SunTrust 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

-

197

-

198

-

199

-

200

-

201

-

202

-

203

-

204

-

205

-

206

-

207

-

208

-

209

-

210

-

211

-

212

-

213

-

214

-

215

-

216

-

217

-

218

-

219

-

220

-

221

-

222

-

223

-

224

-

225

-

226

-

227

-

228

-

229

-

230

-

231

-

232

-

233

-

234

-

235

-

236

Table of contents

-

Page 1

-

Page 2

-

Page 3

... customer service centers. The company has approximately 1,500 branches and 2,250 ATMs, located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the District of Columbia. Private Wealth Management o ers a full array of banking, brokerage, professional...

-

Page 4

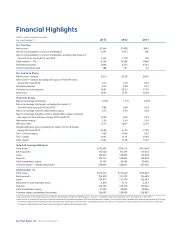

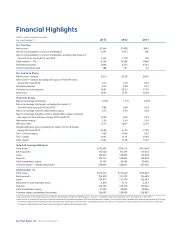

... diluted Net income - diluted, excluding the impact of Form 8-K items during 2013 and 2012 1 Dividends declared Common stock closing price Book value $2.41 2.74 0.35 36.81 38.61 $3.59 2.19 0.20 28.35 37.59 $0.94 0.94 0.12 17.70 36.86

Financial Ratios

Return on average total assets Return on average...

-

Page 5

... several ways, 2013 marked a meaningful step forward in the progression of our company. We delivered improved bottom-line performance and made considerable headway in reducing our overall risk proï¬le, capping the year with strong growth in adjusted earnings and credit quality improvement. Moreover...

-

Page 6

... efficiency ratio goal. We accomplished this despite revenue challenges that resulted from considerable mortgage income headwinds, as longer-term interest rates began to climb and reï¬nance activity slowed, as well as the e ect of the prolonged low short-term interest rate environment on net...

-

Page 7

... our nonguaranteed residential and home equity exposure from 38% to 31%. Furthermore, investment banking income has grown appreciably, achieving a new record year in 2013. Our Wholesale Banking segment, in aggregate, contributed $900 million to the company's bottom line. We have initiatives in...

-

Page 8

... measured by our efficiency ratio. Revenue is an important component and some of our revenue growth initiatives will require investment. We will reinvest in areas that we believe will generate revenue growth and improve our long-term proï¬tability proï¬le.

SunTrust Banks, Inc. 2013 Annual Report

-

Page 9

... ï¬nancial needs of small business clients and being ranked at the top for customer advocacy in the super-regional banks category of Market Probe's 2013 survey. I am also incredibly proud of our community giving and volunteerism. Collectively, this year we achieved a record $6.2 million in teammate...

-

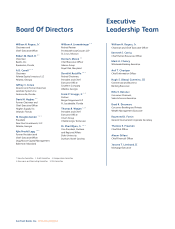

Page 10

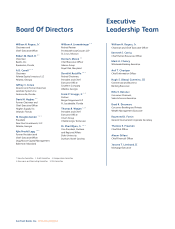

... Mason Capital Management Baltimore, Maryland

Aleem Gillani

Chief Financial Officer

Jerome T. Lienhard, II

Mortgage Executive

1. Executive Committee

2. Audit Committee

3. Compensation Committee 5. Risk Committee

4. Governance and Nominating Committee

SunTrust Banks, Inc. 2013 Annual Report

-

Page 11

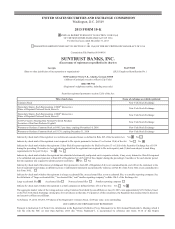

... 20549

2013 FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2013 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission File Number 001-08918

SUNTRUST BANKS, INC...

-

Page 12

... Item 15:

Directors, Executive Officers and Corporate Governance. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. Certain Relationships and Related Transactions, and Director Independence. Principal Accountant Fees and Services...

-

Page 13

... default rate. CDS - Credit default swaps. CET 1 - Common Equity Tier 1 Capital. CEO - Chief Executive Officer. CFO - Chief Financial Officer. CFPB - Bureau of Consumer Financial Protection. CFTC - Commodities Futures Trading Commission. CIB - Corporate and Investment Banking. C&I - Commercial and...

-

Page 14

... Housing Finance Agency. FHLB - Federal Home Loan Bank. FICO - Fair Isaac Corporation. FINRA - Financial Industry Regulatory Authority. Fitch - Fitch Ratings Ltd. Form 8-K items - Items disclosed in Form 8-K that was filed with the SEC on September 6, 2012 or October 10, 2013. FRB - Federal Reserve...

-

Page 15

... Repurchase Agreement. MRMG - Model Risk Management Group. MSR - Mortgage servicing right. MVE - Market value of equity. NCF - National Commerce Financial Corporation. NOL - Net operating loss. NOW - Negotiable order of withdrawal account. NPA - Nonperforming asset. NPL - Nonperforming loan. NPR...

-

Page 16

... stock unit. RWA - Risk-weighted assets. S&P - Standard and Poor's. SBA - Small Business Administration. SCAP - Supervisory Capital Assessment Program. SEC - U.S. Securities and Exchange Commission. SERP - Supplemental Executive Retirement Plan. SPE - Special purpose entity. STIS - SunTrust...

-

Page 17

...including deposit, credit, mortgage banking, and trust and investment services. Additional subsidiaries provide asset management, securities brokerage, and capital market services. SunTrust operates primarily within Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and...

-

Page 18

... plan to both the Federal Reserve and the FDIC; (v) limiting debit card interchange fees; (vi) adopting certain changes to shareholder rights and responsibilities, including a shareholder "say on pay" vote on executive compensation; (vii) strengthening the SEC's powers to regulate securities markets...

-

Page 19

... agencies in December 2013. If a plan is not approved, the Company's and the Bank's growth, activities, and operations may be restricted. Most recently, federal regulators have finalized rules for the new capital requirements for financial institutions that include several changes to the way capital...

-

Page 20

... a one-year time horizon. To comply with these requirements, banks will take a number of actions which may include increasing their asset holdings of U.S. Treasury securities and other sovereign debt, increasing the use of long-term debt as a funding source, and adopting new business practices that...

-

Page 21

... changes related to pre-funding insurance premiums. FDIC regulations require that management report annually on its responsibility for preparing its institution's financial statements, establishing and maintaining an internal control structure and procedures for financial reporting, and compliance...

-

Page 22

... and groups of employees that may expose the company to material amounts of risk. The three primary principles are (i) balanced risk-taking incentives, (ii) compatibility with effective controls and risk management, and (iii) strong corporate governance. The Federal Reserve will monitor compliance...

-

Page 23

... Risk Management" in the MD&A). SunTrust's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act are available free of charge on the Company's web site...

-

Page 24

... advisory and wealth management services. Because investment management fees are often based on the value of assets under management, a decrease in the market prices of those assets could reduce our fee income. Changes in stock market prices could affect the trading activity of investors, reducing...

-

Page 25

... of electronic funds transfer services for U.S. consumers to recipients in other countries. We also implemented policy changes to help customers limit overdraft and returned item fees. These reduced our fee revenue. The Dodd-Frank Act also established the CFPB, which has authority to regulate, among...

-

Page 26

... requirements in excess of current market practice, increased capital requirements and exchange trading requirements. These new rules collectively will impose implementation and ongoing compliance burdens on us and will introduce additional legal risk, including as a result of newly applicable anti...

-

Page 27

... acute liquidity stress scenario, and a NSFR, designed to promote more medium and long-term funding based on the liquidity characteristics of the assets and activities of banking entities over a one-year time horizon. In October 2013, the FRB, jointly with other federal banking regulators, issued an...

