PNC Bank 2015 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

4P

URCHASED

L

OANS

Purchased Impaired Loans

Purchased impaired loan accounting addresses differences

between contractual cash flows and cash flows expected to be

collected from the initial investment in loans if those

differences are attributable, at least in part, to credit quality.

Several factors were considered when evaluating whether a

loan was considered a purchased impaired loan, including the

delinquency status of the loan, updated borrower credit status,

geographic information, and updated LTV. GAAP allows

purchasers to account for loans individually or to aggregate

purchased impaired loans acquired in the same fiscal quarter

into one or more pools, provided that the loans have common

risk characteristics. A pool is then accounted for as a single

asset with a single composite interest rate and an aggregate

expectation of cash flows. Purchased impaired homogeneous

consumer, residential real estate and smaller balance

commercial loans with common risk characteristics are

aggregated into pools where appropriate, whereas commercial

loans with a total commitment greater than a defined threshold

are accounted for individually. For pooled loans, proceeds of

individual loans are not applied individually to each loan

within a pool, but to the pool’s recorded investment since it is

accounted for as a single asset.

Prior to December 31, 2015, upon final disposition of a loan

within a pool and for loans that had nominal collateral value/

expected cash flows, the loan’s carrying value was removed

from the pool and any gain or loss associated with the

transaction was retained in the pool’s recorded investment.

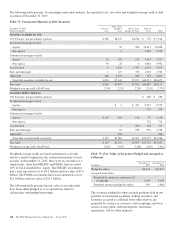

Effective December 31, 2015, in anticipation of the end of the

life of our purchased impaired pooled consumer and

residential real estate loans, and pursuant to supervisory

direction, we changed our derecognition policy for these loans

such that we will write-off the loan’s recorded investment and

derecognize the associated ALLL upon final disposition.

Gains and losses on such loans will be recognized as either an

adjustment to the pool’s associated ALLL, or yield, as

appropriate. The transition to this new policy on December 31,

2015 resulted in a $468 million derecognition of recorded

investment and associated ALLL on such loans. See the

discussion below and Note 1 Accounting Policies and Note 5

Allowances for Loan and Lease Losses and Unfunded Loan

Commitments and Letters of Credit for additional information.

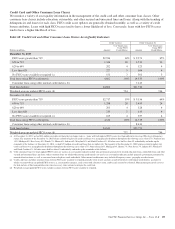

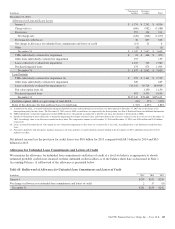

The following table provides balances of purchased impaired loans at December 31, 2015 and December 31, 2014:

Table 65: Purchased Impaired Loans – Balances

December 31, 2015 December 31, 2014

In millions

Outstanding

Balance (a)

Recorded

Investment

Carrying

Value

Outstanding

Balance (a)

Recorded

Investment

Carrying

Value

Commercial lending

Commercial $ 94 $ 36 $ 24 $ 159 $ 74 $ 57

Commercial real estate 155 133 96 307 236 174

Total commercial lending 249 169 120 466 310 231

Consumer lending

Consumer 1,769 1,407 1,392 2,145 1,989 1,661

Residential real estate 1,915 1,946 1,700 2,396 2,559 2,094

Total consumer lending 3,684 3,353 3,092 4,541 4,548 3,755

Total $3,933 $3,522 $3,212 $5,007 $4,858 $3,986

(a) Outstanding balance represents the balance on the loan servicing system. Recorded investment may be greater than the outstanding balance due to expected recoveries of collateral.

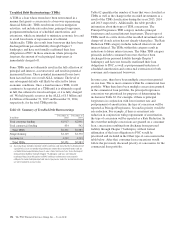

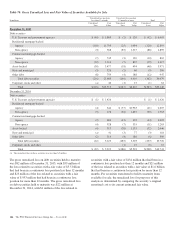

The excess of undiscounted cash flows expected at acquisition over the estimated fair value is referred to as the accretable yield

and is recognized as interest income over the remaining life of the loan using the constant effective yield method. The difference

between contractually required payments at acquisition and the cash flows expected to be collected at acquisition is referred to as

the non-accretable difference and is not recognized in income. Subsequent changes in the expected cash flows of individual or

pooled purchased impaired loans will either impact the accretable yield or result in an impairment charge to provision for credit

losses in the period in which the changes become probable. Decreases to the net present value of expected cash flows will generally

result in an impairment charge recorded as a provision for credit losses, resulting in an increase to the ALLL, and a reclassification

from accretable yield to non-accretable difference.

140 The PNC Financial Services Group, Inc. – Form 10-K