PNC Bank 2015 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

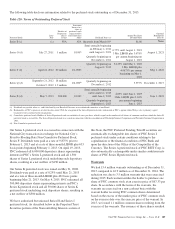

in a reclassification within Capital surplus – Common stock

and other with no impact on PNC’s Shareholders’ equity.

These warrants were sold by the U.S. Treasury in a secondary

public offering that closed on May 5, 2010 after the U.S.

Treasury exchanged its TARP Warrant (issued on

December 31, 2008 under the TARP Capital Purchase

Program) for 16.9 million warrants. These warrants expire

December 31, 2018.

Other Shareholders’ Equity Matters

We have a dividend reinvestment and stock purchase plan.

Holders of preferred stock and PNC common stock may

participate in the plan, which provides that additional shares

of common stock may be purchased at market value with

reinvested dividends and voluntary cash payments. Common

shares issued pursuant to this plan were: 0.3 million shares in

2015, 0.3 million shares in 2014 and 0.4 million shares in

2013.

At December 31, 2015, we had reserved approximately

93 million common shares to be issued in connection with

certain stock plans.

We repurchased 4.4 million shares in 2015 and 13.5 million

shares in 2014 under the stock repurchase program that the

Board of Directors approved effective October 4, 2007.

Effective March 31, 2015, the Board of Directors terminated

this share repurchase program and effective April 1, 2015 the

Board of Directors replaced it with a new stock repurchase

program authorization in the amount of up to 100 million

shares of PNC common stock which may be purchased on the

open market or in privately negotiated transactions. We

repurchased 17.9 million shares under this program in 2015 .

A maximum amount of 82.1 million shares remained available

for repurchase under this program at December 31, 2015. This

program will remain in effect until fully utilized or until

modified, superseded or terminated.

Noncontrolling Interests

Perpetual Trust Securities

In December 2006, one of our indirect subsidiaries, PNC

REIT Corp., sold $500 million of 6.517% Fixed-to-Floating

Rate Non-Cumulative Exchangeable Perpetual Trust

Securities (the “Trust Securities”) of PNC Preferred Funding

Trust I (“Trust I”), in a private placement. PNC REIT Corp.

had previously acquired the Trust Securities from the trust in

exchange for an equivalent amount of Fixed-to-Floating Rate

Non-Cumulative Perpetual Preferred Securities (the “LLC

Preferred Securities”), of PNC Preferred Funding LLC, (the

“LLC”), held by PNC REIT Corp. The LLC’s initial material

assets consist of indirect interests in mortgages and mortgage-

related assets previously owned by PNC REIT Corp. The rate

on these securities at December 31, 2015 was 2.162%.

In March 2007, the LLC, sold $500 million of 6.113% Fixed-

to-Floating Rate Non-Cumulative Exchangeable Perpetual

Trust Securities (the “Trust II Securities”) of PNC Preferred

Funding Trust II (“Trust II”) in a private placement. In

connection with the private placement, Trust II acquired $500

million of LLC Preferred Securities, from the LLC. The rate

on these securities at December 31, 2015 was 1.735%.

The Trust I Securities and Trust II Securities are redeemable

in whole or in part at par ($100,000 per security), plus any

declared and unpaid dividends to the redemption date, on the

quarterly dividend payment date in March 2017 and on the

March quarterly dividend payment date in each fifth

succeeding year (each, a “Five Year Date”).

The Trust I Securities and Trust II Securities are also

redeemable in whole, but not in part, on any quarterly

dividend payment date that is not a Five Year Date at a

redemption price equal to the sum of: (i) the greater of

(A) $100,000 per security or (B) the sum of present values of

$100,000 per security and all undeclared dividends for the

dividend periods from the redemption date to and including

the next succeeding Five Year Date, discounted to the

redemption date on a quarterly basis at the 3-month USD

LIBOR rate applicable to the dividend period immediately

preceding such redemption date plus (ii) any declared and

unpaid dividends to the redemption date.

The Trust I Securities and Trust II Securities are also

redeemable in whole, but not in part, on any quarterly

dividend payment date that is not a Five Year Date in the case

of certain tax, investment company or regulatory capital

events at a redemption price of par plus declared and unpaid

dividends to the redemption date.

Upon certain conditions relating to the capitalization or the

financial condition of PNC Bank and upon the direction of the

OCC, the Trust I Securities are automatically exchangeable

into shares of Series F preferred stock of PNC Bank and the

Trust II Securities are automatically exchangeable into shares

of Series I preferred stock of PNC.

Any redemption is subject to compliance with the applicable

Replacement Capital Covenant (see below) and approval of

the OCC.

PNC REIT Corp. owns 100% of the LLC’s common voting

securities. As a result, the LLC is an indirect subsidiary of

PNC and is consolidated on our Consolidated Balance Sheet.

Trust I and Trust II’s investment in the LLC Preferred

Securities is characterized as a noncontrolling interest on our

Consolidated Balance Sheet since we are not the primary

beneficiary of Trust I and Trust II. This noncontrolling interest

totaled approximately $981 million at December 31, 2015.

190 The PNC Financial Services Group, Inc. – Form 10-K