-

Page 28

... dividend increases and acquisitions. Loss of customer deposits and market illiquidity could increase our funding costs. We rely heavily on bank deposits to be a low cost and stable source of funding for the loans we make. We compete with banks and other financial services companies for deposits. If...

-

Page 29

.... As Florida is our largest banking state in terms of loans and deposits, deterioration in real estate values and underlying economic conditions in those markets or elsewhere could result in materially higher credit losses. A deterioration in economic conditions, housing conditions, or real estate...

-

Page 30

... mortgage loans has limited the market for and liquidity of many mortgage loans. These conditions have resulted in losses, write-downs and impairment charges in our mortgage and other lines of business. Declines in real estate values, low home sales volumes, financial stress on borrowers as a result...

-

Page 31

...requests where an investor or insurer has suffered a loss due to a breach of the servicing agreement. While the number of such claims has been small, these could increase in the future. See additional discussion in Note 17, "Guarantees," to the Consolidated Financial Statements in this Form 10-K. In...

-

Page 32

... costs of satisfying our financial obligations under the amendment to the Consent Order. As a result of the FRB's review of our residential mortgage loan servicing and foreclosure processing practices that preceded the Consent Order, the FRB announced that it would impose a $160 million civil money...

-

Page 33

... as higher risk mortgage, home equity, and commercial construction. These actions have also contributed to declines in early stage delinquencies and NPLs. While these changes have resulted in improving asset quality metrics, elevated losses may continue to occur due to economic factors, changes in...

-

Page 34

... related actions. We are also exposed to market risk in our trading instruments, AFS investment portfolio, MSRs, loan warehouse and pipeline, and debt and brokered deposits carried at fair value. ALCO meets regularly and is responsible for reviewing our open positions and establishing policies...

-

Page 35

..., see "Enterprise Risk Management-Other Market Risk" and "Critical Accounting Policies" in the MD&A, and Note 9, "Goodwill and Other Intangible Assets," to the Consolidated Financial Statements in this Form 10-K. The fiscal and monetary policies of the federal government and its agencies could have...

-

Page 36

... infrastructure or operating systems that support our businesses and clients. Information security risks for large financial institutions such as ours have generally increased in recent years in part because of the proliferation of new technologies, the use of the internet and telecommunications...

-

Page 37

... during 2013, our main online banking website, as well as those of several other prominent financial institutions, was subject to a limited number of distributed denial of service attacks. The attacks against us, which were also generally publicized in the media, did not result in any financial loss...

-

Page 38

...in our credit rating could increase the cost of our funding from the capital markets. Our issuer ratings are rated investment grade by the major rating agencies. There were no changes to our primary credit ratings during 2013. On October 8, 2013, Fitch affirmed our senior long- and short-term credit...

-

Page 39

... and wholesale funding sources, credit ratings have a more direct impact on the cost of wholesale funding, as our primary source of retail funding is bank deposits, most of which are insured by the FDIC. During the most recent financial market crisis and economic recession, our senior debt credit...

-

Page 40

...sufficient number of qualified employees or if the costs of employee compensation or benefits increase substantially. Further, in June 2010, the Federal Reserve and other federal banking regulators jointly issued comprehensive final guidance designed to ensure that incentive compensation policies do...

-

Page 41

... in reports we file or submit under the Exchange Act is accurately accumulated and communicated to management, and recorded, processed, summarized, and reported within the time periods specified in the SEC's rules and forms. We believe that any disclosure controls and procedures or internal controls...

-

Page 42

... leased. The full-service banking offices are located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and the District of Columbia. See Note 8, "Premises and Equipment," to the Consolidated Financial Statements in this Form 10-K for further discussion...

-

Page 43

...'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

The principal market in which the common stock of the Company is traded is the NYSE. See Item 6 and Table 33 in the MD&A for information on the high and the low sales prices of SunTrust common stock on the...

-

Page 44

...to the prior approval of the Federal Reserve through the capital planning and stress testing process, and the Company did not request approval to repurchase any warrants. On September 12, 2006, SunTrust issued and registered under Section 12(b) of the Exchange Act, 20 million Depositary Shares, each...

-

Page 45

...the Company's primary banking regulator as part of the annual capital planning and stress testing process and, therefore, this authority effectively expires on March 31, 2014. During 2013, the Company repurchased approximately $150 million of its common stock at market value as part of this publicly...

-

Page 46

...per common share 1 Market capitalization Market price: High Low Close Selected Average Balances Total assets Earning assets Loans Consumer and commercial deposits Brokered time and foreign deposits Intangible assets including MSRs MSRs Preferred Stock Total shareholders' equity Average common shares...

-

Page 47

... Financial Ratios ROA ROE ROTCE1 Net interest margin - FTE Efficiency ratio Tangible efficiency ratio 1 Tangible efficiency ratio, excluding Form 8-K items 1 Total average shareholders' equity to total average assets Tangible equity to tangible assets 1 Effective tax rate/(benefit) Allowance to year...

-

Page 48

... the credit ratings of instruments issued, insured or guaranteed by related institutions, agencies or instrumentalities, could result in risks to us and general economic conditions that we are not able to predict; weakness in the real estate market, including the secondary residential mortgage loan...

-

Page 49

... our headquarters is located in Atlanta, Georgia. Our principal banking subsidiary, SunTrust Bank, offers a full line of financial services for consumers and businesses both through its branches located primarily in Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and...

-

Page 50

... months and how these developments support any continued improvement in labor market conditions and inflation objectives. Despite the currently planned moderation in asset purchases, the Federal Reserve indicated that, in its view, the sizable and still increasing holdings of longer-term securities...

-

Page 51

... the Form 8-K items. Our provision for credit losses declined 60% during 2013 compared to 2012. The decrease was as a result of continued credit quality improvement and the 2012 impacts related to Chapter 7 bankruptcy loan reclassifications to nonperforming and a junior lien policy change related to...

-

Page 52

... 2012. The provision for loan losses decreased 61% and net charge-offs decreased 60% during 2013 compared to 2012. The declines were the result of improved credit quality, as well as the incremental charge-offs and provision recorded in 2012 related to NPL sales, the junior lien credit policy change...

-

Page 53

... during 2013 compared to 2012. The improvement was predominantly driven by our home equity portfolio as a result of the strengthening housing market, as well as an increase in the provision in the prior year due to a change in our credit policy related to the charge-off of junior lien loans and...

-

Page 54

... to 2012, driven by declines in other real estate and credit related expenses. The decline in noninterest expense drove further improvements in both the efficiency and tangible efficiency ratios during 2013, which remained below 55%. The net loss in Mortgage Banking improved by 18% during 2013 when...

-

Page 55

... mortgages - nonguaranteed Home equity products Residential construction Guaranteed student loans Other direct Indirect Credit cards Nonaccrual 3 Total loans Securities AFS: Taxable Tax-exempt - FTE 2 Total securities AFS - FTE Fed funds sold and securities borrowed or purchased under agreements...

-

Page 56

... Home equity products Residential construction Guaranteed student loans Other direct Indirect Credit cards Nonaccrual Securities AFS: Taxable Tax-exempt - FTE 2 Fed funds sold and securities borrowed or purchased under agreements to resell LHFS Interest earning trading assets Total increase...

-

Page 57

... their original maturity date during 2012 and 2013. However, we added $2.0 billion of new pay variable-receive fixed commercial loan swaps during 2013 after interest rates increased, which aided net interest income during the year. As we manage our interest rate risk we may purchase additional...

-

Page 58

... rates paid.

