SunTrust 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

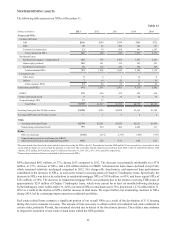

56

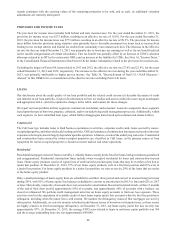

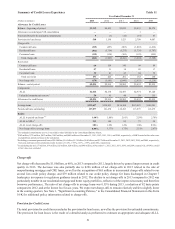

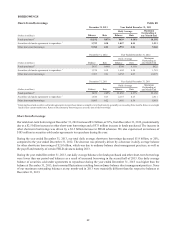

The following tables display our residential real estate TDR portfolio by modification type and payment status. Guaranteed

loans that have been repurchased from Ginnie Mae under an early buyout clause and subsequently modified have been excluded

from the table. Such loans totaled approximately $54 million and $24 million at December 31, 2013 and 2012, respectively.

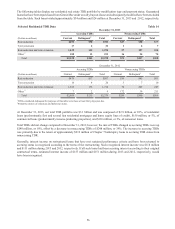

Selected Residential TDR Data Table 14

December 31, 2013

Accruing TDRs Nonaccruing TDRs

(Dollars in millions) Current Delinquent1Total Current Delinquent1Total

Rate reduction $692 $90 $782 $27 $50 $77

Term extension 17 4 21 1 6 7

Rate reduction and term extension 1,439 135 1,574 27 127 154

Other 2180 13 193 16 54 70

Total $2,328 $242 $2,570 $71 $237 $308

December 31, 2012

Accruing TDRs Nonaccruing TDRs

(Dollars in millions) Current Delinquent1Total Current Delinquent1Total

Rate reduction $470 $37 $507 $36 $45 $81

Term extension 16 4 20 3 7 10

Rate reduction and term extension 1,562 172 1,734 78 209 287

Other 27 2 9 172 39 211

Total $2,055 $215 $2,270 $289 $300 $589

1 TDRs considered delinquent for purposes of this table were those at least thirty days past due.

2 Primarily consists of extensions and deficiency notes.

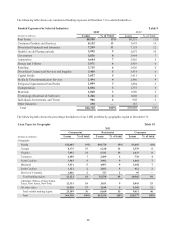

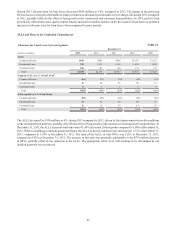

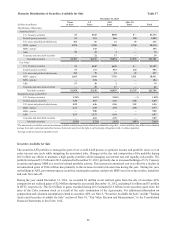

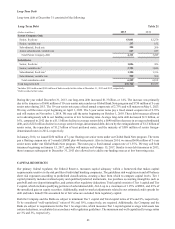

At December 31, 2013, our total TDR portfolio was $3.1 billion and was composed of $2.9 billion, or 92%, of residential

loans (predominantly first and second lien residential mortgages and home equity lines of credit), $150 million, or 5%, of

commercial loans (predominantly income-producing properties), and $110 million, or 3%, of consumer loans.

Total TDRs did not change compared to December 31, 2012; however, the mix of TDRs changed as accruing TDRs were up

$248 million, or 10%, offset by a decrease in nonaccruing TDRs of $248 million, or 39%. The increase in accruing TDRs

was primarily due to the return of approximately $219 million of Chapter 7 bankruptcy loans to accruing TDR status from

nonaccruing TDR.

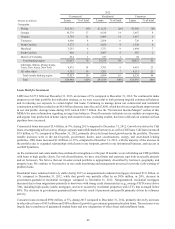

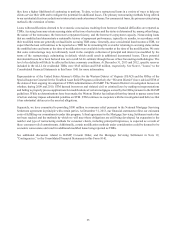

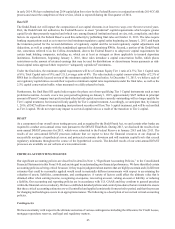

Generally, interest income on restructured loans that have met sustained performance criteria and have been returned to

accruing status is recognized according to the terms of the restructuring. Such recognized interest income was $118 million

and $111 million during 2013 and 2012, respectively. If all such loans had been accruing interest according to their original

contractual terms, estimated interest income of $157 million and $151 million during 2013 and 2012, respectively, would

have been recognized.