PNC Bank 2015 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

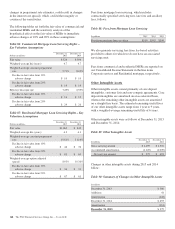

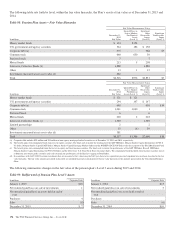

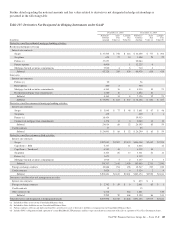

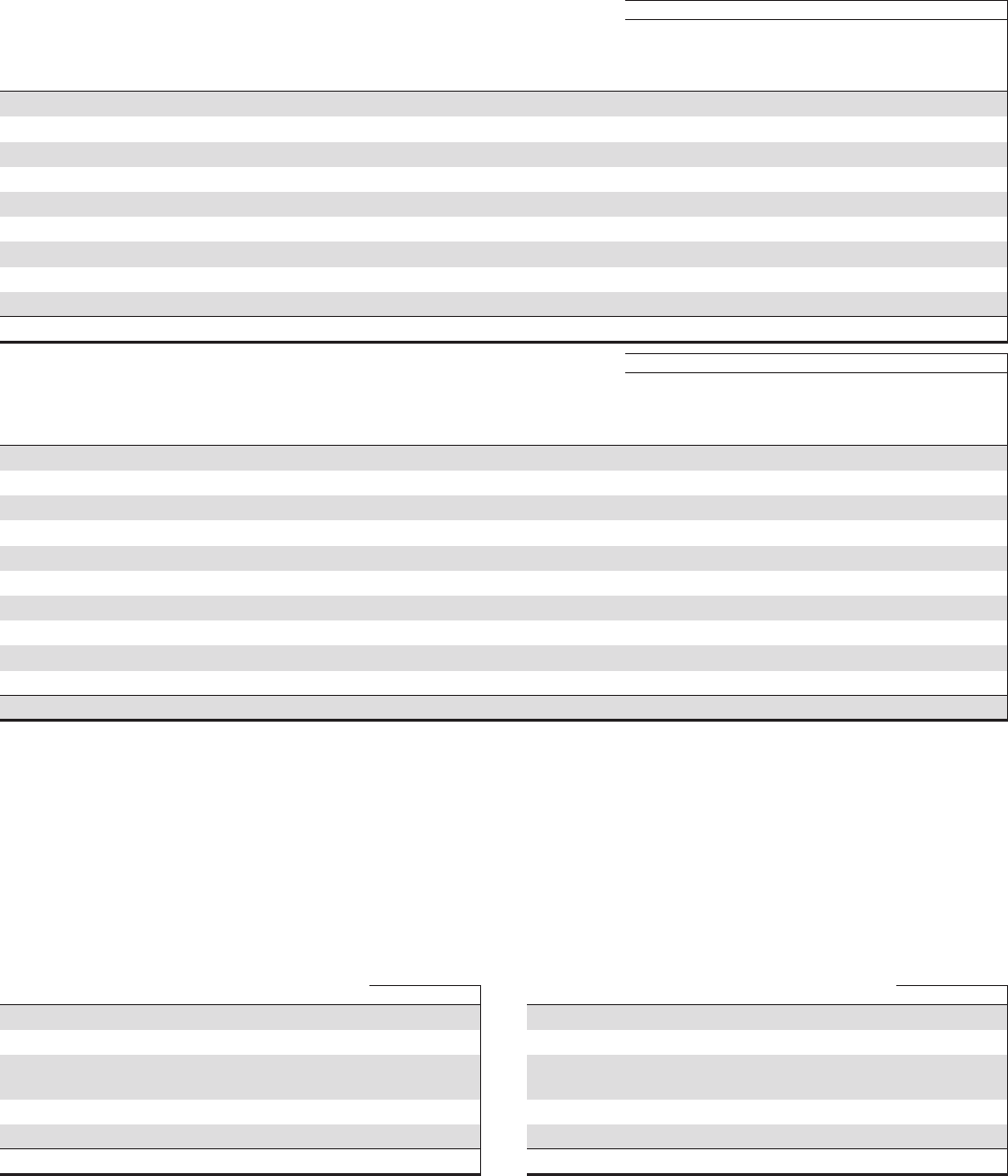

The following table sets forth by level, within the fair value hierarchy, the Plan’s assets at fair value as of December 31, 2015 and

2014.

Table 98: Pension Plan Assets – Fair Value Hierarchy

Fair Value Measurements Using:

In millions

December 31,

2015

Fair Value

Quoted Prices in

Active Markets

For Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Money market funds $ 154 $154

U.S. government and agency securities 324 186 $ 138

Corporate debt (a) 575 568 $7

Common stock 660 630 30

Preferred stock 77

Mutual funds 213 5 208

Interest in Collective Funds (b) 1,888 1,888

Other 13 1 12

Investments measured at net asset value (d) 482

Total $4,316 $976 $2,851 $7

Fair Value Measurements Using:

In millions

December 31,

2014

Fair Value

Quoted Prices in

Active Markets

For Identical

Assets (Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Money market funds $ 121 $ 121

U.S. government and agency securities 294 147 $ 147

Corporate debt (a) 648 638 $10

Common stock 1,041 1,040 1

Preferred Stock 66

Mutual funds 220 2 218

Interest in Collective Funds (c) 1,589 1,589

Limited partnerships 22

Other 55 (4) 59

Investments measured at net asset value (d) 381

Total $4,357 $1,306 $2,660 $10

(a) Corporate debt includes $29 million and $34 million of non-agency mortgage-backed securities as of December 31, 2015 and 2014, respectively.

(b) The benefit plans own commingled funds that invest in equity securities. The funds seek to mirror the benchmark of the S&P 500 Index, Morgan Stanley Capital International ACWI X

US Index, Morgan Stanley Capital EAFE Index, Morgan Stanley Capital Emerging Markets Index and the NCREIF ODCE NOF Index with the exception of the BlackRock Index Fund.

(c) The benefit plans own commingled funds that invest in equity and fixed income securities. The funds seek to mirror the performance of the S&P 500 Index, Russell 3000 Index,

Morgan Stanley Capital International ACWI X US Index and the Dow Jones U.S. Select Real Estate Securities Index. The commingled fund that holds fixed income securities invests

in domestic investment grade securities and seeks to mimic the performance of the Barclays Aggregate Bond Index.

(d) In accordance with ASC 820-10, certain investments that are measured at fair value using the NAV per share (or its equivalent) practical expedient have not been classified in the fair

value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented on the Consolidated Balance

Sheet.

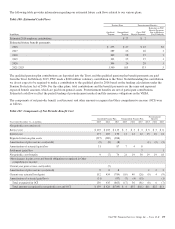

The following summarizes changes in the fair value of the pension plan’s Level 3 assets during 2015 and 2014.

Table 99: Rollforward of Pension Plan Level 3 Assets

In millions Corporate Debt

January 1, 2015 $10

Net realized gain/(loss) on sale of investments 1

Net unrealized gain/(loss) on assets held at end of

year

Purchases 4

Sales (8)

December 31, 2015 $ 7

In millions Corporate Debt

January 1, 2014 $13

Net realized gain/(loss) on sale of investments 3

Net unrealized gain/(loss) on assets held at end of

year

Purchases

Sales (6)

December 31, 2014 $10

174 The PNC Financial Services Group, Inc. – Form 10-K