SunTrust 2013 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

Notes to Consolidated Financial Statements, continued

126

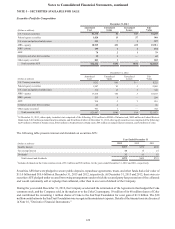

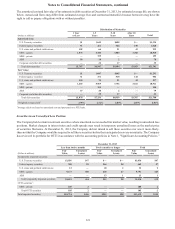

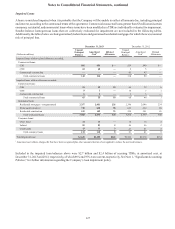

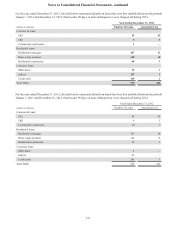

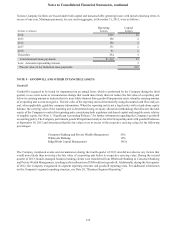

The payment status for the LHFI portfolio is shown in the tables below:

December 31, 2013

(Dollars in millions)

Accruing

Current

Accruing

30-89 Days

Past Due

Accruing

90+ Days

Past Due Nonaccruing 2Total

Commercial loans:

C&I $57,713 $47 $18 $196 $57,974

CRE 5,430 5 7 39 5,481

Commercial construction 842 1 — 12 855

Total commercial loans 63,985 53 25 247 64,310

Residential loans:

Residential mortgages - guaranteed 2,787 58 571 — 3,416

Residential mortgages - nonguaranteed123,808 150 13 441 24,412

Home equity products 14,480 119 — 210 14,809

Residential construction 488 4 — 61 553

Total residential loans 41,563 331 584 712 43,190

Consumer loans:

Guaranteed student loans 4,475 461 609 — 5,545

Other direct 2,803 18 3 5 2,829

Indirect 11,189 75 1 7 11,272

Credit cards 718 7 6 — 731

Total consumer loans 19,185 561 619 12 20,377

Total LHFI $124,733 $945 $1,228 $971 $127,877

1 Includes $302 million of loans carried at fair value, the majority of which were accruing current.

2 Nonaccruing loans past due 90 days or more totaled $653 million. Nonaccruing loans past due fewer than 90 days include modified nonaccrual loans reported

as TDRs and performing second lien loans which are classified as nonaccrual when the first lien loan is nonperforming.

