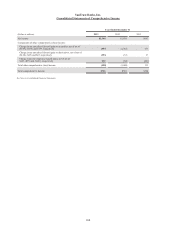

SunTrust 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

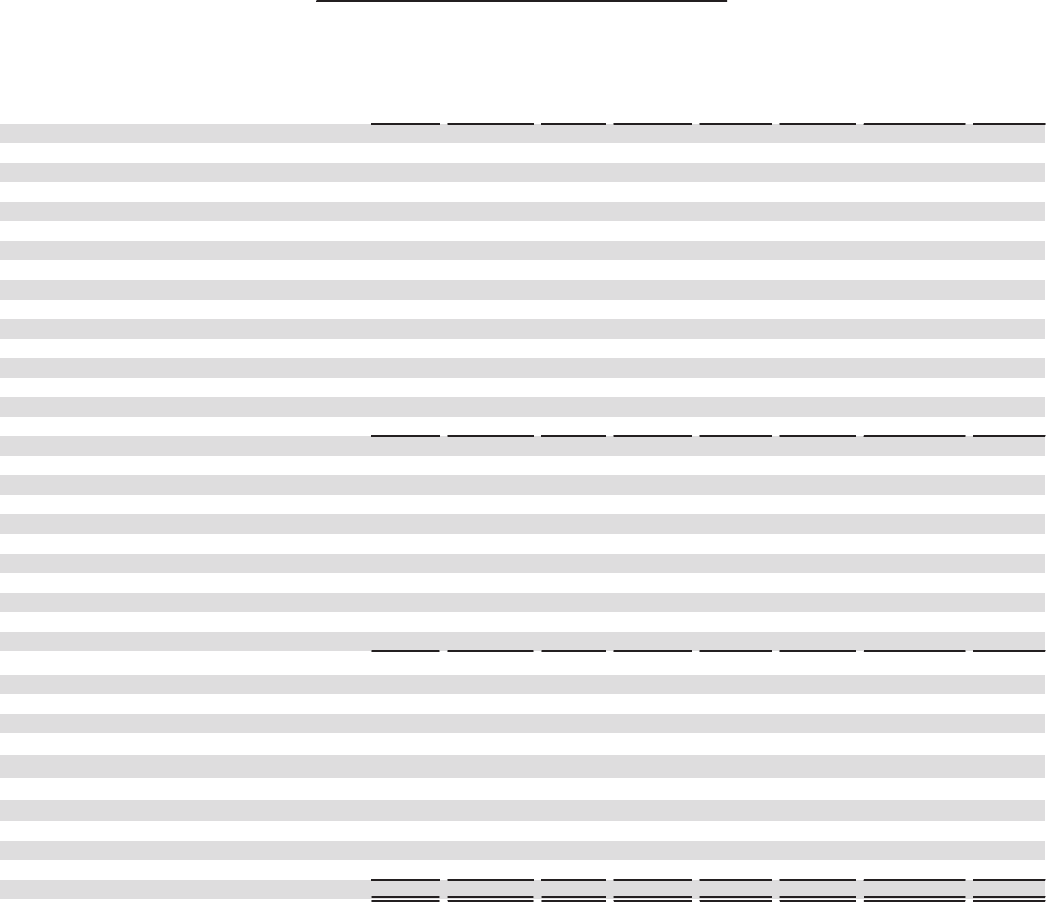

106

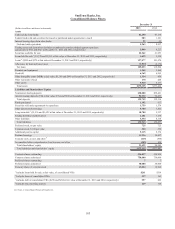

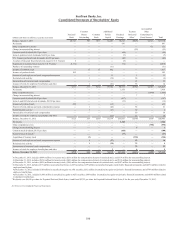

SunTrust Banks, Inc.

