SunTrust 2013 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

150

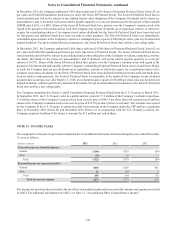

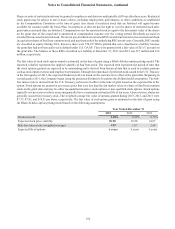

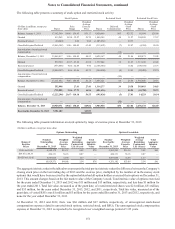

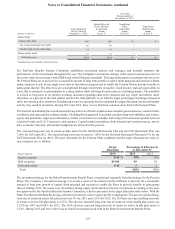

Shares or units of restricted stock may be granted to employees and directors and typically cliff vest after three years. Restricted

stock grants may be subject to one or more criteria, including employment, performance, or other conditions as established

by the Compensation Committee at the time of grant. Any shares of restricted stock that are forfeited will again become

available for issuance under the Stock Plan. An employee or director has the right to vote the shares of restricted stock after

grant unless and until they are forfeited. Compensation cost for restricted stock is equal to the fair market value of the shares

on the grant date of the award and is amortized to compensation expense over the vesting period. Dividends are paid on

awarded but unvested restricted stock. We do not pay dividends on unvested RSU awards but instead accrue and reinvest them

in equivalent shares of SunTrust common stock and pay them only if the underlying RSU award vests. Generally, RSU awards

are classified as equity. During 2012, however, there were 574,257 RSUs granted that were classified as a liability because

the grant date had not been achieved as defined under U.S. GAAP. They were granted with a fair value of $21.67 per unit on

the grant date. The balance of these RSUs classified as a liability at December 31, 2013 and 2012 was $17 million and $12

million, respectively.

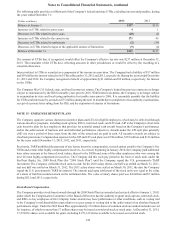

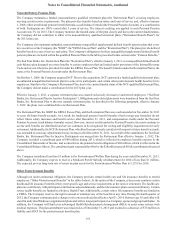

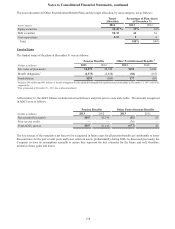

The fair value of each stock option award is estimated on the date of grant using a Black-Scholes option pricing model. The

expected volatility represents the implied volatility of SunTrust stock. The expected term represents the period of time that

the stock options granted are expected to be outstanding and is derived from historical data that is used to evaluate patterns

such as stock option exercise and employee termination. Through the repurchase of preferred stock issued to the U.S. Treasury

in the first quarter of 2011, the expected dividend yield was based on the current rate in effect at the grant date. Beginning in

second quarter 2011, the Company began using the projected dividend to be paid as the dividend yield assumption. The risk-

free interest rate is derived from the U.S. Treasury yield curve in effect at the time of grant based on the expected life of the

option. Stock options are granted at an exercise price that is no less than the fair market value of a share of SunTrust common

stock on the grant date and may be either tax-qualified incentive stock options or non-qualified stock options. Stock options

typically vest pro-rata over three years and generally have a maximum contractual life of ten years. Upon exercise, shares are

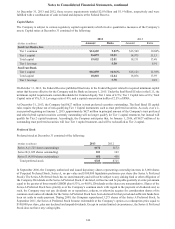

generally issued from treasury stock. The weighted average fair value of options granted during 2013, 2012, and 2011 were

$7.37, $7.83, and $10.51 per share, respectively. The fair value of each option grant is estimated on the date of grant using

the Black-Scholes option pricing model based on the following assumptions:

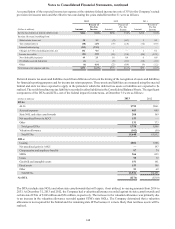

Year Ended December 31

2013 2012 2011

Dividend yield 1.28% 0.91% 0.75%

Expected stock price volatility 30.98 39.88 34.87

Risk-free interest rate (weighted average) 1.02 1.07 2.48

Expected life of options 6 years 6 years 6 years