PNC Bank 2015 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

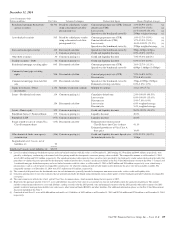

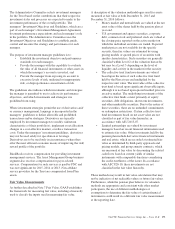

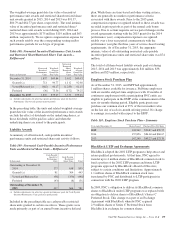

Amortization expense on existing other intangible assets for

2015, 2014 and 2013, as well as estimated future amortization

expense for the next five fiscal years, follows:

Table 91: Amortization Expense on Existing Intangible

Assets

In millions

2013 (a) $243

2014 128

2015 114

2016 97

2017 83

2018 72

2019 61

2020 37

(a) Amounts include amortization expense related to commercial MSRs. As of

January 1, 2014, PNC made an irrevocable election to measure commercial MSRs at

fair value, and, accordingly, amortization expense for commercial MSRs is no

longer recorded.

N

OTE

9P

REMISES

,E

QUIPMENT AND

L

EASEHOLD

I

MPROVEMENTS

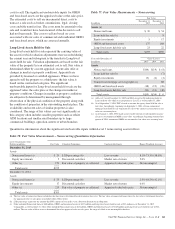

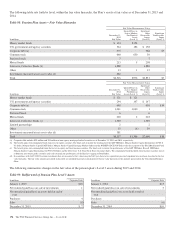

Premises, equipment and leasehold improvements, stated at

cost less accumulated depreciation and amortization, were as

follows:

Table 92: Premises, Equipment and Leasehold

Improvements

In millions

December 31

2015

December 31

2014

Total Premises, equipment and leasehold

improvements (a) $10,257 $ 9,416

Accumulated depreciation and

amortization (4,349) (3,773)

Net book value $ 5,908 $ 5,643

(a) Primarily relates to equipment and buildings.

Depreciation expense on premises, equipment and leasehold

improvements and amortization expense, excluding intangible

assets, primarily for capitalized internally developed software

was as follows:

Table 93: Depreciation and Amortization Expense

Year ended December 31

In millions 2015 2014 2013

Depreciation $643 $618 $546

Amortization 40 30 23

Total depreciation and amortization 683 648 569

We lease certain facilities and equipment under agreements

expiring at various dates through the year 2081. We account

for these as operating leases. Rental expense on such leases

was as follows:

Table 94: Lease Rental Expense

Year ended December 31

In millions 2015 2014 2013

Lease rental expense: $460 $414 $412

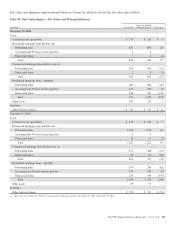

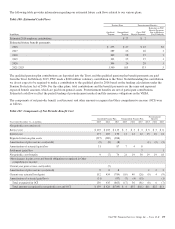

Required minimum annual rentals that we owe on

noncancelable leases having initial or remaining terms in

excess of one year totaled $2.7 billion at December 31, 2015.

Future minimum annual rentals are as follows:

• 2016: $378 million,

• 2017: $350 million,

• 2018: $315 million,

• 2019: $264 million,

• 2020: $222 million, and

• 2021 and thereafter: $1.2 billion.

N

OTE

10 T

IME

D

EPOSITS

Total time deposits of $20.5 billion at December 31, 2015

have future contractual maturities, including related purchase

accounting adjustments, as follows:

• 2016: $15.1 billion,

• 2017: $1.2 billion,

• 2018: $0.4 billion,

• 2019: $0.4 billion,

• 2020: $0.8 billion, and

• 2021 and thereafter: $2.6 billion.

N

OTE

11 B

ORROWED

F

UNDS

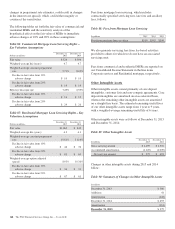

The following shows the carrying value of total borrowed

funds of $54.5 billion at December 31, 2015 (including

adjustments related to purchase accounting, accounting hedges

and unamortized original issuance discounts) by remaining

contractual maturity:

• 2016: $10.9 billion,

• 2017: $10.6 billion,

• 2018: $11.2 billion,

• 2019: $8.4 billion,

• 2020: $4.7 billion, and

• 2021 and thereafter: $8.7 billion.

The PNC Financial Services Group, Inc. – Form 10-K 169