Consolidated Statements of Shareholders’ Equity

(Dollars and shares in millions, except per share data)

Preferred

Stock

Common

Shares

Outstanding

Common

Stock

Additional

Paid in

Capital

Retained

Earnings

Treasury

Stock and

Other 1

Accumulated

Other

Comprehensive

(Loss)/Income 2Total

Balance, January 1, 2011 $4,942 500 $515 $8,403 $8,542 ($888) $1,616 $23,130

Net income — — — — 647 — — 647

Other comprehensive income — — — — — — 133 133

Change in noncontrolling interest — — — — — (22) — (22)

Common stock dividends, $0.12 per share — — — — (64) — — (64)

Series A preferred stock dividends, $4,056 per share — — — — (7)— — (7)

U.S. Treasury preferred stock dividends, $1,236 per share — — — — (60) — — (60)

Accretion of discount for preferred stock issued to U.S. Treasury 6 — — — (6)— ——

Repurchase of preferred stock issued to U.S. Treasury (4,776) — — — (74) — — (4,850)

Purchase of outstanding warrants (11) (11)

Issuance of common stock — 35 35 982 — — — 1,017

Issuance of preferred stock 103 — — — — — — 103

Exercise of stock options and stock compensation expense — — — 11 — 1 — 12

Restricted stock activity — 1 — (58)— 50 — (8)

Amortization of restricted stock compensation — — — — — 32 — 32

Issuance of stock for employee benefit plans and other — 1 — (21) — 35 — 14

Balance, December 31, 2011 $275 537 $550 $9,306 $8,978 ($792) $1,749 $20,066

Net income — — — — 1,958 — — 1,958

Other comprehensive loss — — — — — — (1,440) (1,440)

Change in noncontrolling interest — — — — — 7 — 7

Common stock dividends, $0.20 per share — — — — (107) — — (107)

Series A and B Preferred stock dividends, $4,052 per share — — — — (12) — — (12)

Issuance of preferred stock 450 — — (12) — — — 438

Exercise of stock options and stock compensation expense — 1 — (44) — 65 — 21

Restricted stock activity — 1 — (63)— 69 — 6

Amortization of restricted stock compensation — — — — — 30 — 30

Issuance of stock for employee benefit plans and other — — — (13) — 31 — 18

Balance, December 31, 2012 $725 539 $550 $9,174 $10,817 ($590) $309 $20,985

Net income — — — — 1,344 — — 1,344

Other comprehensive loss — — — — — — (598) (598)

Change in noncontrolling interest —————5 —5

Common stock dividends, $0.35 per share ————

(188) — — (188)

Preferred stock dividends 3————

(37) — — (37)

Acquisition of treasury stock —(5)— — — (150) — (150)

Exercise of stock options and stock compensation expense —1—

(27) — 43 — 16

Restricted stock activity —1—

(35)— 39 — 4

Amortization of restricted stock compensation —————32 —32

Issuance of stock for employee benefit plans and other ———3—6 —9

Balance, December 31, 2013 $725 536 $550 $9,115 $11,936 ($615)($289) $21,422

1 At December 31, 2013, includes ($684) million for treasury stock, ($50) million for compensation element of restricted stock, and $119 million for noncontrolling interest.

At December 31, 2012, includes ($656) million for treasury stock, ($48) million for compensation element of restricted stock, and $114 million for noncontrolling interest.

At December 31, 2011, includes ($851) million for treasury stock, ($48) million for compensation element of restricted stock, and $107 million for noncontrolling interest.

2 At December 31, 2013, includes ($77) million in unrealized net losses on AFS securities, $279 million in unrealized net gains on derivative financial instruments, and ($491) million related to

employee benefit plans.

At December 31, 2012, includes $520 million in unrealized net gains on AFS securities, $532 million in unrealized net gains on derivative financial instruments, and ($743) million related to

employee benefit plans.

At December 31, 2011, includes $1,863 million in unrealized net gains on AFS securities, $569 million in unrealized net gains on derivative financial instruments, and ($683) million related

to employee benefit plans.

3 Dividends were $4,056 per share for Perpetual Preferred Stock Series A and B and $5,793 per share for Perpetual Preferred Stock Series E for the year ended December 31, 2013.

See Notes to Consolidated Financial Statements.