NONINTEREST INCOME Table 5

Year Ended December 31

(Dollars in millions)

Service charges on deposit accounts Other charges and fees Card fees 1 Trust and investment management income Retail investment services Investment banking income Trading income Mortgage production related income...

-

Page 59

... rates and a reduction in trading-related reserves in 2012. These declines were partially offset by a $69 million decline in mark-to-market valuation losses on our fair value debt and index-linked CDs. Mortgage production related income decreased $29 million, or 8%, during 2013 compared to 2012...

-

Page 60

... Credit and collection services Regulatory assessments Equipment expense Marketing and customer development Consulting and legal fees Postage and delivery Other staff expense Communications Operating supplies Amortization/impairment of intangible assets/goodwill Other real estate expense Impairment...

-

Page 61

... reserve increase was part of the Form 8-K items in 2013 and, when excluding these items, credit and collection services expense decreased 30% from 2012, primarily due to declines in credit and collection costs as a result of the significant decline in average NPAs during 2013. Other real estate...

-

Page 62

...to fund business operations or activities, corporate credit cards, loans secured by owneroccupied properties, and other wholesale lending activities. CRE and commercial construction loan types are based on investor exposures where repayment is largely dependent upon the operation, refinance, or sale...

-

Page 63

...loans: C&I CRE Commercial construction Total commercial loans Residential loans: Residential mortgages - guaranteed Residential mortgages - nonguaranteed1 Home equity products Residential construction Total residential loans Consumer loans: Guaranteed student loans Other direct Indirect Credit cards...

-

Page 64

...,966 5,043 4,368 9,411 $20,377

% of total

18% 8 8 4 7 7 2 - 54 25 21 46 100%

Geography: Florida Georgia Virginia Tennessee North Carolina Maryland South Carolina District of Columbia Total banking region California, Illinois, Pennsylvania, Texas, New Jersey, New York All other states Total outside...

-

Page 65

.... Overall economic indicators in our markets are improving, and organic loan production in home equity and consumer loans, excluding student, has been solid and our commercial loan pipelines have increased. Commercial loans increased $5.4 billion, or 9%, during 2013 compared to December 31, 2012...

-

Page 66

... 60%, decline in net charge-offs compared to 2012 were $226 million of charge-offs in 2012 associated with the sale of mortgage and commercial real estate NPLs, and $79 million and $65 million of charge-offs in 2012 related to the changes in policy related to reclassification to nonaccrual for loans...

-

Page 67

... related to our credit policy change for loans discharged in Chapter 7 bankruptcy in response to regulatory guidance issued in 2012. The decline in net charge-offs in 2013 compared to 2012 was particularly notable in our residential mortgage and home equity portfolios, reflective of the improved...

-

Page 68

... to improvements in credit quality trends and lower net charge-offs during 2013 compared to 2012, partially offset by the effect of loan growth in the commercial and consumer loan portfolios. In 2014, positive loan growth may offset future asset quality improvements and result in smaller declines in...

-

Page 69

..., 2013, our ratio of NPLs to total loans was 0.76%, down from 1.27% at December 31, 2012 as a result of the decline in NPLs and the increase in total loans. We expect further, but moderating, declines in NPLs during 2014, led by continuing improvements in residential portfolios. Real estate related...

-

Page 70

... commercial loan portfolio that are most likely to experience distress. Based on our review of these factors and our assessment of overall risk, we evaluate the benefits of proactively initiating discussions with our clients to improve a loan's risk profile. In some cases, we may renegotiate terms...

-

Page 71

... could be deemed to be economic concessions and result in additional modified loans being reported as TDRs. See additional discussion related to HAMP, Consent Order, and the Mortgage Servicing Settlement in Note 19, "Contingencies," to the Consolidated Financial Statements in this Form 10-K.

55

-

Page 72

... first and second lien residential mortgages and home equity lines of credit), $150 million, or 5%, of commercial loans (predominantly income-producing properties), and $110 million, or 3%, of consumer loans. Total TDRs did not change compared to December 31, 2012; however, the mix of TDRs...

-

Page 73

...31, 2013 and 2012. For a complete discussion of our fair value elections and the methodologies used to estimate the fair values of our financial instruments, see Note 18, "Fair Value Election and Measurement," to the Consolidated Financial Statements in this Form 10-K. Trading Assets and Liabilities...

-

Page 74

... MBS - agency MBS - private ABS Corporate and other debt securities Other equity securities1 Total securities AFS

1

At December 31, 2013, other equity securities included the following: $336 million in FHLB of Atlanta stock, $402 million in Federal Reserve Bank stock, $103 million in mutual fund...

-

Page 75

... rate and liquidity risk profile. The portfolio increased $1.5 billion in 2013 compared to December 31, 2012, primarily due to increased holdings of U.S. Treasury securities and agency MBS as a result of normal portfolio activity. This increase in amortized cost was offset by a decline in net...

-

Page 76

... Atlanta and in the Federal Reserve Bank. In order to be an FHLB member, we are required to purchase capital stock in the FHLB. In exchange, members take advantage of competitively priced advances as a wholesale funding source and access grants and low-cost loans for affordable housing and community...

-

Page 77

... NOW accounts Money market accounts Savings Consumer time Other time Total consumer and commercial deposits Brokered time deposits Foreign deposits Total deposits

During 2013, we experienced modest deposit growth as well as improving deposit mix as the proportion of lower-cost deposit account...

-

Page 78

... FHLB advances during 2013. During the year ended December 31, 2013, our daily average balances for funds purchased and other short-term borrowings were lower than our period-end balances as a result of increased borrowing in the second half of 2013. Our daily average balance of securities sold...

-

Page 79

... gain on equity securities. Additionally, mark-to-market adjustments related to our estimated credit spreads for debt and index linked CDs accounted for at fair value are excluded from regulatory capital. Both the Company and the Bank are subject to minimum Tier 1 capital and Total capital ratios of...

-

Page 80

... 2013, the new Risk-Based Capital Guidelines: Market Risk Rule (the "Market Risk Rule") promulgated by the Federal Reserve and other U.S. regulators became effective. The application of the Market Risk Rule required changes to the computation of RWA associated with assets held in our trading account...

-

Page 81

... Dodd-Frank Act, we and certain other banks are required to conduct semi-annual stress tests pursuant to the DFAST Final Rule. During 2013, we disclosed the results of our semi-annual DFAST processes for 2013, which were submitted to the Federal Reserve in January 2013 and July 2013. The results of...

-

Page 82

...statements. In addition to the ALLL, we also estimate probable losses related to unfunded lending commitments, such as letters of credit and binding unfunded loan commitments. Unfunded lending commitments are analyzed and segregated by risk similarly to funded loans based on our internal risk rating...

-

Page 83

... Assets" sections in this MD&A as well as Note 6, "Loans," and Note 7, "Allowance for Credit Losses," to the Consolidated Financial Statements in this Form 10-K. Mortgage Repurchase Reserve We sell residential mortgage loans to investors through whole loan sales in the normal course of our business...

-

Page 84

... 17, "Guarantees - Loan Sales," to the Consolidated Financial Statements in this Form 10-K for further discussion. Legal and Regulatory Matters We are parties to numerous claims and lawsuits arising in the course of our normal business activities, some of which involve claims for substantial amounts...

-

Page 85

... the credit crisis led to limited or nonexistent trading in certain of the financial asset classes that we have owned. Although market conditions have improved and we have seen the return of liquidity in certain markets, we continue to experience a low level of activity in a number of markets and...

