PNC Bank 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Troubled Debt Restructurings

A TDR is a loan whose terms have been restructured in a

manner that grants a concession to a borrower experiencing

financial difficulties. TDRs result from our loss mitigation

activities and include rate reductions, principal forgiveness,

postponement/reduction of scheduled amortization and

extensions, which are intended to minimize economic loss and

to avoid foreclosure or repossession of collateral.

Additionally, TDRs also result from borrowers that have been

discharged from personal liability through Chapter 7

bankruptcy and have not formally reaffirmed their loan

obligations to PNC.

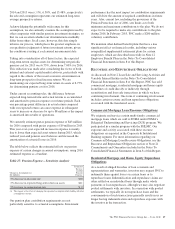

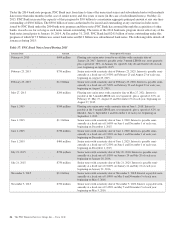

Table 34: Summary of Troubled Debt Restructurings (a)

In millions

December 31

2015

December 31

2014

Consumer lending:

Real estate-related $1,775 $1,864

Credit card 108 130

Other consumer 34 47

Total consumer lending (b) 1,917 2,041

Total commercial lending 434 542

Total TDRs $2,351 $2,583

Nonperforming $1,119 $1,370

Accruing 1,232 1,213

Total TDRs $2,351 $2,583

(a) Amounts in table represent recorded investment, which includes the unpaid principal

balance plus accrued interest and net accounting adjustments, less any charge-offs.

Recorded investment does not include any associated valuation allowance.

(b) Excludes $1.2 billion and $.9 billion of consumer loans held for sale, loans

accounted for under the fair value option and pooled purchased impaired loans, as

well as certain government insured or guaranteed loans at December 31, 2015 and

December 31, 2014, respectively.

Total TDRs decreased $232 million, or 9%, during 2015.

Nonperforming TDRs were approximately 53% of total

nonperforming loans, and 48% of total TDRs.

TDRs that are performing, including credit card loans, are

excluded from nonperforming loans. These TDRs remained

generally flat during 2015 at $1.2 billion. Generally, the

accruing category is comprised of loans where borrowers have

been performing under the restructured terms for at least six

consecutive months. Loans where borrowers have been

discharged from personal liability through Chapter 7

bankruptcy and have not formally reaffirmed their loan

obligations to PNC and loans to borrowers not currently

obligated to make both principal and interest payments under

the restructured terms are not returned to accrual status.

See Note 3 Asset Quality in the Notes To Consolidated

Financial Statements in Item 8 of this Report for additional

information on loan modifications and TDRs.

Allowances for Loan and Lease Losses and Unfunded

Loan Commitments and Letters of Credit

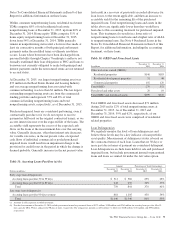

Table 35: Loan Charge-Offs And Recoveries

Year ended December 31

Dollars in millions

Gross

Charge-offs Recoveries

Net

Charge-offs /

(Recoveries)

Percent of

Average Loans

2015

Commercial $ 206 $170 $ 36 .04%

Commercial real estate 44 66 (22) (.09)

Equipment lease

financing 5 4 1 .01

Home equity 181 93 88 .26

Residential real estate 24 13 11 .08

Credit card 160 21 139 3.06

Other consumer 185 52 133 .60

Total $ 805 $419 $386 .19

2014

Commercial $ 276 $207 $ 69 .07%

Commercial real estate 70 84 (14) (.06)

Equipment lease

financing 14 14

Home equity 275 78 197 .56

Residential real estate 40 26 14 .10

Credit card 163 21 142 3.24

Other consumer 183 60 123 .54

Total $1,021 $490 $531 .27

Total net charge-offs are lower than they would have been

otherwise due to the accounting treatment for purchased

impaired loans. This treatment also results in a lower ratio of

net charge-offs to average loans. See Note 4 Purchased Loans

in the Notes To Consolidated Financial Statements in Item 8

of this Report for additional information on net charge-offs

related to these loans.

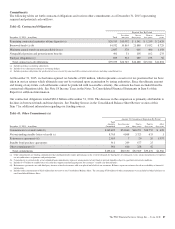

We maintain an ALLL to absorb losses from the loan and

lease portfolio and determine this allowance based on

quarterly assessments of the estimated probable credit losses

incurred in the loan and lease portfolio. Our total ALLL of

$2.7 billion at December 31, 2015 consisted of $1.6 billion

and $1.1 billion established for the commercial lending and

consumer lending categories, respectively. We maintain the

ALLL at a level that we believe to be appropriate to absorb

estimated probable credit losses incurred in the loan and lease

portfolio as of the balance sheet date. The reserve calculation

and determination process is dependent on the use of key

assumptions. Key reserve assumptions and estimation

processes react to and are influenced by observed changes in

loan and lease portfolio performance experience, the financial

strength of the borrower, and economic conditions. Key

reserve assumptions are periodically updated.

The PNC Financial Services Group, Inc. – Form 10-K 77