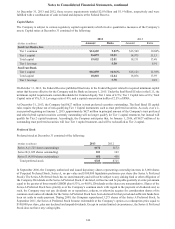

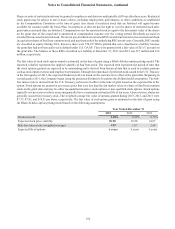

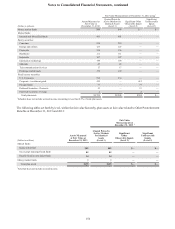

A reconciliation of the expected income tax expense at the statutory federal income tax rate of 35% to the Company’s actual

provision for income taxes and the effective tax rate during the years ended December 31 were as follows:

2013 2012 2011

(Dollars in millions) Amount

Percent of

Pre-Tax

Income Amount

Percent of

Pre-Tax

Income Amount

Percent of

Pre-Tax

Income

Income tax expense at federal statutory rate $566 35.0% $956 35.0% $254 35.0%

Increase (decrease) resulting from:

State income taxes, net 20 1.2 (9) (0.3) 1 0.1

Tax-exempt interest (80) (4.9) (77) (2.8) (72) (9.9)

Internal restructuring (343) (21.3) —— ——

Changes in UTBs (including interest), net 152 9.4 1 — 1 0.1

Income tax credits (84) (5.2) (83) (3.0) (88) (12.1)

Non-deductible expenses 49 3.1 16 0.6 6 0.8

Dividends received deduction (1) — (8) (0.3) (14) (1.9)

Other (6) (0.4) (23) (0.9) (9) (1.2)

Total income tax expense and rate $273 16.9% $773 28.3% $79 10.9%

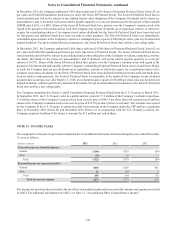

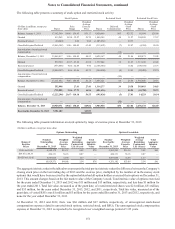

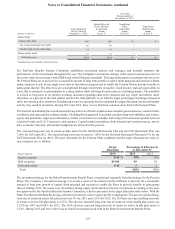

Deferred income tax assets and liabilities result from differences between the timing of the recognition of assets and liabilities

for financial reporting purposes and for income tax return purposes. These assets and liabilities are measured using the enacted

federal and state tax rates expected to apply in the periods in which the deferred tax assets or liabilities are expected to be

realized. The net deferred income tax liability is recorded in other liabilities in the Consolidated Balance Sheets. The significant

components of the DTAs and DTLs, net of the federal impact for state taxes, at December 31 were as follows:

(Dollars in millions) 2013 2012

DTAs:

ALLL $795 $861

Accrued expenses 463 685

State NOL and other carryforwards 208 169

Net unrealized losses in AOCI 153 —

Other 131 173

Total gross DTAs 1,750 1,888

Valuation allowance (102) (56)

Total DTAs $1,648 $1,832

DTLs:

Leasing $804 $786

Net unrealized gains in AOCI —197

Compensation and employee benefits 97 74

MSRs 566 623

Loans 98 72

Goodwill and intangible assets 151 141

Fixed assets 153 196

Other 53 62

Total DTLs $1,922 $2,151

Net DTL ($274) ($319)

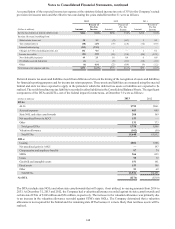

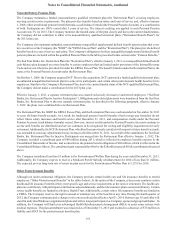

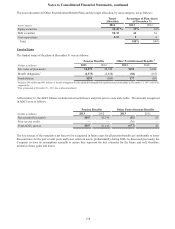

The DTAs include state NOLs and other state carryforwards that will expire, if not utilized, in varying amounts from 2014 to

2033. At December 31, 2013 and 2012, the Company had a valuation allowance recorded against its state carryforwards and

certain state DTAs of $102 million and $56 million, respectively. The increase in the valuation allowance was primarily due

to an increase in the valuation allowance recorded against STM’s state NOLs. The Company determined that a valuation

allowance is not required for the federal and the remaining state DTAs because it is more likely than not these assets will be

realized.