PNC Bank 2015 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Bolster our critical infrastructure and

streamline our core processes;

• Utilize technology to develop and deliver

products and services to our customers and

protect PNC’s systems and customer

information; and

• Sustain our expense management.

• Effectively managing capital and liquidity including:

• Continuing to maintain and grow our deposit

base as a low-cost stable funding source;

• Prudent liquidity and capital management to

meet evolving regulatory capital, capital

planning, stress testing and liquidity standards;

and

• Actions we take within the capital and other

financial markets.

• Managing credit risk in our portfolio;

• Our ability to manage and implement strategic

business objectives within the changing regulatory

environment;

• The impact of legal and regulatory-related

contingencies; and

• The appropriateness of reserves needed for critical

accounting estimates and related contingencies.

For additional information, see the Cautionary Statement

Regarding Forward-Looking Information section in this

Item 7 and Item 1A Risk Factors in this Report.

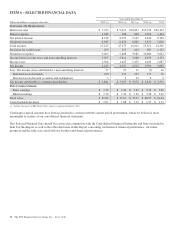

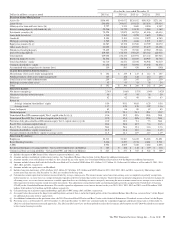

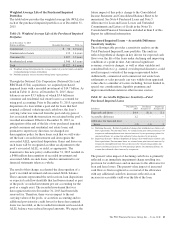

Table 1: Summary Financial Results

Year ended December 31 2015 2014

Net income (millions) $4,143 $4,207

Diluted earnings per common share from net

income $ 7.39 $ 7.30

Return from net income on:

Average common shareholders’ equity 9.50% 9.91%

Average assets 1.17% 1.28%

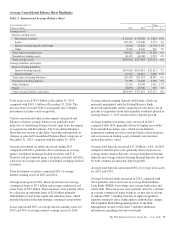

Income Statement Highlights

Our performance in 2015 included the following:

• Net income for 2015 of $4.1 billion decreased 2%

compared to 2014, as a 1% decline in revenue was

partially offset by reductions in noninterest expense

and the provision for credit losses. Lower revenue

was driven by a 3% decrease in net interest income,

offset in part by a 1% increase in noninterest income

reflecting strong fee income growth. For additional

detail, see the Consolidated Income Statement

Review section in this Item 7.

• Net interest income of $8.3 billion for 2015

decreased 3% compared to 2014 due to lower

purchase accounting accretion and lower interest-

earning asset yields, partially offset by commercial

and commercial real estate loan growth and higher

securities balances.

• Net interest margin decreased to 2.74% for 2015

compared to 3.08% for 2014, principally due to the

impact of increasing the company’s liquidity

position, lower benefit from purchase accounting

accretion, and lower loan and securities yields.

• Noninterest income of $6.9 billion for 2015 increased

1% compared with 2014, primarily driven by strong

growth in consumer and corporate services fees and

asset management revenue, partially offset by lower

gains on asset sales and lower residential mortgage

revenue.

• The provision for credit losses decreased to $255

million for 2015 compared to $273 million for 2014

due to improved credit quality.

• Noninterest expense decreased $25 million to $9.5

billion for 2015 compared to 2014, reflecting PNC’s

focus on expense management as higher personnel

expense associated with higher business activity and

investments in technology and business infrastructure

were more than offset by lower legal and residential

mortgage compliance costs and lower third party

expenses.

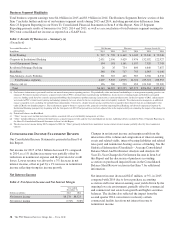

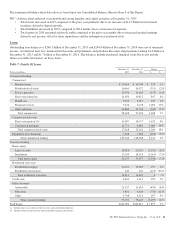

Credit Quality Highlights

• Overall credit quality in 2015 improved from 2014.

For additional detail, see the Credit Risk

Management portion of the Risk Management section

of this Item 7.

• Nonperforming assets decreased $.5 billion, or 16%,

to $2.4 billion at December 31, 2015 compared to

December 31, 2014. Nonperforming assets to total

assets were 0.68% at December 31, 2015, compared

to 0.83% at December 31, 2014.

• Overall loan delinquencies of $1.6 billion at

December 31, 2015 decreased $.3 billion, or 16%,

compared with December 31, 2014.

• Net charge-offs of $.4 billion in 2015 declined 27%

compared to net charge-offs of $.5 billion for 2014.

Net charge-offs were 0.19% of average loans in 2015

and 0.27% of average loans in 2014.

• The allowance for loan and lease losses was 1.32% of

total loans and 128% of nonperforming loans at

December 31, 2015, compared with 1.63% and 133%

at December 31, 2014, respectively. The decline in

these ratios reflected PNC’s implementation of its

change in the derecognition policy for purchased

impaired pooled consumer and residential real estate

loans, effective December 31, 2015. This change

resulted in the derecognition of the recorded

investment balance included in total loans and the

associated allowance for loan losses balance each by

$468 million.

The PNC Financial Services Group, Inc. – Form 10-K 35