PNC Bank 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Directors approved the termination of the 2007 common stock

repurchase program authorization, and replaced it with a new

stock repurchase program authorization in the amount of

100 million shares of PNC common stock, effective April 1,

2015. The extent and timing of share repurchases under this

authorization will depend on a number of factors including,

among others, market and general economic conditions,

economic and regulatory capital considerations, alternative

uses of capital, the potential impact on our credit ratings,

contractual and regulatory limitations, and the results of future

supervisory assessments of capital adequacy and capital

planning processes undertaken by the Federal Reserve as part

of the CCAR process.

In the first quarter of 2015, we repurchased 4.4 million

common shares for $.4 billion and completed our common

stock repurchase programs for the four quarter period that

began in second quarter 2014 with total repurchases over that

period of 17 million common shares for $1.5 billion. These

repurchases were included in our 2014 capital plan accepted

by the Federal Reserve as part of our 2014 CCAR submission.

In connection with the 2015 CCAR process, we submitted our

2015 capital plan, as approved by PNC’s Board of Directors,

to the Federal Reserve in January 2015. The Federal Reserve

accepted the capital plan and did not object to our proposed

capital actions in March 2015. As provided for in the 2015

capital plan, we announced new share repurchase programs of

up to $2.875 billion for the five quarter period beginning in

the second quarter of 2015. These programs include

repurchases of up to $375 million over the five quarter period

related to stock issuances under employee benefit-related

programs.

PNC repurchased 17.9 million common shares for $1.7 billion

in the second through fourth quarters of 2015 under the

current share repurchase programs described above.

For 2015, PNC repurchased a total of 22.3 million common

shares for $2.1 billion.

On May 4, 2015, we redeemed $500 million of PNC’s Fixed-

to-Floating Rate Non-Cumulative Perpetual Preferred Stock,

Series K, as well as all Depositary Shares representing

interests therein. All 50,000 shares of Series K Preferred

Stock, as well as all 500,000 Depositary Shares representing

interests therein, were redeemed. The redemption price was

$10,000 per share of Series K Preferred Stock equivalent to

$1,000 per Depositary Share, plus declared and unpaid

dividends up to but excluding the redemption date.

See the Supervision and Regulation section of Item 1 Business

in this Report for further information concerning the CCAR

process and the factors the Federal Reserve takes into

consideration in its evaluation of capital plans.

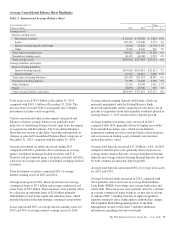

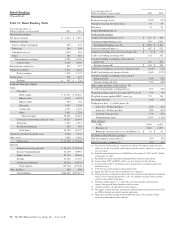

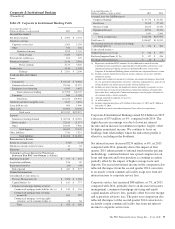

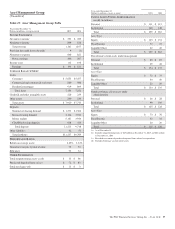

Table 18: Shareholders’ Equity

Dollars in millions

December 31

2015

December 31

2014

Change

$%

Shareholders’ equity

Preferred stock (a)

Common stock $ 2,708 $ 2,705 $ 3 –%

Capital surplus – preferred stock 3,452 3,946 (494) (13)%

Capital surplus – common stock and other 12,745 12,627 118 1%

Retained earnings 29,043 26,200 2,843 11%

Accumulated other comprehensive income 130 503 (373) (74)%

Common stock held in treasury at cost (3,368) (1,430) (1,938) (136)%

Total shareholders’ equity $44,710 $44,551 $ 159 –%

(a) Par value less than $.5 million at each date.

The increase in total shareholders’ equity compared to December 31, 2014 was mainly due to a $2.8 billion increase in retained

earnings, partially offset by common share repurchases of $2.1 billion and the redemption of $500 million of preferred stock. The

increase in retained earnings was driven by net income of $4.1 billion, reduced by $1.3 billion of common and preferred dividends

declared. Common shares outstanding were 504 million and 523 million at December 31, 2015 and 2014, respectively.

The PNC Financial Services Group, Inc. – Form 10-K 47