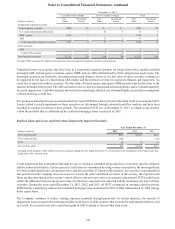

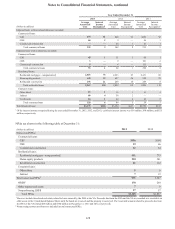

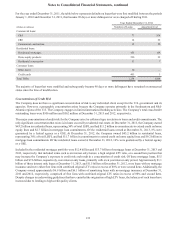

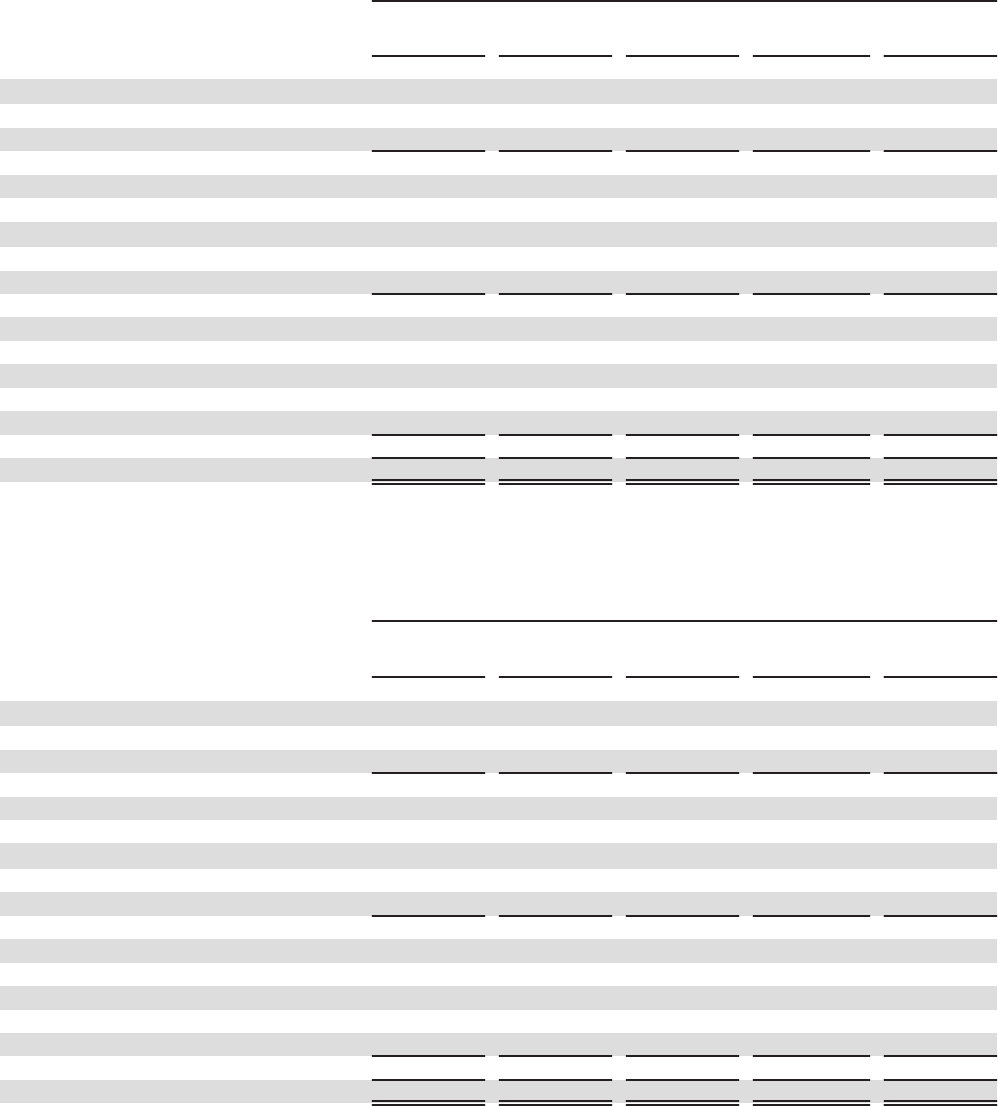

December 31, 2012

(Dollars in millions)

Accruing

Current

Accruing

30-89 Days

Past Due

Accruing

90+ Days

Past Due Nonaccruing 2Total

Commercial loans:

C&I $53,747 $81 $26 $194 $54,048

CRE 4,050 11 — 66 4,127

Commercial construction 679 — — 34 713

Total commercial loans 58,476 92 26 294 58,888

Residential loans:

Residential mortgages - guaranteed 3,523 39 690 — 4,252

Residential mortgages - nonguaranteed122,401 192 21 775 23,389

Home equity products 14,314 149 1 341 14,805

Residential construction 625 15 1 112 753

Total residential loans 40,863 395 713 1,228 43,199

Consumer loans:

Guaranteed student loans 4,769 556 32 — 5,357

Other direct 2,372 15 3 6 2,396

Indirect 10,909 68 2 19 10,998

Credit cards 619 7 6 — 632

Total consumer loans 18,669 646 43 25 19,383

Total LHFI $118,008 $1,133 $782 $1,547 $121,470

1 Includes $379 million of loans carried at fair value, the majority of which were accruing current.

2 Nonaccruing loans past due 90 days or more totaled $975 million. Nonaccruing loans past due fewer than 90 days include modified nonaccrual loans reported

as TDRs and performing second lien loans which are classified as nonaccrual when the first lien loan is nonperforming.