-

Page 86

... and Measurement," to the Consolidated Financial Statements in this Form 10-K for a detailed discussion regarding level 2 and 3 securities and valuation methodologies for each class of securities. Trading and Derivative Assets and Liabilities and Securities AFS In estimating the fair values for the...

-

Page 87

...to FHLB of Atlanta stock purchases, partially offset by FHLB of Atlanta stock redemptions and continued paydowns and sales of level 3 securities. During the year ended December 31, 2013, we recognized $122 million in net gains through earnings related to trading and derivative assets and liabilities...

-

Page 88

... Banking and Private Wealth Management, Wholesale Banking and Ridgeworth Capital Management. See Note 20, "Business Segment Reporting," to the Consolidated Financial Statements in this Form 10-K for a further discussion of our reportable segments and changes that occurred during 2013. We review...

-

Page 89

... key business drivers such as new business initiatives, client service and retention standards, market share changes, anticipated loan and deposit growth, forward interest rates, historical performance, and industry and economic trends, among other considerations. The long-term growth rate used in...

-

Page 90

... the Consolidated Financial Statements in this Form 10-K. Pension Accounting Several variables affect the annual cost for our retirement programs. The main variables are: (1) size and characteristics of the eligible population, (2) discount rate, (3) expected long-term rate of return on plan assets...

-

Page 91

... 15, "Employee Benefit Plans," to the Consolidated Financial Statements in this Form 10-K for details on changes in the pension benefit obligation and the fair value of plan assets. If we were to assume a 0.25% increase/decrease in the expected long-term rate of return for the retirement and other...

-

Page 92

... and orders, and stated corporate business objectives and risk appetite, tolerances and limits. The third line of defense is comprised of our assurance functions, i.e., Audit Services and Risk Review, which independently test, verify, and evaluate management controls and provide risk-based advice...

-

Page 93

... reviews have resulted in changes such as enhanced documentation standards, maximum LTV ratios, and changes in production channels, which contributed to material reductions in higher-risk exposures, such as higher-risk mortgage, home equity, and commercial construction loans, as well as a decline...

-

Page 94

...market risk. Market Risk from Non-Trading Activities The primary goal of interest rate risk management is to control exposure to interest rate risk, within policy limits approved by the Board. These limits and guidelines reflect our tolerance for interest rate risk over both short-term and long-term...

-

Page 95

... in asset sensitivity and net interest income compared to December 31, 2012, is predominantly due to slower assumed prepayments on mortgage-related products due to higher long-term rates and balance sheet mix changes. We also perform valuation analysis, which we use for discerning levels of risk...

-

Page 96

Market Risk from Trading Activities Under established policies and procedures, we manage market risk associated with trading activities using a VAR approach that takes into account exposures resulting from interest rate risk, equity risk, foreign exchange risk, credit spread risk, and commodity risk...

-

Page 97

...and Note 18, "Fair Value Election and Measurement" to the Consolidated Financial Statements in this Form 10K and the "Critical Accounting Policies" section of this MD&A. Model risk management: Our model risk management approach for validating and evaluating the accuracy of internal and vended models...

-

Page 98

... reserves, which is based upon a daily average.

Uses of Funds. Our primary uses of funds include the extension of loans and credit, the purchase of investment securities, working capital, and debt and capital service. The Bank and the Parent Company borrow in the money markets using instruments...

-

Page 99

... the Bank and the Parent Company, the economic environment, and the adequacy of our capital base. At December 31, 2013, both S&P and Fitch maintained a "Positive" outlook on our credit ratings based on our improving overall risk profile and asset quality, solid liquidity profile, and sound capital...

-

Page 100

..., we measure how long the Parent Company can meet its capital and debt service obligations after experiencing material attrition of short-term, unsecured funding and without the support of dividends from the Bank or access to the capital markets. At December 31, 2013, the Parent's Months to Required...

-

Page 101

... between the time the customer locks the rate on the anticipated loan and the time the loan is sold on the secondary market, which is typically 60-150 days. We manage interest rate risk predominantly with interest rate swaps, futures, and forward sale agreements, where the changes in value of the...

-

Page 102

...service contracts. The table below presents our significant contractual obligations at December 31, 2013, except for pension and other postretirement benefit plans, which are included in Note 15, "Employee Benefit Plans," to the Consolidated Financial Statements in this Form 10-K.

Table 32

(Dollars...

-

Page 103

...per common share 2 Market capitalization Market price: High Low Close Selected Average Balances Total assets Earning assets Loans Consumer and commercial deposits Brokered time and foreign deposits Intangible assets including MSRs MSRs Preferred Stock Total shareholders' equity

Average common shares...

-

Page 104

...in 2013 and the increased charge-offs in the fourth quarter of 2012 related to NPL sales and the policy change related to Chapter 7 bankruptcy loans. See additional discussion of policy information in Note 1, "Significant Accounting Policies," to the Consolidated Financial Statements in this Form 10...

-

Page 105

... $2.0 billion student loan sale executed in the fourth quarter of 2012 and home equity line paydowns during 2013. These declines were partially offset by increases in other consumer loan categories as a result of higher consumer loan production. Net interest income related to deposits decreased $104...

-

Page 106

... year included a $96 million impairment charge related to the planned dispositions of affordable housing partnership assets that were substantially completed during 2013. Mortgage Banking Mortgage Banking reported a net loss of $568 million during the year ended December 31, 2013, an improvement...

-

Page 107

... improvement was driven by a decline in net charge-offs, partially attributable to the $193 million in net charge-offs related to the transfer of loans to LHFS and subsequent sale of nonperforming residential mortgage loans during 2012. Additionally, policy changes related to second lien home equity...

-

Page 108

... acquisitions of student loan portfolios and higher production in indirect auto loans, partially offset by decreases in equity lines, commercial real estate, and residential mortgages. Other funding costs related to other assets improved by $28 million, driven primarily by a decline in funding rates...

-

Page 109

... sales and policy changes, net charge-offs declined during 2012. Noninterest income was $502 million during 2012, an increase of $261 million, compared to 2011 driven by higher mortgage production related and servicing income, partially offset by higher losses on the sale of Ginnie Mae loans during...

-

Page 110

... cost trust preferred securities. The increase in total staff expense was due to a $60 million gain related to curtailment of our pension plan, net of a discretionary 401(k) contribution recognized during 2011 and increased incentive expenses during 2012 as a result of improved business performance...

-

Page 111

...Expense Employee compensation and benefits Outside processing and software Net occupancy expense Operating losses Credit and collection services Regulatory assessments Equipment expense Marketing and customer development Consulting and legal fees Amortization/impairment of intangible assets/goodwill...

-

Page 112

... can be found in Form 8-Ks filed with the SEC on October 10, 2013 and September 6, 2012. 2 Reflects the pre-tax provision expense associated with the planned sale of $0.5 billion of nonperforming mortgage and CRE loans and impacts the Mortgage Banking and Wholesale Banking segments. 3 Reflects the...

-

Page 113

... repurchase of preferred stock issued to the U.S. Treasury 1 Efficiency ratio 2 Impact of excluding impairment/amortization of goodwill/ intangible assets other than MSRs Tangible efficiency ratio 3 ROA Impact of removing Form 8-K items from net income ROA excluding Form 8-K items 4 ROE Impact of...

-

Page 114

... improved treatment of mortgage servicing assets essentially offset by certain disallowed DTAs. 12 The Basel III calculations of CET 1, RWA, and the common equity Tier 1 ratio are based upon our current interpretation of the final Basel III rules published by the Federal Reserve during October 2013...

