SunTrust 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

EXECUTIVE OVERVIEW

Economic and regulatory

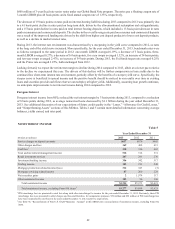

The economic landscape in 2013 reflected gradual improvement in economic activity and labor market conditions, increased

consumer confidence and household spending, and further strengthening of many housing markets in which we operate. As the

overall economy improved, increases in mortgage interest rates during the year resulted in a decline in mortgage refinance activity

from the strong levels in 2012. Despite the increase in mortgage interest rates, consumer borrowing costs remained at relatively

low levels which continued to be a catalyst to increased consumer spending. Consumer spending increased compared to 2012 and

during 2013 reached levels last seen prior to the recession, before declining at December 31, 2013, to a level moderately below

the prior year end. The unemployment rate dropped to below 7% at December 31, 2013, compared to the rate at December 31,

2012, which was slightly below 8%. The drop in unemployment and improvement in economic conditions during 2013 aided the

changes in U.S. monetary policy announced at the end of 2013, as discussed further below. The housing market continued to

strengthen in 2013, as demonstrated by continued price increases, favorable shifts in supply and demand, and some encouraging

signs from certain homebuilding activities. However, the rise in mortgage interest rates that began in the second quarter of 2013

applied pressure on the housing recovery and significantly impacted refinancing activity.

During 2013, the Federal Reserve maintained a highly accommodative monetary policy and indicated that this policy would remain

in effect for a considerable time after its asset purchase program ends and the economic recovery strengthens. Accordingly, the

Federal Reserve maintained key interest rates at exceptionally low levels during 2013, and indicated that they would likely remain

at these levels well past the time that the unemployment rate drops below 6.5%, especially if its long-term inflation goals are not

met. As a result of executing its monetary policy, the Federal Reserve continued to maintain large portfolios of U.S. Treasury notes

and bonds and agency MBS and continued adding Treasuries and agency MBS to its portfolio during 2013. However, during 2013,

driven in large part by the financial markets' expectations regarding future Federal Reserve monetary policy actions, certain market

interest rates increased and the yield curve steepened compared to December 31, 2012. During December 2013, the Federal Reserve

indicated that it would begin to modestly reduce its pace of Treasury and agency MBS purchases in January 2014 in light of

cumulative progress in unemployment and labor market conditions. The Federal Reserve indicated further that a reduction of its

asset purchases was likely with continued improving economic indicators, but that its asset purchases are not on a preset course

and the decision to moderate purchases further will be based on close monitoring of economic and financial developments over

the coming months and how these developments support any continued improvement in labor market conditions and inflation

objectives. Despite the currently planned moderation in asset purchases, the Federal Reserve indicated that, in its view, the sizable

and still increasing holdings of longer-term securities should maintain downward pressure on longer-term interest rates, support

mortgage markets, and allow more accommodative financial conditions. The Federal Reserve outlook includes economic growth

that will strengthen from current levels with appropriate policy accommodation, a gradual decline in unemployment, and the

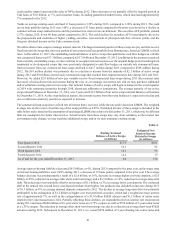

expectation of gradually increasing longer-term inflation. See additional discussion regarding the increase in interest rates in the

"Net Interest Income/Margin" and "Noninterest Income" sections of this MD&A.

Capital

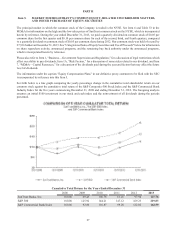

During 2013, we announced capital plans in conjunction with the 2013 CCAR submission and completion of the Federal Reserve's

review of our capital plan. Accordingly, during 2013 we repurchased $150 million of our common stock, and we subsequently

repurchased an additional $50 million of our common stock in early 2014. Additionally, we increased our quarterly common stock

dividend by $0.05 per common share effective in the second quarter of 2013, which resulted in dividends for 2013 of $0.35 per

common share, an increase from $0.20 per common share in 2012. We have submitted our 2014 capital plan in conjunction with

the 2014 CCAR submission, and upon completion of the Federal Reserve's review of the capital plan, we will announce any future

capital actions.

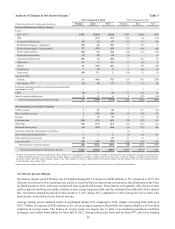

At December 31, 2013 our capital ratios were well above the requirements to be considered “well capitalized” according to current

and expected future regulatory standards, as earnings during 2013 drove a $1.1 billion increase in our Tier 1 common equity. Our

Tier 1 common equity ratio was 9.82% at December 31, 2013, compared to 10.04% at December 31, 2012. The decline in the ratio

compared to the prior year was primarily due to an increase in RWA as a result of loan growth and an increase in unused lending

commitments. Our Tier 1 capital and total capital ratios were 10.81% and 12.81%, respectively, at December 31, 2013 compared

to 11.13% and 13.48%, respectively, at December 31, 2012, which also declined moderately from the prior year primarily due to

the same reasons as the decline in the Tier 1 common equity ratio. See additional discussion of our capital and liquidity position

in the “Capital Resources” and “Liquidity Risk Management” sections of this MD&A.

The Federal Reserve published final rules on October 11, 2013 related to capital adequacy requirements to implement the BCBS's

Basel III framework for financial institutions in the U.S. The final rules become effective for us on January 1, 2015, and, based

on our current analysis of the rules, we believe that our RWA will increase slightly primarily due to increased risk-weightings for

MSRs and certain on and off-balance sheet exposures, resulting in a small decline in our capital ratios. Based on our current and

ongoing analysis of the recently published rules, we estimate our current Basel III common equity Tier 1 ratio, on a fully phased-