PNC Bank 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 and 2013 were (.1%), 6.50%, and 15.48%, respectively),

the selected assumption represents our estimated long-term

average prospective returns.

Acknowledging the potentially wide range for this

assumption, we also annually examine the assumption used by

other companies with similar pension investment strategies, so

that we can ascertain whether our determinations markedly

differ from others. In all cases, however, this data simply

informs our process, which places the greatest emphasis on

our qualitative judgment of future investment returns, given

the conditions existing at each annual measurement date.

Taking into consideration all of these factors, the expected

long-term return on plan assets for determining net periodic

pension cost for 2015 was 6.75%, down from 7.00% for 2014.

This reduction was made after considering the views of both

internal and external capital market advisors, particularly with

regard to the effects of the recent economic environment on

long-term prospective fixed income returns. We are

maintaining our expected long-term return on assets at 6.75%

for determining pension cost for 2016.

Under current accounting rules, the difference between

expected long-term returns and actual returns is accumulated

and amortized to pension expense over future periods. Each

one percentage point difference in actual return compared

with our expected return can cause expense in subsequent

years to increase or decrease by up to $8 million as the impact

is amortized into results of operations.

We currently estimate pretax pension expense of $43 million

for 2016 compared with pretax expense of $9 million in 2015.

This year-over-year expected increase in expense is mainly

due to lower than expected asset returns during 2015, which

reduced year-end pension asset balances and increased the

amortization of actuarial losses in 2016.

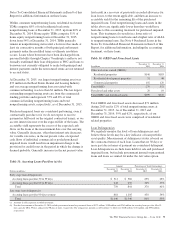

The table below reflects the estimated effects on pension

expense of certain changes in annual assumptions, using 2016

estimated expense as a baseline.

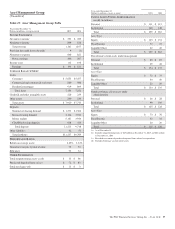

Table 27: Pension Expense – Sensitivity Analysis

Change in Assumption (a)

(In millions)

Estimated

Increase

to 2016

Pension

Expense

.5% decrease in discount rate $18

.5% decrease in expected long-term return on assets $21

.5% increase in compensation rate $ 2

(a) The impact is the effect of changing the specified assumption while holding all other

assumptions constant.

Our pension plan contribution requirements are not

particularly sensitive to actuarial assumptions. Investment

performance has the most impact on contribution requirements

and will drive the amount of required contributions in future

years. Also, current law, including the provisions of the

Pension Protection Act of 2006, sets limits as to both

minimum and maximum contributions to the plan. We do not

expect to be required to make any contributions to the plan

during 2016. In February 2015, PNC made a $200 million

voluntary contribution.

We maintain other defined benefit plans that have a less

significant effect on financial results, including various

nonqualified supplemental retirement plans for certain

employees, which are described more fully in Note 12

Employee Benefit Plans in the Notes To Consolidated

Financial Statements in Item 8 of this Report.

R

ECOURSE AND

R

EPURCHASE

O

BLIGATIONS

As discussed in Note 2 Loan Sale and Servicing Activities and

Variable Interest Entities in the Notes To Consolidated

Financial Statements in Item 8 of this Report, PNC has sold

commercial mortgage, residential mortgage and home equity

loans/lines of credit directly or indirectly through

securitization and loan sale transactions in which we have

continuing involvement. One form of continuing involvement

includes certain recourse and loan repurchase obligations

associated with the transferred assets.

Commercial Mortgage Loan Recourse Obligations

We originate and service certain multi-family commercial

mortgage loans which are sold to FNMA under FNMA’s

Delegated Underwriting and Servicing (DUS) program. We

participated in a similar program with the FHLMC. Our

exposure and activity associated with these recourse

obligations are reported in the Corporate & Institutional

Banking segment. For more information regarding our

Commercial Mortgage Loan Recourse Obligations, see the

Recourse and Repurchase Obligations section of Note 21

Commitments and Guarantees included in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

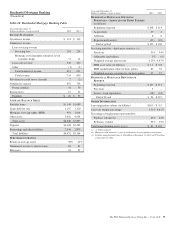

Residential Mortgage and Home Equity Repurchase

Obligations

As a result of alleged breaches of loan covenants and

representations and warranties, investors may request PNC to

indemnify them against losses on certain loans or to

repurchase loans. Indemnification and repurchase claims are

often settled on an individual basis through make whole

payments or loan repurchases, although we may also negotiate

pooled settlements with investors. In connection with pooled

settlements, we typically do not repurchase loans and the

consummation of such transactions generally results in us no

longer having indemnification and repurchase exposure with

the investor in the transaction.

The PNC Financial Services Group, Inc. – Form 10-K 67