SunTrust 2013 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements, continued

155

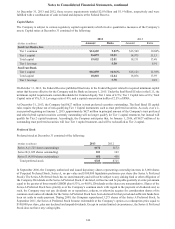

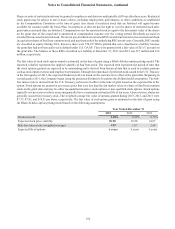

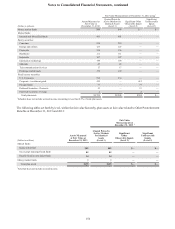

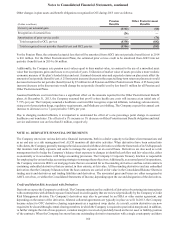

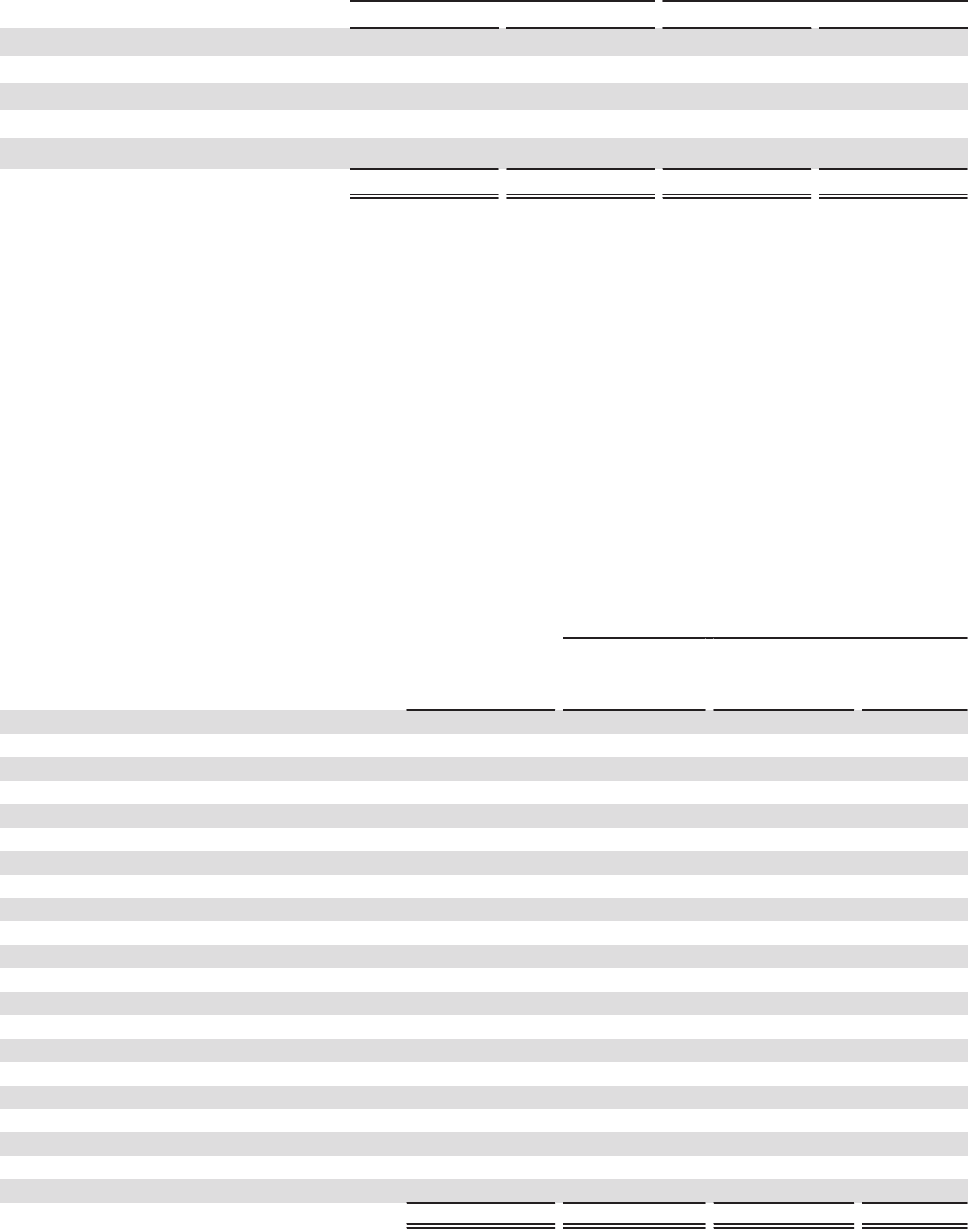

The changes in plan assets during the year ended December 31 were as follows:

Pension Benefits Other Postretirement Benefits

(Dollars in millions) 2013 2012 2013 2012

Fair value of plan assets, beginning of year $2,742 $2,550 $164 $161

Actual return on plan assets 304 350 14 17

Employer contributions 826 ——

Plan participants’ contributions ——21 22

Benefits paid (181) (184)(41)(36)

Fair value of plan assets, end of year $2,873 $2,742 $158 $164

Employer contributions indicated under pension benefits represent the benefits that were paid to nonqualified plan participants.

SERPs are not funded through plan assets.

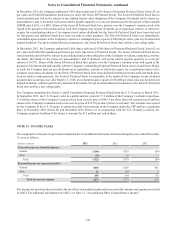

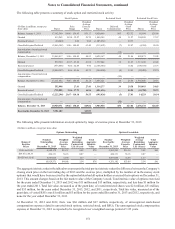

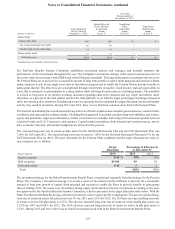

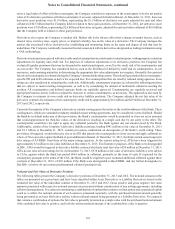

The fair value of plan assets is measured based on the fair value hierarchy which is discussed in Note 18, “Fair Value Election

and Measurement.” The valuations are based on third party data received as of the balance sheet date. Level 1 assets such as

money market funds, equity securities, and mutual funds are instruments that are traded in active markets and are valued based

on identical instruments. Fixed income securities are primarily classified as level 2 assets because there is not an identical

asset in the market upon which to base the valuation; however, there are no significant unobservable assumptions used to

