PNC Bank 2015 Annual Report Download - page 86

Download and view the complete annual report

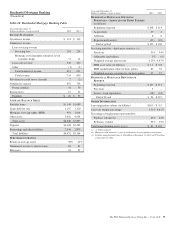

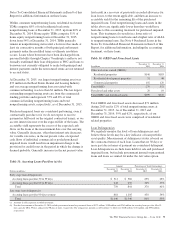

Please find page 86 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Residential Mortgage Loan Repurchase Obligations

While residential mortgage loans are sold on a non-recourse

basis, we assume certain loan repurchase obligations

associated with mortgage loans we have sold to investors.

These loan repurchase obligations primarily relate to

situations where PNC is alleged to have breached certain

origination covenants and representations and warranties

made to purchasers of the loans in the respective purchase and

sale agreements. Residential mortgage loans covered by these

loan repurchase obligations include first and second-lien

mortgage loans we have sold through Agency securitizations,

Non-Agency securitizations, and loan sale transactions. As

discussed in Note 2 Loan Sale and Servicing Activities and

Variable Interest Entities in the Notes To Consolidated

Financial Statements in Item 8 of this Report, Agency

securitizations consist of mortgage loan sale transactions with

FNMA, FHLMC and the Government National Mortgage

Association (GNMA), while Non-Agency securitizations

consist of mortgage loan sale transactions with private

investors. Mortgage loan sale transactions that are not part of a

securitization may involve FNMA, FHLMC or private

investors. Our historical exposure and activity associated with

Agency securitization repurchase obligations has primarily

been related to transactions with FNMA and FHLMC, as

indemnification and repurchase losses associated with FHA

and VA-insured and uninsured loans pooled in GNMA

securitizations historically have been minimal. In addition to

indemnification and repurchase risk, we face other risks of

loss with respect to our participation in these programs, some

of which are described in Note 20 Legal Proceedings in the

Notes To Consolidated Financial Statements in Item 8 of this

Report with respect to governmental inquiries related to FHA-

insured loans. Repurchase obligation activity associated with

residential mortgages is reported in the Residential Mortgage

Banking segment.

Origination and sale of residential mortgages is an ongoing

business activity and, accordingly, management continually

assesses the need to recognize indemnification and repurchase

liabilities pursuant to the associated investor sale agreements.

We establish indemnification and repurchase liabilities for

estimated losses on sold first and second-lien mortgages for

which indemnification is expected to be provided or for loans

that are expected to be repurchased. For the first and second-

lien mortgage sold portfolio, we have established an

indemnification and repurchase liability pursuant to investor

sale agreements based on claims made and our estimate of

future claims on a loan by loan basis. To estimate the

mortgage repurchase liability arising from breaches of

representations and warranties, we consider the following

factors: (i) borrower performance in our historically sold

portfolio (both actual and estimated future defaults); (ii) the

level of outstanding unresolved repurchase claims;

(iii) estimated probable future repurchase claims, considering

information about expected investor behaviors, delinquent and

liquidated loans, resolved and unresolved mortgage insurance

rescission notices and our historical experience with claim

rescissions; (iv) the potential ability to cure the defects

identified in the repurchase claims (“rescission rate”); (v) the

availability of legal defenses; and (vi) the estimated severity

of loss upon repurchase of the loan or collateral, make-whole

settlement or indemnification.

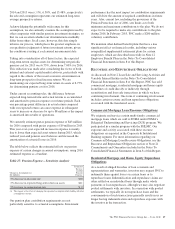

We previously reached agreements with both FNMA and

FHLMC to resolve their repurchase claims with respect to

loans sold between 2000 and 2008. Thus, our repurchase

obligations involve Agency securitizations and other loan

sales with FNMA and FHLMC subsequent to 2008 only, as

well as Agency securitizations with GNMA and Non-Agency

securitizations and other loan sales with private investors. The

unpaid principal balance of loans associated with our exposure

to repurchase obligations totaled $65.3 billion at

December 31, 2015, of which $1.2 billion was 90 days or

more delinquent. The comparative amounts were $68.3 billion

and $1.5 billion, respectively, at December 31, 2014.

We believe our indemnification and repurchase liability

appropriately reflects the estimated probable losses on

indemnification and repurchase claims for all residential

mortgage loans sold and outstanding as of December 31, 2015

and December 31, 2014. In making these estimates we

consider the losses that we expect to incur over the life of the

sold loans. See Note 21 Commitments and Guarantees in this

Report for additional information on residential mortgage

repurchase obligations.

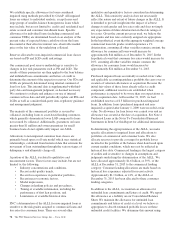

Home Equity Loan/Line of Credit Repurchase Obligations

PNC’s repurchase obligations include obligations with respect

to certain brokered home equity loans/lines of credit that were

sold to a limited number of private investors in the financial

services industry by National City prior to our acquisition of

National City. PNC is no longer engaged in the brokered

home equity lending business, and our exposure under these

loan repurchase obligations is limited to repurchases of the

loans sold in these transactions. Repurchase activity

associated with brokered home equity loans/lines of credit is

reported in the Non-Strategic Assets Portfolio segment.

Loan covenants and representations and warranties were

established through loan sale agreements with various

investors to provide assurance that loans PNC sold to the

investors were of sufficient investment quality. Key aspects of

such covenants and representations and warranties include the

loan’s compliance with any applicable loan criteria established

for the transaction, including underwriting standards, delivery

of all required loan documents to the investor or its designated

party, sufficient collateral valuation, and the validity of the

lien securing the loan. As a result of alleged breaches of these

contractual obligations, investors may request PNC to

indemnify them against losses on certain loans or to

repurchase loans.

Investor indemnification or repurchase claims are typically

settled on an individual loan basis through make-whole

68 The PNC Financial Services Group, Inc. – Form 10-K