-

Page 115

... items can be found in Form 8-Ks filed with the SEC on October 10, 2013 and September 6, 2012 and in Table 36, "Reconcilement of Non-U.S. GAAP Measures - Annual," in this MD&A. 2 Computed by dividing noninterest expense by total revenue - FTE. The FTE basis adjusts for the tax-favored status of net...

-

Page 116

..., in 2012. 7 We present a tangible equity to tangible assets ratio that excludes the after-tax impact of purchase accounting intangible assets. We believe this measure is useful to investors because, by removing the effect of intangible assets that result from merger and acquisition activity (the...

-

Page 117

... ABOUT MARKET RISK

See "MD&A-Enterprise Risk Management," in this Form 10-K, which is incorporated herein by reference.

Item 8.

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Report of Independent Registered Public Accounting Firm

The Board of Directors and Shareholders of SunTrust Banks, Inc...

-

Page 118

... financial reporting as of December 31, 2013, based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of SunTrust Banks, Inc. as of December 31, 2013 and 2012, and the related...

-

Page 119

... compensation Employee benefits Outside processing and software Net occupancy expense Operating losses Credit and collection services Regulatory assessments Equipment expense Marketing and customer development Consulting and legal fees Amortization/impairment of intangible assets/goodwill Other real...

-

Page 120

... of tax of ($148), ($25) and $22, respectively Change related to employee benefit plans, net of tax of $147, ($35) and ($141), respectively Total other comprehensive (loss)/income Total comprehensive income

See Notes to Consolidated Financial Statements.

(597) (253) 252 (598) $746

(1,343) (37) (60...

-

Page 121

... assets Liabilities and Shareholders' Equity Noninterest-bearing deposits Interest-bearing deposits (CDs at fair value: $764 and $832 at December 31, 2013 and 2012, respectively) Total deposits Funds purchased Securities sold under agreements to repurchase Other short-term borrowings Long-term debt...

-

Page 122

... stock, and $107 million for noncontrolling interest. 2 At December 31, 2013, includes ($77) million in unrealized net losses on AFS securities, $279 million in unrealized net gains on derivative financial instruments, and ($491) million related to employee benefit plans. At December 31, 2012...

-

Page 123

... credit losses and foreclosed property Mortgage repurchase provision Deferred income tax expense Stock option compensation and amortization of restricted stock compensation Net loss/(gain) on extinguishment of debt Net securities gains Net gain on sale of loans held for sale, loans, and other assets...

-

Page 124

...including deposit, credit, mortgage banking, and trust and investment services. Additional subsidiaries provide asset management, securities brokerage, and capital market services. SunTrust operates primarily within Florida, Georgia, Maryland, North Carolina, South Carolina, Tennessee, Virginia, and...

-

Page 125

Notes to Consolidated Financial Statements, continued

Securities and Trading Activities Debt securities and marketable equity securities are classified at trade date as trading or securities AFS. Trading account assets and liabilities are carried at fair value with changes in fair value recognized ...

-

Page 126

... court order. To date, the Company's TDRs have been predominantly first and second lien residential mortgages and home equity lines of credit. Prior to granting a modification of a borrower's loan terms, the Company performs an evaluation of the borrower's financial condition and ability to service...

-

Page 127

... the ALLL process and/or are qualitatively considered in evaluating the overall reasonableness of the ALLL. Large commercial (all loan classes) nonaccrual loans and certain consumer (other direct, indirect, and credit card), residential (nonguaranteed residential mortgages, home equity products, and...

-

Page 128

...ALLL, the Company also estimates probable losses related to unfunded lending commitments, such as letters of credit and binding unfunded loan commitments. Unfunded lending commitments are analyzed and segregated by risk similar to funded loans based on the Company's internal risk rating scale. These...

-

Page 129

... changes in fair value are also reported in mortgage servicing related income in the Consolidated Statements of Income. For additional information on the Company's servicing fees, see Note 9, "Goodwill and Other Intangible Assets." Other Real Estate Owned Assets acquired through, or in lieu of, loan...

-

Page 130

... and as a risk management tool to economically hedge certain identified market risks, along with certain IRLCs on residential mortgage loans that are a normal part of the Company's operations. The Company also evaluates contracts, such as brokered deposits and short-term debt, to determine whether...

-

Page 131

... derivative instruments, AFS and trading securities, certain LHFI and LHFS, certain issuances of long-term debt, brokered deposits, and MSR assets. Fair value is used on a non-recurring basis as a measurement basis either when assets are evaluated for impairment, the basis of accounting is LOCOM, or...

-

Page 132

... valued based on the best available data, some of which may be internally developed, and considers risk premiums that a market participant would require.

To determine the fair value measurement for assets and liabilities required or permitted to be recorded at fair value, the Company considers...

-

Page 133

...2012 ($12) $32 $- $-

There were no material acquisitions or dispositions during the year ended December 31, 2013; however, the Company reached a definitive agreement in 2013 to sell RidgeWorth, and the sale is expected to close in the second quarter of 2014. See Note 20, "Business Segment Reporting...

-

Page 134

... appropriate margin evaluation on the acquisition date based on market volatility, as necessary. It is the Company's policy to obtain possession of collateral with a fair value between 95% to 110% of the principal amount loaned under resale and securities borrowing agreements. The total market value...

-

Page 135

...similar financial instruments. Other trading-related activities include acting as a market maker in certain debt and equity securities and related derivatives. The Company also uses end user derivatives to manage interest rate and market risk from non-trading activities. The Company has policies and...

-

Page 136

...- agency MBS - private ABS Corporate and other debt securities Other equity securities1 Total securities AFS

1

At December 31, 2013, other equity securities was comprised of the following: $336 million in FHLB of Atlanta stock, $402 million in Federal Reserve Bank stock, $103 million in mutual fund...

-

Page 137

... yields are based on amortized cost and presented on a FTE basis.

Securities in an Unrealized Loss Position The Company held certain investment securities where amortized cost exceeded fair market value, resulting in unrealized loss positions. Market changes in interest rates and credit spreads may...

-

Page 138

... cost basis of these securities. During the years ended December 31, 2013, 2012, and 2011, all OTTI recognized in earnings related to private MBS that have underlying collateral of residential mortgage loans securitized in 2007 or ABS collateralized by 2004 vintage home equity loans. The Company...

-

Page 139

Notes to Consolidated Financial Statements, continued

The securities that gave rise to credit impairments recognized during the years ended December 31, 2013, 2012, and 2011, as shown in the table below, consisted of private MBS and ABS with a fair value of approximately $22 million, $209 million, ...

-

Page 140

... including consumer credit risk scores, rating agency information, borrower/guarantor financial capacity, LTV ratios, collateral type, debt service coverage ratios, collection experience, other internal metrics/analysis, and qualitative assessments. For the commercial portfolio, the Company believes...

-

Page 141

... to Consolidated Financial Statements, continued

Risk ratings are refreshed at least annually, or more frequently as appropriate, based upon considerations such as market conditions, loan characteristics, and portfolio trends. Additionally, management routinely reviews portfolio risk ratings, trends...

-

Page 142

...loans: C&I CRE Commercial construction Total commercial loans Residential loans: Residential mortgages - guaranteed Residential mortgages - nonguaranteed1 Home equity products Residential construction Total residential loans Consumer loans: Guaranteed student loans Other direct Indirect Credit cards...

-

Page 143

... to Consolidated Financial Statements, continued

Impaired Loans A loan is considered impaired when it is probable that the Company will be unable to collect all amounts due, including principal and interest, according to the contractual terms of the agreement. Commercial nonaccrual loans greater...

-

Page 144

... 9 37 $1,857

Does not include foreclosed real estate related to loans insured by the FHA or the VA. Proceeds due from the FHA and the VA are recorded as a receivable in other assets in the Consolidated Balance Sheets until the funds are received and the property is conveyed. The receivable amount...