value level 2 instruments. Corporate, foreign bonds, and preferred securities are valued based on quoted market prices obtained

from external pricing sources where trading in an active market exists for level 2 assets. Level 3 assets are assets where limited

visible market activity exists for these instruments or similar instruments, and therefore, significant unobservable assumptions

are used to value the securities.

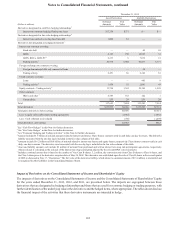

The following tables set forth by level, within the fair value hierarchy, plan assets at fair value related to Pension Benefits at

December 31, 2013 and 2012:

Fair Value Measurements at December 31, 2013 using 1

(Dollars in millions)

Assets Measured at

Fair Value at

December 31, 2013

Quoted Prices In

Active Markets for

Identical Assets

(Level 1)

Significant Other

Observable Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Money market funds $83 $83 $— $—

Equity securities:

Consumer 297 297 — —

Energy and utilities 163 163 — —

Financials 268 268 — —

Healthcare 166 166 — —

Industrials 157 157 — —

Information technology 244 244 — —

Materials 51 51 — —

Telecommunications services 28 28 — —

Futures contracts 8—8—

Fixed income securities:

U.S. Treasuries 157 157 — —

Corporate - investment grade 932 — 932 —

Foreign bonds 183 — 183 —

Government agencies 2— 2—

Foreign governments 4— 4—

Municipal taxable 53 — 53 —

Corporate obligations CMO and REMIC 56 — 56 —

Other assets

Other assets 22——

Total plan assets $2,854 $1,616 $1,238 $—

1 Schedule does not include accrued income amounting to less than 0.7% of total plan assets.