PNC Bank 2015 Annual Report Download - page 230

Download and view the complete annual report

Please find page 230 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

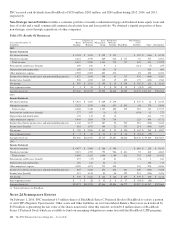

PNC received cash dividends from BlackRock of $320 million, $285 million, and $249 million during 2015, 2014, and 2013,

respectively.

Non-Strategic Assets Portfolio includes a consumer portfolio of mainly residential mortgage and brokered home equity loans and

lines of credit and a small commercial/commercial real estate loan and lease portfolio. We obtained a significant portion of these

non-strategic assets through acquisitions of other companies.

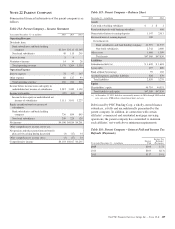

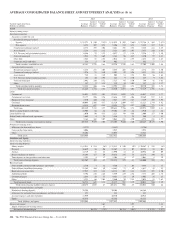

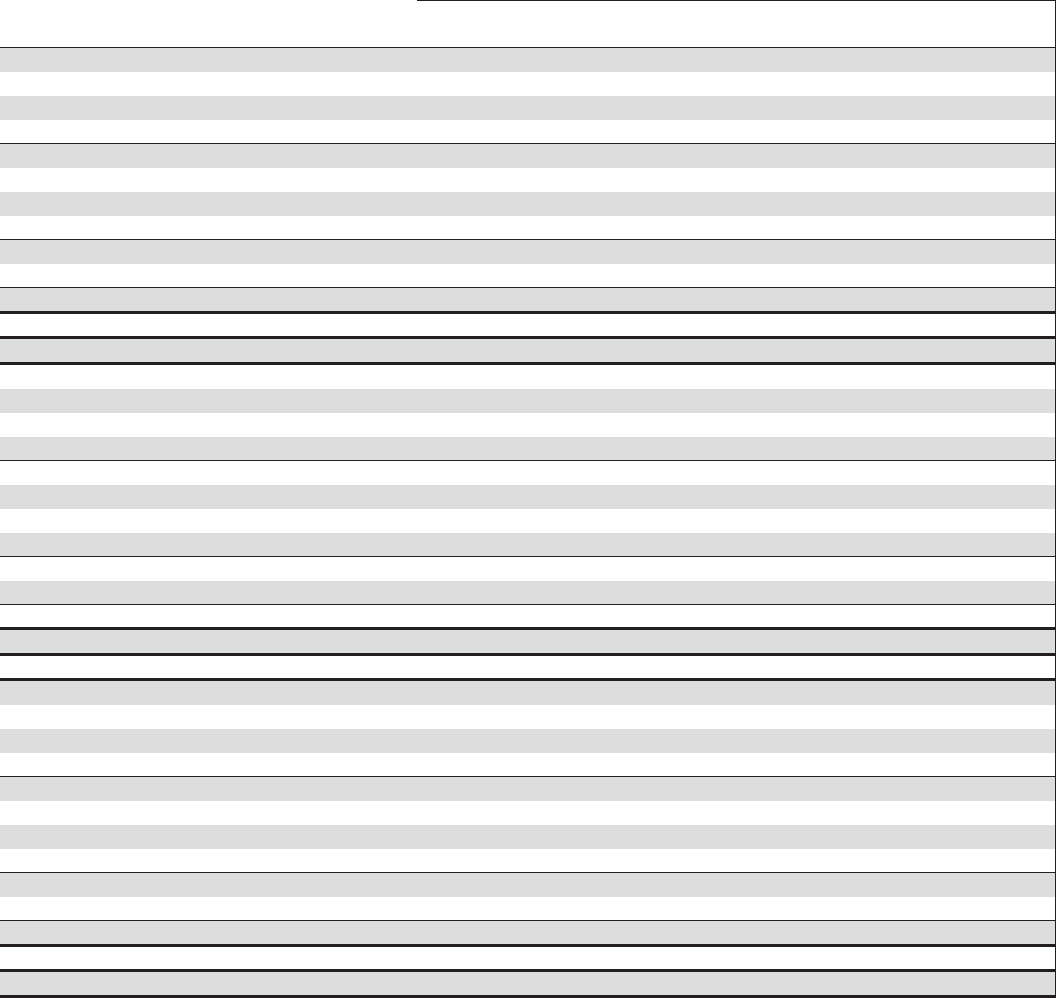

Table 138: Results Of Businesses

Year ended December 31

In millions

Retail

Banking

Corporate &

Institutional

Banking

Asset

Management

Group

Residential

Mortgage

Banking BlackRock

Non-Strategic

Assets

Portfolio Other Consolidated

2015

Income Statement

Net interest income $ 4,224 $ 3,365 $ 292 $ 121 $ 392 $ (116) $ 8,278

Noninterest income 2,223 1,935 869 613 $ 717 53 537 6,947

Total revenue 6,447 5,300 1,161 734 717 445 421 15,225

Provision for credit losses (benefit) 259 106 9 2 (114) (7) 255

Depreciation and amortization 169 145 44 15 436 809

Other noninterest expense 4,592 2,003 802 676 83 498 8,654

Income (loss) before income taxes and noncontrolling interests 1,427 3,046 306 41 717 476 (506) 5,507

Income taxes (benefit) 520 1,015 112 15 169 175 (642) 1,364

Net income $ 907 $ 2,031 $ 194 $ 26 $ 548 $ 301 $ 136 $ 4,143

Inter-segment revenue $ 1 $ 24 $ 9 $ 20 $ 15 $ (8) $ (61)

Average Assets (a) $73,240 $132,032 $7,920 $6,840 $6,983 $6,706 $121,243 $354,964

2014

Income Statement

Net interest income $ 3,923 $ 3,605 $ 289 $ 149 $ 547 $ 12 $ 8,525

Noninterest income 2,125 1,743 818 651 $ 703 40 770 6,850

Total revenue 6,048 5,348 1,107 800 703 587 782 15,375

