PNC Bank 2015 Annual Report Download - page 74

Download and view the complete annual report

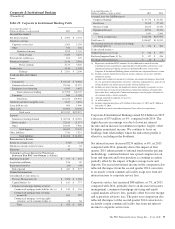

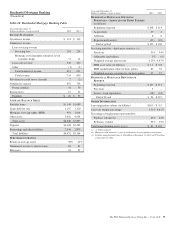

Please find page 74 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other noninterest income increased $104 million, or 23%, in

2015 compared to 2014, driven by higher corporate securities

underwriting activity, multifamily loans originated for sale to

agencies, derivative sales, and revenue associated with credit

valuations for customer-related derivative activities.

Overall credit quality remained generally stable in 2015. The

provision for credit losses was essentially unchanged from

2014 and net charge-offs continued to be low relative to recent

historic levels. Nonperforming assets declined 7% in the year-

over-year comparison; however, there was an increase in the

fourth quarter of 2015, compared to the third quarter of 2015,

driven by deterioration in the oil and gas sector.

Noninterest expense increased $84 million, or 4%, in 2015

compared to 2014, primarily driven by investments in

technology, other costs associated with business activities and

higher asset writedowns.

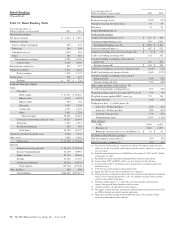

Average loans increased $8.4 billion, or 8%, in 2015

compared to the prior year, and period-end loan balances

increased $4.7 billion, or 4%, at December 31, 2015 compared

to prior year-end, reflecting solid growth in Real Estate,

Corporate Banking, Business Credit and Equipment Finance:

• PNC Real Estate provides banking, financing and

servicing solutions for commercial real estate clients

across the country. Average loans for this business

increased $3.6 billion, or 13%, in 2015 compared

with 2014, due to increased originations and higher

utilization.

• Corporate Banking business provides lending,

treasury management and capital markets-related

products and services to midsized and large

corporations, government and not-for-profit entities.

Average loans for this business increased $3.4

billion, or 6%, in 2015 compared with 2014,

primarily due to an increase in loan commitments

from large corporate clients and specialty lending

businesses, partially offset by the impact of ongoing

capital and liquidity management activities.

• PNC Business Credit provides asset-based lending.

The loan portfolio is relatively high yielding, with

acceptable risk as the loans are mainly secured by

short-term assets. Average loans for this business

increased $1.3 billion, or 10%, in 2015 compared

with 2014, due to new originations.

• PNC Equipment Finance provides equipment

financing solutions for clients throughout the U.S.

and Canada. Average loans and operating leases were

$11.8 billion in 2015, an increase of $.6 billion, or

5%, compared with 2014.

Average deposits increased $7.1 billion, or 10%, in 2015

compared to the prior year, as a result of business growth and

increases in demand, money market and certificates of deposit

products.

The commercial loan servicing portfolio increased $70 billion,

or 19%, at December 31, 2015 compared to December 31,

2014, as servicing additions from new and existing customers

exceeded portfolio run-off.

Product Revenue

In addition to credit and deposit products for commercial

customers, Corporate & Institutional Banking offers other

services, including treasury management, capital markets-

related products and services, and commercial mortgage

banking activities. On a consolidated basis, the revenue from

these other services is included in net interest income,

corporate service fees and other noninterest income. From a

segment perspective, the majority of the revenue and expense

related to these services is reflected in the Corporate &

Institutional Banking segment results and the remainder is

reflected in the results of other businesses. The Other

Information section in Table 22 in the Corporate &

Institutional Banking portion of this Business Segments

Review section includes the consolidated revenue to PNC for

these services. A discussion of the consolidated revenue from

these services follows.

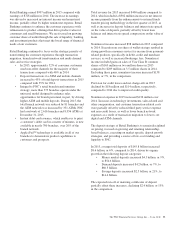

Treasury management revenue, comprised of fees and net

interest income from customer deposit balances, increased

$100 million, or 8%, in 2015 compared with 2014, driven by

growth in our commercial card, wholesale lockbox,

PINACLE®, funds transfer fees and liquidity-related revenue.

Capital markets-related products and services include foreign

exchange, derivatives, securities, loan syndications, mergers

and acquisitions advisory, and equity capital markets advisory

activities and related services. Revenue from capital markets-

related products and services increased $36 million, or 5%, in

2015 compared with 2014. The increase in the comparison

was primarily driven by higher derivative sales and revenue

associated with credit valuations for customer-related

derivative activities, increased corporate securities

underwriting activity and higher equity capital markets

advisory fees, partially offset by lower merger and acquisition

advisory fees.

Commercial mortgage banking activities include revenue

derived from commercial mortgage servicing (including net

interest income and noninterest income) and revenue derived

from commercial mortgage loans held for sale and related

hedges. Total commercial mortgage banking activities

increased $43 million, or 11%, in 2015 compared with 2014.

The increase in the comparison was mainly due to higher

mortgage servicing revenue and higher multifamily loans

originated for sale to agencies, partially offset by lower net

valuation adjustment on commercial mortgage servicing

rights.

56 The PNC Financial Services Group, Inc. – Form 10-K