-

Page 145

... 146 27 4 65 3 $635

Commercial loans: C&I CRE Commercial construction Residential loans: Residential mortgages - nonguaranteed Home equity products Residential construction Consumer loans: Other direct Indirect Credit cards Total TDRs

1 2

Includes loans modified under the terms of a TDR that were...

-

Page 146

... 249 140 53 4 14 $819

Commercial loans: C&I CRE Commercial construction Residential loans: Residential mortgages - nonguaranteed Home equity products Residential construction Consumer loans: Other direct Credit cards Total TDRs

1 2

Includes loans modified under the terms of a TDR that were charged...

-

Page 147

... 169 975

Amortized Cost $5 3 - 23 10 3 1 2 1 $48

Commercial loans: C&I CRE Commercial construction Residential loans: Residential mortgages Home equity products Residential construction Consumer loans: Other direct Indirect Credit cards Total TDRs

For the year ended December 31, 2012, the table...

-

Page 148

... of mortgage loans at December 31, 2013 and 2012, respectively, that included terms such as an interest only feature, a high original LTV ratio, or a second lien position that may increase the Company's exposure to credit risk and result in a concentration of credit risk. Of these mortgage loans...

-

Page 149

... loans and TDRs and general allowances grouped into loan pools based on similar characteristics. No allowance is required for loans carried at fair value. Additionally, the Company records an immaterial allowance for loan products that are guaranteed by government agencies, as there is nominal risk...

-

Page 150

... equipment subject to mortgage indebtedness (included in long-term debt) were immaterial at December 31, 2013 and 2012. Net premises and equipment included $5 million and $6 million related to capital leases at December 31, 2013 and 2012, respectively. Aggregate rent expense (principally for offices...

-

Page 151

... 2013, branch-managed business banking clients were transferred from Wholesale Banking to Consumer Banking and Private Wealth Management, resulting in the reallocation of $300 million in goodwill. Additionally, during the first quarter of 2012, the Company reorganized its segment reporting structure...

-

Page 152

Notes to Consolidated Financial Statements, continued

The changes in the carrying amount of goodwill by reportable segment for the years ended December 31 are as follows:

Consumer Banking and Private Wealth Management $3,962 300 $4,262 $- 3,930 32 - $3,962

(Dollars in millions)

Retail Banking $- -...

-

Page 153

... value of the estimated future net servicing income. The model incorporates a number of assumptions as MSRs do not trade in an active and open market with readily observable prices. The Company determines fair value using market based prepayment rates, discount rates, and other assumptions that are...

-

Page 154

... of the Company's fair value methodologies. No events occurred during the year ended December 31, 2013 that changed the Company's sale accounting conclusion in regards to the residential mortgage loans, student loans, commercial and corporate loans, or CDO securities. When evaluating transfers and...

-

Page 155

... for estimating the fair values of these financial instruments. At December 31, 2013, the Company's Consolidated Balance Sheets reflected $261 million of loans held by the CLO and $256 million of debt issued by the CLO. At December 31, 2012, the Company's Consolidated Balance Sheets reflected...

-

Page 156

... information for the years ended December 31, related to the Company's asset transfers in which it has continuing economic involvement.

(Dollars in millions)

2013

2012

2011

Cash flows on interests held1: Residential Mortgage Loans2 Commercial and Corporate Loans CDO Securities Total cash flows...

-

Page 157

... 31, 2013 and 2012, respectively. Excludes loans that have completed the foreclosure or short sale process (i.e., involuntary prepayments).

Other Variable Interest Entities In addition to the Company's involvement with certain VIEs related to transfers of financial assets, the Company also has...

-

Page 158

... within its footprint in multi-family affordable housing developments and other community development entities as a limited and/or general partner and/ or a debt provider. The Company receives tax credits for various investments. The Company has determined that the related partnerships are VIEs. For...

-

Page 159

...assets of these funds at December 31, 2013 and 2012, were $247 million and $372 million, respectively. On December 11, 2013, it was publicly announced that the Company had reached a definitive agreement to sell RidgeWorth to an investor group led by a private equity fund managed by Lightyear Capital...

-

Page 160

...several long-term debt agreements prevent the Company from creating liens on, disposing of, or issuing (except to related parties) voting stock of subsidiaries. Further, there are restrictions on mergers, consolidations, certain leases, sales or transfers of assets, minimum shareholders' equity, and...

-

Page 161

...During 2013, the Company submitted its CCAR capital plans for review by the Federal Reserve. Upon completion of the Federal Reserve's review, they did not object to the Company's capital actions. Accordingly, during 2013, the Company maintained dividend payments on its preferred stock, increased its...

-

Page 162

...2013, the Federal Reserve published final rules in the Federal Register related to required minimum capital ratios that become effective for the Company and the Bank on January 1, 2015. Under the final Basel III rules in the U.S., the minimum capital requirements contain thresholds for Common Equity...

-

Page 163

..., plus any declared and unpaid dividends. Except in certain limited circumstances, the Series B Preferred Stock does not have any voting rights. In December 2012, the Company authorized 5,000 shares and issued 4,500 shares of Perpetual Preferred Stock, Series E, no par value and $100,000 liquidation...

-

Page 164

... AOCI Compensation and employee benefits MSRs Loans Goodwill and intangible assets Fixed assets Other Total DTLs Net DTL

The DTAs include state NOLs and other state carryforwards that will expire, if not utilized, in varying amounts from 2014 to 2033. At December 31, 2013 and 2012, the Company had...

-

Page 165

... of a private letter ruling from the IRS, and the expiration of statutes of limitations.

NOTE 15 - EMPLOYEE BENEFIT PLANS The Company sponsors various short-term incentive plans and LTIs for eligible employees, which may be delivered through various incentive programs, including stock options, RSUs...

-

Page 166

... on the date of grant using the Black-Scholes option pricing model based on the following assumptions: Year Ended December 31 2013 2012 2011 1.28% 0.91% 0.75% 30.98 39.88 34.87 1.02 1.07 2.48 6 years 6 years 6 years

Dividend yield Expected stock price volatility Risk-free interest rate (weighted...

-

Page 167

... changes based on the fair market value of the Company's stock. Total intrinsic value of options exercised for the years ended December 31, 2013 and 2012 was $11 million and $15 million, respectively, and less than $1 million for the year ended 2011. Total fair value, measured as of the grant date...

-

Page 168

...to the 401(k) plan. Compensation expense related to this plan for each year ended December 31, 2013 and 2012 was $96 million. SunTrust also maintains the SunTrust Banks, Inc. Deferred Compensation Plan in which key executives of the Company are eligible. In accordance with the terms of the plan, the...

-

Page 169

... after 3 years of service. The interest crediting rate applied to each Personal Pension Account was 3% for 2013. The Company monitors the funded status of the plan closely and due to the current funded status, the Company did not contribute to either of its noncontributory qualified retirement plans...

-

Page 170

...to Consolidated Financial Statements, continued

Assumptions Each year, the SunTrust Benefits Finance Committee, which includes several members of senior management, reviews and approves the assumptions used in the year-end measurement calculations for each plan. The discount rate for each plan, used...

-

Page 171

... as of the balance sheet date. Level 1 assets such as money market funds, equity securities, and mutual funds are instruments that are traded in active markets and are valued based on identical instruments. Fixed income securities are primarily classified as level 2 assets because there is not an...

