PNC Bank 2015 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

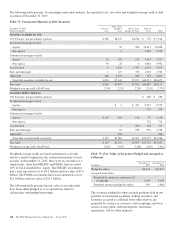

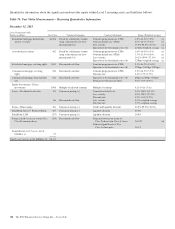

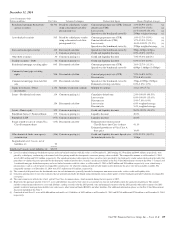

(a) Included in Other assets on the Consolidated Balance Sheet.

(b) Amounts at December 31, 2015 and December 31, 2014, are presented gross and are not reduced by the impact of legally enforceable master netting agreements that allow PNC to net

positive and negative positions and cash collateral held or placed with the same counterparty. At December 31, 2015 and December 31, 2014, the net asset amounts were $1.8 billion

and $2.6 billion, respectively, and the net liability amounts were $.6 billion and $1.4 billion, respectively.

(c) Included in Loans held for sale on the Consolidated Balance Sheet. PNC has elected the fair value option for certain residential and commercial mortgage loans held for sale.

(d) Fair value includes net unrealized gains of $23 million at December 31, 2015 compared with net unrealized gains of $54 million at December 31, 2014.

(e) Approximately 28% of these securities are residential mortgage-backed securities and 57% are U.S. Treasury and government agencies securities at December 31, 2015. Comparable

amounts at December 31, 2014 were 34% and 57%, respectively.

(f) In accordance with ASC 820-10, certain investments that are measured at fair value using the NAV per share (or its equivalent) practical expedient have not been classified in the fair

value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented on the Consolidated Balance

Sheet.

(g) Included in Federal funds sold and resale agreements on the Consolidated Balance Sheet. PNC has elected the fair value option for these items.

(h) Included in Loans on the Consolidated Balance Sheet.

(i) PNC has elected the fair value option for these shares.

(j) Included in Other liabilities on the Consolidated Balance Sheet.

(k) Included in Other borrowed funds on the Consolidated Balance Sheet.

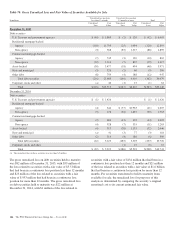

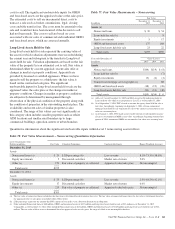

Reconciliations of assets and liabilities measured at fair value on a recurring basis using Level 3 inputs for 2015 and 2014 follow.

Table 75: Reconciliation of Level 3 Assets and Liabilities

Year Ended December 31, 2015

Total realized / unrealized

gains or losses for the period (a)

Unrealized

gains (losses)

on assets and

liabilities held on

Consolidated

Balance Sheet

at Dec. 31,

2015 (b)

Level 3 Instruments Only

In millions

Fair Value

Dec. 31,

2014

Included in

Earnings

Included

in Other

comprehensive

income Purchases Sales Issuances Settlements

Transfers

into

Level 3

Transfers

out of

Level 3

Fair Value

Dec. 31,

2015

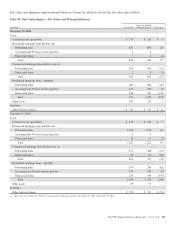

Assets

Securities available for sale

Residential mortgage-backed non-

agency $4,798 $114 $(58) $ (846) $4,008 $ (2)

Commercial mortgage backed non-

agency 8 (8)

Asset-backed 563 20 (101) 482 (2)

State and municipal 134 (1) (118) 15

Other debt 30 2 (1) $ 13 $ (7) (7) 30

Total securities available for sale 5,525 144 (60) 13 (7) (1,080) 4,535 (4)

Financial derivatives 42 135 3 (149) 31 126

Residential mortgage loans held for sale 6 1 25 (4) $ 6 $ (29) (c) 5 1

Trading securities – Debt 32 (29) 3

Residential mortgage servicing rights 845 2 316 $ 78 (178) 1,063 5

Commercial mortgage servicing rights 506 (9) 55 63 (89) 526 (10)

Commercial mortgage loans held for sale 893 76 (56) 4,163 (4,435) 641 (5)

Equity investments – direct investments 1,152 120 274 (448) 1,098 86

Loans 397 23 114 (26) (122) 25(c) (71) (d) 340 12

Other assets

BlackRock Series C Preferred Stock 375 (18) 357 (18)

Other 15 (7) (1) 7

Total other assets 390 (18) (7) (1) 364 (18)

Total assets $9,788 $474 (e) $(60) $800 $(548) $4,304 $(6,083) $31 $(100) $8,606 $193 (f)

Liabilities

Financial derivatives (g) $ 526 $ 22 $ 1 $ (76) $ 473 $ 4

Other borrowed funds 181 (3) $ 92 (258) 12

Other liabilities 9 1 10

Total liabilities $ 716 $ 20 (e) $ 1 $ 92 $ (334) $ 495 $ 4 (f)

156 The PNC Financial Services Group, Inc. – Form 10-K