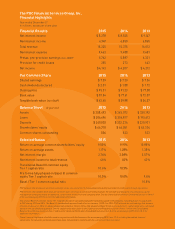

PNC Bank 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

more secure product set to customers. We have the customer relationships

today, and we need to change the way we serve our customers to protect

this franchise. To that end, we are making important investments across our

business and, in some cases, alongside others in the industry. In 2015, PNC

invested with six other banks in Early Warning Services (EWS), a leading

provider of fraud prevention and risk management solutions. EWS then

acquired ClearXchange, the first network in the United States created by banks

that lets customers send and receive person-to-person (P-to-P) payments

easily and securely using an email address or mobile phone number.

Integrating the services and capabilities of these businesses and their related

networks will enable us to create a secure, real-time solution for P-to-P

payments and mobile check deposits that no single bank could accomplish

alone and that will work for customers of virtually any bank in the country.

Additionally, in January of this year, we announced an investment in Digital

Asset Holdings, a developer of distributed ledger technology, which is expected to improve efficiency, security,

compliance and settlement speed for financial institutions.

PNC will continue to make investments in financial technologies that help us deliver the products and services

our customers want in a way that strengthens the relationships we already enjoy with them. That focus on our

customers — not innovating for the sake of innovation but rather to provide a superior banking experience and

meet the evolving needs of the people we serve — is at the heart of our investment strategy, just as it remains at

the heart of our Main Street banking philosophy.

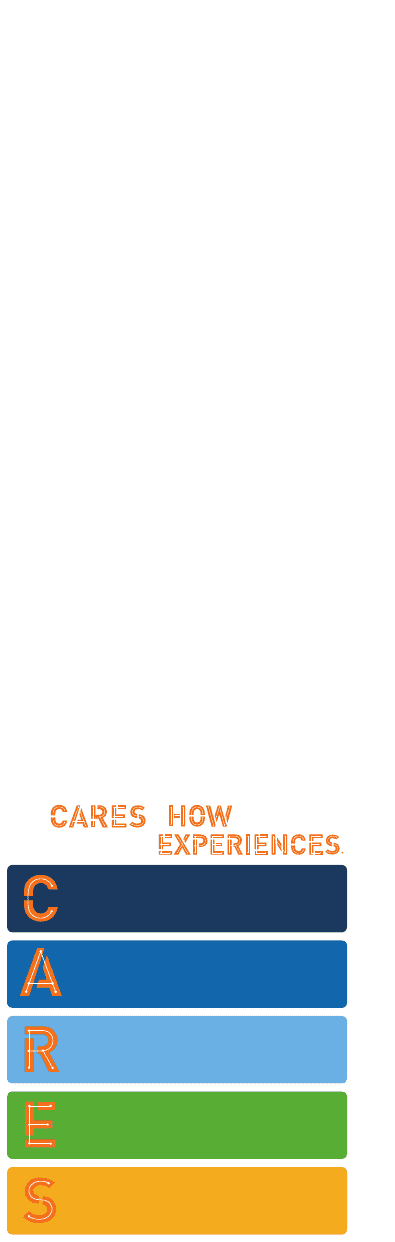

In 2015, we continued to take important steps to improve the PNC

customer experience. We rolled out a new service model, PNC

CARES, across our lines of business. We launched a new innovation

lab that enables us to test new products and services and improve

the way we engage with customers across all of our channels.

We introduced a new model for gauging customer satisfaction

and loyalty to the brand — Net Promoter Score — which tells us

not only whether customers are satisfied with the quality of their

relationship with PNC, but also how likely they are to recommend

us to family and friends. We created a Voice of the Customer

database to help us turn customer feedback into experience

enhancements. And we implemented more than 100 improvements

enterprise-wide driven by customer and employee input.

Our ability to differentiate PNC comes down to the quality of the

experiences we create for the people we serve and the quality of

the teams we field to deliver those experiences. In 2015, we took

action to ensure through time that we are building the highest-

Creating a Better Bank for the People We Serve and Our Employees

CONNECT

ACKNOWLEDGE

RESOLVE

EXPRESS THANKS

SHARE

is

we deliver

exceptional service

The CARES model encourages employees to

connect with customers in a personal way,

acknowledge the customer’s feelings, resolve

issues and recommend options, express sincere

thanks, and share best practices among their

colleagues.

“While perhaps

daunting, there are clear

opportunities for banks

that have the resources

and risk management

systems to meet these

FinTech companies in the

marketplace and offer

a better, more secure

product set to customers.”