PNC Bank 2015 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The ISP is a 401(k) Plan and includes an employee stock

ownership (ESOP) feature. Employee contributions are

invested in a number of investment options, including pre

mixed portfolios and individual core funds, available under

the ISP at the direction of the employee. Although employees

were also historically permitted to direct the investment of

their contributions into the PNC common stock fund, this fund

was frozen to future investments of such contributions

effective January 1, 2010. All shares of PNC common stock

held by the ISP are part of the ESOP. Effective January 1,

2011, employer matching contributions were made in cash.

We also maintain a nonqualified supplemental savings plan

for certain employees, known as The PNC Financial Services

Group, Inc. Supplemental Incentive Savings Plan. Effective

January 1, 2012, the Supplemental Incentive Savings Plan was

frozen to new participants and for any deferrals of amounts

earned on or after such date. It was replaced by a new plan

called The PNC Financial Services Group, Inc. Deferred

Compensation and Incentive Plan.

N

OTE

13 S

TOCK

B

ASED

C

OMPENSATION

P

LANS

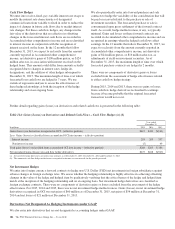

We have long-term incentive award plans (Incentive Plans)

that provide for the granting of incentive stock options,

nonqualified stock options, stock appreciation rights, incentive

shares/performance units, restricted shares, restricted share

units, other share-based awards and dollar-denominated

awards to executives and, other than incentive stock options,

to non-employee directors. Certain Incentive Plan awards may

be paid in stock, cash or a combination of stock and cash. We

typically grant a substantial portion of our stock-based

compensation awards during the first quarter of the year. As of

December 31, 2015, no stock appreciation rights were

outstanding.

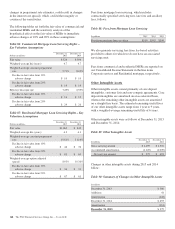

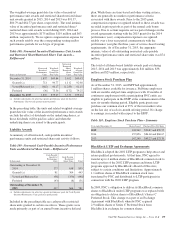

Total compensation expense recognized related to all share-

based payment arrangements during 2015, 2014 and 2013 was

approximately $173 million, $181 million and $154 million,

respectively. The total tax benefit recognized related to

compensation expense on all share-based payment

arrangements during 2015, 2014 and 2013 was approximately

$63 million, $66 million and $56 million, respectively. At

December 31, 2015, there was $191 million of unamortized

share-based compensation expense related to nonvested equity

compensation arrangements granted under the Incentive Plans.

This unamortized cost is expected to be recognized as expense

over a period of no longer than five years.

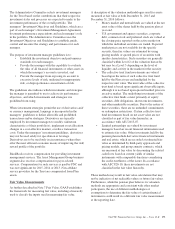

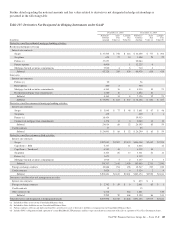

Nonqualified Stock Options

Beginning in 2014, PNC discontinued the use of stock options

as a standard element of our long-term equity incentive

compensation programs under our Incentive Plans and did not

grant any options in 2015 and 2014. Prior to 2014, options

were granted at exercise prices not less than the market value

of a share of common stock on the grant date. Generally,

options become exercisable in installments after the grant

date. No option can be exercised after 10 years from its grant

date. Payment of the option exercise price may be in cash or

by surrendering shares of common stock at market value on

the exercise date. The exercise price may also be paid by

using previously owned shares.

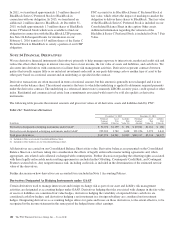

Option Pricing Assumptions

For purposes of computing stock option expense for grants

made in 2013, we estimated the fair value of stock options at

the grant date by using the Black-Scholes option pricing

model. Option pricing models require the use of numerous

assumptions, many of which are subjective.

We used the following assumptions in the Black-Scholes

option pricing model to determine 2013 grant date fair value:

• The risk-free interest rate is based on the U.S.

Treasury yield curve,

• The dividend yield is indicative of our current

dividend rate,

• Volatility is measured using the fluctuation in month-

end closing stock prices over a period which

corresponds with the average expected option life,

but in no case less than a five-year period, and

• The expected life represents the period of time that

options granted are expected to be outstanding and is

based on a weighted-average of historical option

activity.

Table 106: Option Pricing Assumptions (a)

Weighted-average for the

year ended December 31 2013

Risk-free interest rate .9%

Dividend yield 2.5

Volatility 34.0

Expected life 6.5yrs.

Grant date fair value $ 16.35

(a) PNC did not grant any stock options in 2015 and 2014.

The PNC Financial Services Group, Inc. – Form 10-K 177