PNC Bank 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Qualitative Component

While our reserve methodologies strive to reflect all relevant

risk factors, there continues to be uncertainty associated with,

but not limited to, potential imprecision in the estimation

process due to the inherent time lag of obtaining information

and normal variations between estimates and actual outcomes.

We provide additional reserves that are designed to provide

coverage for losses attributable to such risks. The ALLL also

includes factors that may not be directly measured in the

determination of specific or pooled reserves. Such qualitative

factors may include:

• Industry concentrations and conditions,

• Recent credit quality trends,

• Recent loss experience in particular portfolios,

• Recent macro-economic factors,

• Model imprecision,

• Changes in lending policies and procedures,

• Timing of available information, including the

performance of first lien positions, and

• Limitations of available historical data.

Allowance for Purchased Non-Impaired Loans

ALLL for purchased non-impaired loans is determined based

upon a comparison between the methodologies described

above and the remaining acquisition date fair value discount

that has yet to be accreted into interest income. After making

the comparison, an ALLL is recorded for the amount greater

than the discount, or no ALLL is recorded if the discount is

greater.

Allowance for Purchased Impaired Loans

ALLL for purchased impaired loans is determined in

accordance with ASC 310-30 by comparing the net present

value of the cash flows expected to be collected to the

recorded investment for a given loan (or pool of loans). In

cases where the net present value of expected cash flows is

lower than the recorded investment, ALLL is established.

Cash flows expected to be collected represent management’s

best estimate of the cash flows expected over the life of a loan

(or pool of loans). For large balance commercial loans, cash

flows are separately estimated at the loan level. For smaller

balance pooled loans, pool cash flows are estimated using

cash flow models. Pools were defined at acquisition based on

the risk characteristics of the loan. Our cash flow models use

loan data including, but not limited to, contractual loan

balance, delinquency status of the loan, updated borrower

FICO credit scores, geographic information, historical loss

experience, and updated LTVs, as well as best estimates for

changes in unemployment rates, home prices and other

economic factors, to determine estimated cash flows.

Our credit risk management policies, procedures and practices

are designed to promote sound lending standards and prudent

credit risk management. We have policies, procedures and

practices that address financial statement requirements,

collateral review and appraisal requirements, advance rates

based upon collateral types, appropriate levels of exposure,

cross-border risk, lending to specialized industries or borrower

type, guarantor requirements, and regulatory compliance.

Allowance for Unfunded Loan Commitments and

Letters of Credit

We maintain the allowance for unfunded loan commitments

and letters of credit at a level we believe is appropriate to

absorb estimated probable credit losses incurred on these

unfunded credit facilities as of the balance sheet date. We

determine the allowance based on periodic evaluations of the

unfunded credit facilities, including an assessment of the

probability of commitment usage, credit risk factors, and,

solely for commercial lending, the terms and expiration dates

of the unfunded credit facilities. Other than the estimation of

the probability of funding, the reserve for unfunded loan

commitments is estimated in a manner similar to the

methodology used for determining reserves for funded

exposures. The allowance for unfunded loan commitments and

letters of credit is recorded as a liability on the Consolidated

Balance Sheet. Net adjustments to the allowance for unfunded

loan commitments and letters of credit are included in the

provision for credit losses.

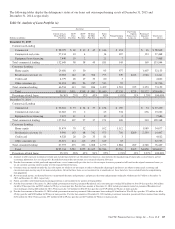

See Note 5 Allowances for Loan and Lease Losses and

Unfunded Loan Commitments and Letters of Credit for

additional loan data and application of the policies disclosed

herein.

Mortgage And Other Servicing Rights

We provide servicing under various loan servicing contracts

for commercial, residential and other consumer loans. These

contracts are either purchased in the open market or retained

as part of a loan securitization or loan sale. All newly acquired

or originated servicing rights are initially measured at fair

value. Fair value is based on the present value of the expected

future net cash flows, including assumptions as to:

• Deposit balances and interest rates for escrow and

commercial reserve earnings,

• Discount rates,

• Estimated prepayment speeds, and

• Estimated servicing costs.

As of January 1, 2014, PNC made an irrevocable election to

subsequently measure all classes of commercial MSRs at fair

value in order to eliminate any potential measurement

mismatch between our economic hedges and the commercial

MSRs. The impact was not material. As a result of that

election, changes in the fair value of commercial MSRs are

recognized as gains/(losses).

Prior to January 1, 2014, we elected to utilize the amortization

method for subsequent measurement of our commercial

mortgage loan servicing rights. This election was made based

on the unique characteristics of the commercial mortgage

The PNC Financial Services Group, Inc. – Form 10-K 117