PNC Bank 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

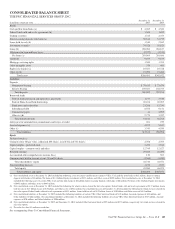

Shareholders’ Equity

Total shareholders’ equity increased $2.2 billion, to $44.6

billion at December 31, 2014 compared with December 31,

2013, primarily reflecting an increase in retained earnings,

partially offset by share repurchases of $1.2 billion under

PNC’s existing common stock repurchase authorization. The

increase in retained earnings was driven by net income of $4.2

billion, reduced by $1.2 billion of common and preferred

dividends declared. Accumulated other comprehensive

income increased slightly as the impact of market interest

rates and credit spreads on securities available for sale and

derivatives that are part of cash flow hedging strategies were

mostly offset by the impact of pension and other

postretirement benefit plan adjustments. Common shares

outstanding were 523 million at December 31, 2014 and

533 million at December 31, 2013.

Risk-Based Capital

As a result of the staggered effective dates of the final U.S.

Basel III regulatory capital rules (Basel III rules), as well as

the fact that PNC remains in the parallel run qualification

phase for the advanced approaches, PNC’s regulatory risk-

based ratios in 2014 were based on the definitions of, and

deductions from, capital under Basel III (as such definitions

and deductions were phased-in for 2014) and Basel I risk

weighted assets (subject to certain adjustments as defined by

the Basel III rules). We refer to the capital ratios calculated

using the phased-in Basel III provisions in effect for 2014 and

applicable risk-weighted assets as the 2014 Transitional

Basel III ratios.

Our 2014 Transitional Basel III ratios at December 31, 2014

were 10.9% for Tier 1 common, 10.8% for leverage, 12.6%

for Tier 1 risk-based and 15.8% for total risk-based capital.

PNC’s Basel I ratios as of December 31, 2013, which were

PNC’s effective regulatory capital ratios as of that date, were

10.5% for Tier 1 common, 11.1% for leverage, 12.4% for

Tier 1 risk-based and 15.8% for total risk-based capital.

We provide additional information on our 2014 risk-based

capital ratios in the Capital portion of the Balance Sheet

Review section in Item 7 of our 2014 Form 10-K. For

additional information on our 2014 Transitional Basel III

ratios and 2013 Basel I Tier 1 ratio, see also the Statistical

Information (Unaudited) section in Item 8 of this Report.

The PNC Financial Services Group, Inc. – Form 10-K 95