SunTrust 2013 Annual Report Download - page 201

Download and view the complete annual report

Please find page 201 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

Notes to Consolidated Financial Statements, continued

185

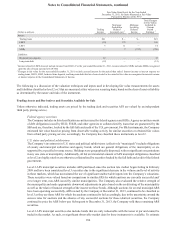

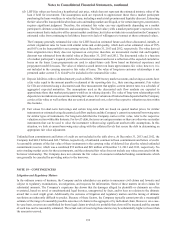

value the debt was made to align the accounting for the debt with the accounting for the derivatives without having

to account for the debt under hedge accounting, thus avoiding the complex and time consuming fair value hedge

accounting requirements.

The Company’s public debt carried at fair value impacts earnings predominantly through changes in the Company’s

credit spreads as the Company has entered into derivative financial instruments that economically convert the interest

rate on the debt from fixed to floating. The estimated earnings impact from changes in credit spreads above U.S.

Treasury rates were $40 million and $78 million of losses and $57 million of gains for the years ended December

31, 2013, 2012, and 2011, respectively.

The Company also carries approximately $256 million of issued securities contained in a consolidated CLO at fair

value to recognize the nonrecourse nature of these liabilities to the Company. Specifically, the holders of the liabilities

are only paid interest and principal to the extent of the cash flows from the assets of the vehicle, and the Company

has no current or future obligations to fund any of the CLO vehicle’s liabilities. The Company classified these

securities as level 2, as the primary driver of their fair values are the loans owned by the CLO, which the Company

also elected to carry at fair value, as discussed herein under “Loans Held for Sale and Loans Held for Investment–

Corporate and other LHFS.”

Other liabilities

The Company’s other liabilities that are carried at fair value on a recurring basis include contingent consideration

obligations related to acquisitions, as well as the derivative that the Company obtained as a result of its sale of Visa

Class B shares. Contingent consideration associated with acquisitions is adjusted to fair value until settled. As the

assumptions used to measure fair value are based on internal metrics that are not market observable, the earn-out is

considered a level 3 liability. During the second quarter of 2009, in connection with its sale of Visa Class B shares,

the Company entered into a derivative contract whereby the ultimate cash payments received or paid, if any, under

the contract are based on the ultimate resolution of litigation involving Visa. The value of the derivative was estimated

based on the Company’s expectations regarding the ultimate resolution of that litigation, which involved a high

degree of judgment and subjectivity. Accordingly, the value of the derivative liability is classified as a level 3

instrument. See Note 17, "Guarantees," for a discussion of the valuation assumptions.