SunTrust 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

collateral may be sold could require us to significantly decrease or increase the level of the Allowance for Credit Losses. Such

an adjustment could materially affect net income as a result of the change in provision for credit losses. For additional discussion

of the ALLL see the “Allowance for Credit Losses” and “Nonperforming Assets” sections in this MD&A as well as Note 6,

“Loans,” and Note 7, “Allowance for Credit Losses,” to the Consolidated Financial Statements in this Form 10-K.

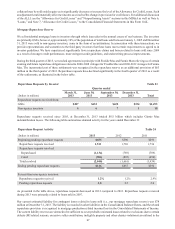

Mortgage Repurchase Reserve

We sell residential mortgage loans to investors through whole loan sales in the normal course of our business. The investors

are primarily GSEs; however, approximately 10% of the population of total loans sold between January 1, 2005 and December

31, 2013 were sold to non-agency investors, some in the form of securitizations. In association with these transactions, we

provide representations and warranties to the third party investors that these loans meet certain requirements as agreed to in

investor guidelines. We have experienced significantly fewer repurchase claims and losses related to loans sold since 2009

as a result of stronger credit performance, more stringent credit guidelines, and underwriting process improvements.

During the third quarter of 2013, we reached agreements in principle with Freddie Mac and Fannie Mae relieving us of certain

existing and future repurchase obligations related to 2000-2008 vintages for Freddie Mac and 2000-2012 vintages for Fannie

Mae. The incremental cost of these settlements was recognized in the repurchase reserve as an additional provision of $63

million in the third quarter of 2013. Repurchase requests have declined significantly in the fourth quarter of 2013 as a result

of the settlements, as illustrated in the below table.

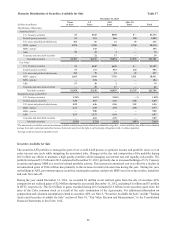

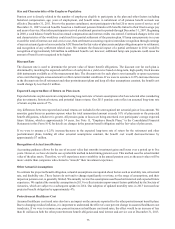

Repurchase Requests by Investor Table 23

Quarter ended

(Dollars in millions)

March 31,

2013

June 30,

2013

September 30,

2013

December 31,

2013 Total

Repurchase requests received from:

GSEs $487 $432 $420 $154 $1,493

Non-agency investors 467118

Repurchase requests received since 2005, at December 31, 2013 totaled $8.5 billion which includes Ginnie Mae

indemnification losses. The following table summarizes demand activity for the years ended December 31:

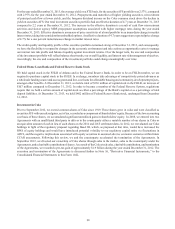

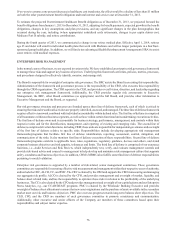

Repurchase Request Activity Table 24

(Dollars in millions) 2013 2012 2011

Beginning pending repurchase requests $655 $590 $293

Repurchase requests received 1,511 1,726 1,736

Repurchase requests resolved:

Repurchased (1,134) (769)(789)

Cured (906) (892)(650)

Total resolved (2,040) (1,661)(1,439)

Ending pending repurchase requests $126 $655 $590

Percent from non-agency investors:

Repurchase requests received 1.2% 1.2% 2.9%

Pending repurchase requests 2.8 2.5 2.0

As presented in the table above, repurchase requests decreased in 2013 compared to 2012. Repurchase requests received

during 2013 were primarily related to loans sold in 2007.

Our current estimated liability for contingent losses related to loans sold (i.e., our mortgage repurchase reserve) was $78

million at December 31, 2013. The liability is recorded in other liabilities in the Consolidated Balance Sheets, and the related

repurchase provision is recognized in mortgage production related income/(loss) in the Consolidated Statements of Income.

The current liability reserves are deemed to be sufficient to cover probable estimated losses related to exclusions due to certain

defects (MI related reasons, excessive seller contribution, ineligible property and other charter violations) as outlined in the