PNC Bank 2015 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

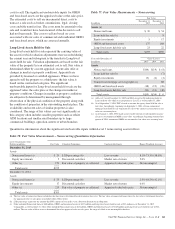

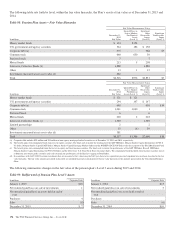

We use a measurement date of December 31 for plan assets and benefit obligations. A reconciliation of the changes in the

projected benefit obligation for qualified pension, nonqualified pension and postretirement benefit plans as well as the change in

plan assets for the qualified pension plan follows.

Table 96: Reconciliation of Changes in Projected Benefit Obligation and Change in Plan Assets

Qualified

Pension

Nonqualified

Pension

Postretirement

Benefits

December 31 (Measurement Date) – in millions 2015 2014 2015 2014 2015 2014

Accumulated benefit obligation at end of year $4,330 $4,427 $ 292 $ 316

Projected benefit obligation at beginning of year $4,499 $3,966 $ 322 $ 292 $ 379 $ 375

Service cost 107 1033355

Interest cost 177 187 11 12 15 16

Plan amendments (7)

Actuarial (gains)/losses and changes in assumptions (126) 504 (10) 40 (9) 4

Participant contributions 58

Federal Medicare subsidy on benefits paid 22

Benefits paid (260) (254) (28) (25) (28) (31)

Settlement payments (1)

Projected benefit obligation at end of year $4,397 $4,499 $ 298 $ 322 $ 368 $ 379

Fair value of plan assets at beginning of year $4,357 $4,252

Actual return on plan assets 19 359

Employer contribution 200 $ 28 $ 25 $ 222 $ 21

Participant contributions 58

Federal Medicare subsidy on benefits paid 22

Benefits paid (260) (254) (28) (25) (28) (31)

Settlement payments (1)

Fair value of plan assets at end of year $4,316 $4,357 $ 200

Funded status $ (81) $ (142) $(298) $(322) $(168) $(379)

Amounts recognized on the consolidated balance sheet

Noncurrent asset

Current liability $ (27) $ (31) $ (2) $ (25)

Noncurrent liability $ (81) $ (142) (271) (291) (166) (354)

Net amount recognized on the consolidated balance sheet $ (81) $ (142) $(298) $(322) $(168) $(379)

Amounts recognized in accumulated other comprehensive income consist of:

Prior service cost (credit) $ (13) $ (22) $ 1 $ 1 $ (3) $ (4)

Net actuarial loss 794 673 71 88 22 31

Amount recognized in AOCI $ 781 $ 651 $ 72 $ 89 $ 19 $ 27

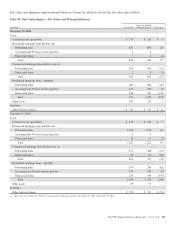

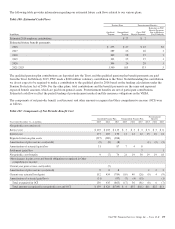

At December 31, 2015, the fair value of the qualified pension

plan assets was less than both the accumulated benefit

obligation and the projected benefit obligation.

The nonqualified pension plan is unfunded. Contributions

from PNC and, in the case of the postretirement benefit plans,

participant contributions cover all benefits paid under the

nonqualified pension plan and postretirement benefit plans.

The postretirement plan provides benefits to certain retirees

that are at least actuarially equivalent to those provided by

Medicare Part D and accordingly, we receive a federal subsidy

as shown in Table 96.

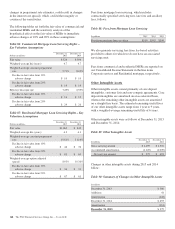

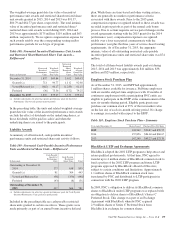

In March 2010, the Patient Protection and Affordable Care

Act (PPACA) was enacted. Key aspects of the PPACA which

are reflected in our consolidated financial statements include

the excise tax on high-cost health plans beginning in 2018 and

fees for the Transitional Reinsurance Program and the Patient-

Centered Outcomes Research Institute. These provisions did

not have a significant effect on our postretirement medical

liability or costs. The Early Retiree Reinsurance Program

(ERRP) was established by the PPACA. Congress

appropriated funding of $5.0 billion for this temporary ERRP

to provide financial assistance to employers, unions, and state

and local governments to help them maintain coverage for

early retirees age 55 and older who are not yet eligible for

Medicare, including their spouses, surviving spouses, and

dependents. PNC did not receive reimbursement in 2014

related to the 2013 plan year. The ERRP terminated effective

January 1, 2014.

The PNC Financial Services Group, Inc. – Form 10-K 171