-

Page 172

..., within the fair value hierarchy, plan assets at fair value related to Other Postretirement Benefits at December 31, 2013 and 2012:

Fair Value Measurements at December 31, 2013 1 Quoted Prices In Active Markets for Identical Assets (Level 1)

(Dollars in millions)

Assets Measured at Fair Value at...

-

Page 173

.... Capital market simulations from internal and external sources, survey data, economic forecasts, and actuarial judgment are all used in this process. The expected long-term rate of return on plan assets for the SunTrust Retirement Plan and the NCF Retirement Plan was 7.00% for 2013 and 2012. The...

-

Page 174

... 2013 2012 33% 30% 62 61 5 9 100% 100%

Asset Category

Equity securities Debt securities Cash equivalents Total Funded Status The funded status of the plans at December 31 was as follows:

(Dollars in millions)

Fair value of plan assets Benefit obligations 1 Funded status

1

Pension Benefits 2013...

-

Page 175

... service credit Recognized net actuarial loss Curtailment gain Settlement loss Net periodic (benefit)/cost Weighted average assumptions used to determine net (benefit)/cost: Discount rate Expected return on plan assets Rate of compensation increase 5

1 2

2013 $ - 113 (187) - 26 - - ($48)

Pension...

-

Page 176

... of market value of assets provides a more realistic economic measure of the plan's funded status and cost. Assumed discount rates and expected returns on plan assets affect the amounts of net periodic (benefit)/cost. A 25 basis point increase/decrease in the expected long-term return on plan assets...

-

Page 177

... the counterparties to close-out net and apply collateral or, where a CSA is present, require the Bank to post additional collateral. At December 31, 2013, the Bank carried senior long-term debt ratings of A3/BBB+ from three of the major ratings agencies. At the current rating level, ATEs have...

-

Page 178

... to Consolidated Financial Statements, continued

December 31, 2013 Asset Derivatives

(Dollars in millions)

Liability Derivatives Notional Amounts Fair Value

Notional Amounts

Fair Value

Derivatives designated in cash flow hedging relationships 1 Interest rate contracts hedging floating rate loans...

-

Page 179

...rate contracts covering: Foreign-denominated debt and commercial loans Trading activity Credit contracts covering: Loans Trading activity Other contracts: IRLCs and other 7 Commodities Total Total derivatives Total gross derivatives, before netting Less: Legally enforceable master netting agreements...

-

Page 180

... Fixed rate debt MSRs LHFS, IRLCs Trading activity Foreign exchange rate contracts covering: Commercial loans Trading activity Credit contracts covering: Loans Trading activity Equity contracts - trading activity Other contracts - IRLCs Total Trading income Mortgage servicing related income Mortgage...

-

Page 181

...: Commercial loans and foreign-denominated debt Trading activity Credit contracts covering: Loans 1 Trading activity Equity contracts - trading activity Other contracts - IRLCs Total

1

Trading income Mortgage servicing related income Mortgage production related income/(loss) Trading income Trading...

-

Page 182

...Foreign exchange rate contracts covering: Commercial loans and foreign-denominated debt Trading activity Credit contracts covering: Loans Trading activity Equity contracts - trading activity Other contracts - IRLCs Total Trading income Trading income Trading income Mortgage production related income...

-

Page 183

... at fair value, with changes in fair value recognized in trading income in the Consolidated Statements of Income. The Company writes CDS, which are agreements under which the Company receives premium payments from its counterparty for protection against an event of default of a reference asset. In...

-

Page 184

... based on prevailing market conditions and the shape of the yield curve. In conjunction with this strategy, the Company may employ various interest rate derivatives as risk management tools to hedge interest rate risk from recognized assets and liabilities or from forecasted transactions. The terms...

-

Page 185

...Statements of Income. Fair Value Hedges The Company enters into interest rate swap agreements as part of the Company's risk management objectives for hedging its exposure to changes in fair value due to changes in interest rates. These hedging arrangements convert Company-issued fixed rate long-term...

-

Page 186

... used for all commercial borrowers. The management of credit risk regarding letters of credit leverages the risk rating process to focus higher visibility on the higher risk and/or higher dollar letters of credit. The associated reserve is a component of the unfunded commitments reserve recorded...

-

Page 187

...and Fannie Mae settlement agreements, GSE owned loans serviced by third party servicers, loans sold to private investors, and future indemnifications. At December 31, 2013 and 2012, the Company's estimate of the liability for incurred losses related to all vintages of mortgage loans sold totaled $78...

-

Page 188

... Part I., "Item 1A. Risk Factors," in this Form 10-K for further information regarding potential additional liability.

The following table summarizes the changes in the Company's reserve for mortgage loan repurchases: Year Ended December 31 2013 2012 2011 $632 114 (668) $78 $320 713 (401) $632 $265...

-

Page 189

... obtained state and federal tax credits through the construction and development of affordable housing properties and continues to obtain state and federal tax credits through investments in affordable housing developments. SunTrust Community Capital or its subsidiaries are limited and/or general...

-

Page 190

Notes to Consolidated Financial Statements, continued

STIS and STRH, broker-dealer affiliates of the Company, use a common third-party clearing broker to clear and execute their customers' securities transactions and to hold customer accounts. Under their respective agreements, STIS and STRH agree ...

-

Page 191

.../ask spreads, declines in (or the absence of) new issuances, and the availability of public information. Inactive markets necessitate the use of additional judgment in valuing financial instruments, such as pricing matrices, cash flow modeling, and the selection of an appropriate discount rate. The...

-

Page 192

...by the Mortgage Banking segment to hedge its interest rate risk. See Note 16, "Derivative Financial Instruments," for further disaggregation of derivative assets and liabilities. 3 Includes $336 million of FHLB of Atlanta stock, $402 million of Federal Reserve Bank stock, $103 million in mutual fund...

-

Page 193

... to Consolidated Financial Statements, continued

December 31, 2012 Fair Value Measurements

(Dollars in millions)

Level 1

Level 2

Level 3

Netting Adjustments 1

Assets/Liabilities at Fair Value

Assets Trading assets and derivatives: U.S. Treasury securities Federal agency securities U.S. states...

-

Page 194

... $30 16 (1) (13) (23) (4)

Assets: Trading loans LHFS Past due loans of 90 days or more Nonaccrual loans LHFI Nonaccrual loans Liabilities: Brokered time deposits Long-term debt 764 1,556 761 1,432 3 124

(Dollars in millions)

Aggregate Fair Value at December 31, 2012 $2,319 3,237 3 3 360 1 18...

-

Page 195

... related economic hedges the Company used to mitigate the market-related risks associated with the financial instruments. Generally, the changes in the fair value of economic hedges are also recognized in trading income, mortgage production related income/(loss), or mortgage servicing related income...

-

Page 196

... 2 $21 169 14 (726)

(Dollars in millions)

Trading income $21 (10) 3 -

Mortgage Production Related Income/(Loss) 1 $- 179 11 7

Mortgage Servicing Related Income $- - - (733)

Assets: Trading loans LHFS LHFI MSRs Liabilities: Brokered time deposits Long-term debt

1

32 (12)

- -

- -

32 (12...

-

Page 197

... perceived risk of the issuer as determined by credit ratings or total leverage of the trust. These adjustments may be significant; therefore, the subordinate student loan ARS held as trading assets continue to be classified as level 3. Corporate and other debt securities Corporate debt securities...

-

Page 198

... years ended December 31, 2013 and 2012, the Company transferred $222 million and $882 million, respectively, of IRLCs out of level 3 as the associated loans were closed. Trading loans The Company engages in certain businesses whereby the election to carry loans at fair value for financial reporting...

