SunTrust 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.92

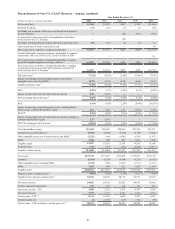

Years Ended December 31, 2012 vs. 2011

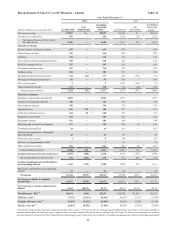

Consumer Banking and Private Wealth Management

Consumer Banking and Private Wealth Management reported net income of $310 million during the year ended December

31, 2012, a decrease of $40 million, or 11%, compared to 2011. The decrease in net income was due to lower noninterest

income and higher noninterest expenses, partially offset by lower provision for credit losses.

Net interest income was $2.7 billion during 2012, a decrease of $6 million compared to 2011. The decrease was driven by

lower loan and deposit spreads, partially offset by the impact of higher average loan balances. Net interest income related to

loans increased $17 million, or 2%, compared to the prior year driven by a $1.6 billion, or 4%, increase in average loan

balances, partially offset by a decrease in loan spreads of six basis points. The increase in average loans was driven by the

fourth quarter of 2011 acquisitions of student loan portfolios and higher production in indirect auto loans, partially offset by

decreases in equity lines, commercial real estate, and residential mortgages. Other funding costs related to other assets improved

by $28 million, driven primarily by a decline in funding rates. Net interest income related to client deposits decreased $52

million, or 3%, compared to the same period in 2011. The decrease in net interest income was driven by a five basis point

decline in deposit spreads and a $560 million decrease in average client deposit balances.

Provision for credit losses was $645 million during 2012, a decrease of $144 million, or 18%, compared to 2011. The decrease

was driven by declines in net charge-offs of $70 million in home equity lines, $31 million in commercial, $17 million in

indirect, $17 million in credit card, and $10 million in residential mortgage loans. Included in these amounts were $43 million

of incremental charge-offs related to a change in credit policy accelerating the charge-off of second lien loans from 180 days

to 120 days past due and $31 million of incremental charge-offs related to a change in policy to recognize charge-offs on loans

discharged in Chapter 7 bankruptcy. See additional discussion of credit and asset quality in the “Loans,” “Allowance for Credit

Losses,” and “Nonperforming Assets” sections of this MD&A.

Total noninterest income was $1.5 billion during 2012, a decrease of $178 million, or 11%, compared to 2011. Card fees

decreased $153 million compared to 2011 driven by regulations on debit interchange fee income that became effective during

2011. Additionally, there was a $20 million decline in trust and investment management income influenced by clients' desires

for additional liquidity, along with a $16 million decline in service charges on deposit accounts, partially offset by a $12

million increase in retail investment income.

Total noninterest expense was $3.1 billion during 2012, an increase of $22 million, or 1%, compared to 2011. The increase

was driven by corporate overhead allocations that offset a decrease in expenses managed by the business, such as reduced

staff expense, other real estate, advertising, other staff, and operating supplies expense.

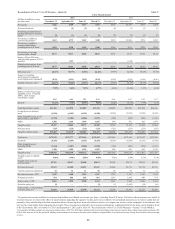

Wholesale Banking

Wholesale Banking reported net income of $698 million during the year ended December 31, 2012, an increase of $428

million, compared to 2011. The increase was attributable to decreases in provision for credit losses and noninterest expense

combined with increases in both net interest income and noninterest income.

Net interest income was $1.7 billion during 2012, an increase of $165 million, or 11%, compared to 2011, driven by higher

loan and deposit balances. Net interest income related to loans increased $94 million, or 10%, as average loan balances

increased $3.8 billion, or 8%, driven by increases in commercial domestic and tax-exempt loans, partially offset by decreases

in CRE loans. Net interest income related to deposits increased $51 million, or 9%, resulting from a $3.6 billion, or 10%,

increase in client deposit balances. Favorable trends in deposit mix continued as lower cost demand deposits increased $4.3

billion, or 27%, while average interest-bearing transaction accounts and money market accounts decreased a combined $608

million, or 3%.

Provision for credit losses was $266 million during 2012, a decrease of $293 million, or 52%, compared to 2011. The decrease

was driven by lower net charge-offs in CRE, commercial domestic, and residential mortgage loans.

Total noninterest income was $1.4 billion during 2012, an increase of $182 million, or 15%, compared to 2011, predominantly

driven by increased trading revenue, investment banking revenue, service charges on deposit accounts, card services, and non

margin loan fees. These increases were partially offset by declines in letter of credit fees and other miscellaneous income.