Provision for credit losses (benefit) 277 107 (1) (2) (119) 11 273

Depreciation and amortization 176 135 42 12 411 776

Other noninterest expense 4,449 1,929 779 734 125 696 8,712

Income (loss) before income taxes and noncontrolling interests 1,146 3,177 287 56 703 581 (336) 5,614

Income taxes (benefit) 418 1,071 106 21 173 214 (596) 1,407

Net income $ 728 $ 2,106 $ 181 $ 35 $ 530 $ 367 $ 260 $ 4,207

Inter-segment revenue $ 2 $ 23 $ 11 $ 17 $ 16 $ (10) $ (59)

Average Assets (a) $75,046 $122,927 $7,745 $7,857 $6,640 $8,338 $ 99,300 $327,853

2013

Income Statement

Net interest income $ 4,077 $ 3,680 $ 288 $ 194 $ 689 $ 219 $ 9,147

Noninterest income 2,021 1,702 752 906 $ 621 53 810 6,865

Total revenue 6,098 5,382 1,040 1,100 621 742 1,029 16,012

Provision for credit losses (benefit) 657 (25) 10 21 (21) 1 643

Depreciation and amortization 186 128 42 11 348 715

Other noninterest expense 4,390 1,871 732 834 163 976 8,966

Income (loss) before income taxes and noncontrolling interests 865 3,408 256 234 621 600 (296) 5,688

Income taxes (benefit) 315 1,144 94 86 152 221 (536) 1,476

Net income $ 550 $ 2,264 $ 162 $ 148 $ 469 $ 379 $ 240 $ 4,212

Inter-segment revenue $ 3 $ 28 $ 12 $ 8 $ 17 $ (10) $ (58)

Average Assets (a) $74,971 $112,970 $7,366 $9,896 $6,272 $9,987 $ 84,202 $305,664

(a) Period-end balances for BlackRock.

N

OTE

24 S

UBSEQUENT

E

VENTS

On February 1, 2016, PNC transferred 0.5 million shares of BlackRock Series C Preferred Stock to BlackRock to satisfy a portion

of our LTIP obligation. Upon transfer, Other assets and Other liabilities on our Consolidated Balance Sheet were each reduced by

$138 million, representing the fair value of the shares transferred. After this transfer, we hold 0.8 million shares of BlackRock

Series C Preferred Stock which are available to fund our remaining obligation in connection with the BlackRock LTIP programs.

212 The PNC Financial Services Group, Inc. – Form 10-K