PNC Bank 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

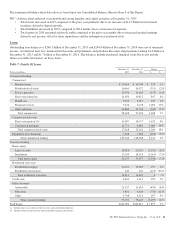

Net interest margin decreased in the comparison to the prior

year, driven by a 32 basis point decline in the yield on total

interest-earning assets, which was principally due to the

impact of increasing the company’s liquidity position, lower

loan and securities yields, and lower benefit from purchase

accounting accretion. The decline also included the impact of

the second quarter 2014 correction to reclassify certain

commercial facility fees.

We expect net interest income for the first quarter of 2016 to

be stable, compared with fourth quarter 2015 in light of an

unlikely increase in interest rates during the first quarter of

2016. For full year 2016, we expect purchase accounting

accretion to be down approximately $175 million compared to

2015.

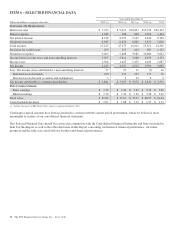

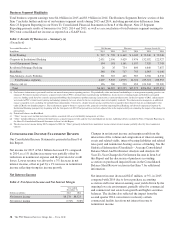

Noninterest Income

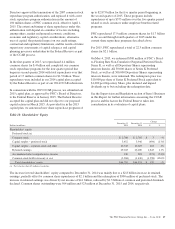

Table 5: Noninterest Income

Year ended December 31 Change

Dollars in millions 2015 2014 $ %

Noninterest income

Asset management $1,567 $1,513 $ 54 4%

Consumer services 1,335 1,254 81 6%

Corporate services 1,491 1,415 76 5%

Residential mortgage 566 618 (52) (8)%

Service charges on deposits 651 662 (11) (2)%

Net gains on sales of securities 43 4 39 *

Other 1,294 1,384 (90) (7)%

Total noninterest income $6,947 $6,850 $ 97 1%

* – Not meaningful

Noninterest income in 2015 increased compared to the prior

year, driven by strong growth in consumer and corporate

services fees and asset management revenue, partially offset

by lower gains on asset sales and lower residential mortgage

revenue. Noninterest income as a percentage of total revenue

was 46% for 2015, up from 45% for 2014.

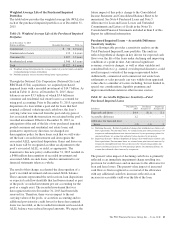

Asset management revenue increased in 2015 compared to

2014, driven by new sales production and stronger average

equity markets, as well as the benefit from a $30 million trust

settlement during the second quarter of 2015. Discretionary

client assets under management in the Asset Management

Group were $134 billion at December 31, 2015 compared with

$135 billion at December 31, 2014.

Consumer service fees increased in the comparison to the

prior year, primarily due to growth in customer-initiated

transaction volumes related to debit card, credit card and

merchant services activity, along with higher brokerage

revenue.

Corporate service fees increased in 2015 compared to 2014,

driven by higher treasury management, commercial mortgage

servicing and equity capital markets advisory fees, partially

offset by lower mergers and acquisition advisory fees. The

increase also reflected the impact of the correction to

reclassify certain commercial facility fees from net interest

income to noninterest income beginning in the second quarter

of 2014.

Residential mortgage revenue decreased in 2015 compared to

2014, primarily due to lower loan sales and servicing revenue,

partially offset by higher net hedging gains on residential

mortgage servicing rights.

Other noninterest income decreased in 2015 compared to the

prior year, primarily attributable to lower gains on asset

dispositions, including the impact of the fourth quarter 2014

gain of $94 million on the sale of PNC’s Washington, D.C.

regional headquarters building and lower gains on sales of

Visa Class B common shares.

Gains on sales of two million Visa Class B Common shares

equaled $169 million in 2015 compared to gains of $209

million on sales of 3.5 million shares in 2014. As of

December 31, 2015, we held approximately 4.9 million Visa

Class B common shares with a fair value of approximately

$622 million and a recorded investment of approximately $31

million.

Other noninterest income typically fluctuates from period to

period depending on the nature and magnitude of transactions

completed. Further details regarding our customer-related

trading activities are included in the Market Risk

Management – Customer-Related Trading Risk portion of the

Risk Management section of this Item 7. Further details

regarding private and other equity investments are included in

the Market Risk Management – Equity And Other Investment

Risk section, and further details regarding gains or losses

related to our equity investment in BlackRock are included in

the Business Segments Review section of this Item 7.

In the first quarter of 2016, we expect fee income, consisting

of asset management, consumer services, corporate services,

residential mortgage and service charges on deposits, to be

down mid-single digits, on a percentage basis, compared with

the fourth quarter of 2015 due to seasonality and typically

lower first quarter client activity. Continued volatility in the

equity markets in combination with other economic factors

could add to pressure on noninterest income. For full year

2016, we expect modest growth in revenue.

The PNC Financial Services Group, Inc. – Form 10-K 39