-

Page 199

... economic hedges are captured in mortgage production related income/(loss). Level 2 LHFS are primarily agency loans which trade in active secondary markets and are priced using current market pricing for similar securities adjusted for servicing, interest rate risk, and credit risk. Non-agency...

-

Page 200

... to changes in its own credit spread on its brokered time deposits carried at fair value. Long-term debt The Company has elected to carry at fair value certain fixed rate debt issuances of public debt which are valued by obtaining quotes from a third party pricing service and utilizing broker quotes...

-

Page 201

...fair value hedge accounting requirements. The Company's public debt carried at fair value impacts earnings predominantly through changes in the Company's credit spreads as the Company has entered into derivative financial instruments that economically convert the interest rate on the debt from fixed...

-

Page 202

... cash flow Matrix pricing Internal model Indicative pricing based on overcollateralization ratio Discount margin ABS Derivative contracts, net Securities AFS: U.S. states and political subdivisions MBS - private ABS Corporate and other debt securities Other equity securities Residential LHFS 34 154...

-

Page 203

...9-28% (11%) 0-150% (92%) NM 3

LHFI

369

10 899

Collateral based pricing Discounted cash flow

Appraised value Conditional prepayment rate Discount rate

24 7

Internal model Internal model

Loan production volume Revenue run rate

For certain assets and liabilities that the Company utilizes third...

-

Page 204

...Transfers out of Level 3

Fair value December 31, 2013

Assets Trading assets and derivatives: CDO/CLO securities ABS Derivative contracts, net Corporate and other debt securities Total trading assets and derivatives Securities AFS: U.S. states and political subdivisions MBS - private ABS Corporate...

-

Page 205

... 31, 2012) 1

(Dollars in millions)

Included in earnings

OCI

Purchases

Sales

Settlements

Transfers into Level 3

Transfers out of Level 3

Assets Trading assets and derivatives: CDO/CLO securities ABS Derivative contracts, net Corporate and other debt securities Total trading assets and...

-

Page 206

... 31, 2013 to those at December 31, 2012, generally result from the application of LOCOM or through write-downs of individual assets. The table does not reflect the change in fair value attributable to any related economic hedges the Company may have used to mitigate the interest rate risk associated...

-

Page 207

... industry equipment dealers as well as the discounted cash flows derived from the underlying lease agreement. As market data for similar assets and lease arrangements is available and used in the valuation, these assets are considered level 2. During 2013 and 2012, the Company recognized impairment...

-

Page 208

...: Deposits Short-term borrowings Long-term debt Trading liabilities and derivatives 129,759 8,739 10,700 1,181 129,801 8,739 10,678 1,181 - - - 979 129,801 8,739 10,086 198 - (e) - (f) 592 (f) 4 (b)

December 31, 2012

Fair Value Measurement Using Quoted Prices in Active Markets for Identical Assets...

-

Page 209

... 31, 2013 and 2012, the Company had $48.9 billion and $42.7 billion, respectively, of unfunded commercial loan commitments and letters of credit. A reasonable estimate of the fair value of these instruments is the carrying value of deferred fees plus the related unfunded commitments reserve, which...

-

Page 210

.... All cases were transferred for coordination to the multi-district litigation captioned In re Lehman Brothers Equity/Debt Securities Litigation pending in the U.S. District Court for the Southern District of New York. Defendants filed a motion to dismiss all claims asserted in the class action. On...

-

Page 211

...SunTrust Banks, Inc., SunTrust Bank, and STM agreed to strengthen oversight of, and improve risk management, internal audit, and compliance programs concerning, the residential mortgage loan servicing, loss mitigation, and foreclosure activities of STM. Under the terms of the Consent Order, SunTrust...

-

Page 212

... Order, and the Company's financial results at December 31, 2013 reflect the expected costs of satisfying its financial obligations under the amendment to the Consent Order. As a result of the FRB's review of the Company's residential mortgage loan servicing and foreclosure processing practices...

-

Page 213

...motion to transfer this case to the Southern District of Florida. SunTrust Mortgage, Inc. v. United Guaranty Residential Insurance Company of North Carolina STM filed suit in the Eastern District of Virginia in July 2009 against United Guaranty Residential Insurance Company of North Carolina ("UGRIC...

-

Page 214

...store branches, ATMs, the internet (www.suntrust.com), mobile banking, and telephone (1-800-SUNTRUST). Financial products and services offered to consumers and small business clients include deposits, home equity lines and loans, credit lines, indirect auto, student lending, bank card, other lending...

-

Page 215

... operations group; Corporate Real Estate, Marketing, SunTrust Online, Human Resources, Finance, Corporate Risk Management, Legal and Compliance, Branch Operations, Communications, Procurement, and Executive Management. Because the business segment results are presented based on management accounting...

-

Page 216

..., the impact of these changes is quantified and prior period information is reclassified wherever practicable. Prior year results have been restated to reflect the 2013 transfer of branch-managed business banking clients from Wholesale Banking to Consumer Banking and Private Wealth Management.

200

-

Page 217

Notes to Consolidated Financial Statements, continued

Year Ended December 31, 2013

Consumer Banking and Private Wealth Management $45,487 84,977 -

(Dollars in millions)

Wholesale Banking $66,618 47,310 -

Mortgage Banking $32,708 3,845 -

Corporate Other $26,033 15,293 -

Reconciling Items $1,651...

-

Page 218

Notes to Consolidated Financial Statements, continued

Year Ended December 31, 2011 Consumer Banking and Private Wealth Management $45,221 85,335 -

(Dollars in millions)

Wholesale Banking $61,323 47,181 -

Mortgage Banking $33,719 3,838 -

Corporate Other $30,876 15,598 -

Reconciling Items $1,301 ...

-

Page 219

... gains Less: Reclassification adjustment for realized net gains Change related to employee benefit plans AOCI, December 31, 2012 Unrealized (losses)/gains on AFS securities: Unrealized net losses Less: Reclassification adjustment for realized net gains Unrealized gains/(losses) on cash flow hedges...

-

Page 220

... Realized gains on AFS securities:

Affected line item in the Consolidated Statements of Income

($117) Net securities gains 43 Provision for income taxes ($74) ($625) Interest and fees on loans 231 Provision for income taxes ($394) ($64) Employee benefits (318) Other assets/other liabilities 1 (382...

-

Page 221

... Dividends1 Interest on loans Trading income Other income Total income Expense Interest on short-term borrowings Interest on long-term debt Employee compensation and benefits2 Service fees to subsidiaries Other expense Total expense Income/(loss) before income tax benefit and equity in undistributed...

-

Page 222

... SunTrust Bank Interest-bearing deposits held at other banks Cash and cash equivalents Trading assets and derivatives Securities available for sale Loans to subsidiaries Investment in capital stock of subsidiaries stated on the basis of the Company's equity in subsidiaries' capital accounts: Banking...

-

Page 223

... sales of trading securities Net change in loans to subsidiaries Capital contributions to subsidiaries Net cash provided by investing activities Cash Flows from Financing Activities: Net (decrease)/increase in short-term borrowings Proceeds from the issuance of long-term debt Repayment of long-term...

-

Page 224

... public accounting firm that audited our consolidated financial statements at and for the year ended December 31, 2013, has issued a report on the effectiveness of the Company's internal control over financial reporting at December 31, 2013. The report of Ernst & Young LLP is included under Item...

-

Page 225

...Management," "Executive Compensation" ("Compensation Discussion and Analysis," "Compensation Committee Report," "2013 Summary Compensation Table," "2013 Grants of Plan-Based Awards," "Option Exercises and Stock Vested in 2013," "Outstanding Equity Awards at December 31, 2013," "2013 Pension Benefits...