PNC Bank 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

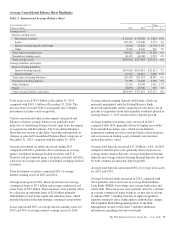

The increase in loans was the result of an increase in total

commercial lending driven by commercial real estate loans,

partially offset by a decline in consumer lending due to lower

home equity, education, and automobile loans.

Loans represented 58% of total assets at December 31, 2015

and 59% at December 31, 2014. Commercial lending

represented 65% of the loan portfolio at December 31, 2015

and 63% at December 31, 2014. Consumer lending

represented 35% of the loan portfolio at December 31, 2015

and 37% at December 31, 2014.

Commercial real estate loans represented 13% of total loans at

December 31, 2015 and 11% of total loans at December 31,

2014 and represented 8% and 7% of total assets at

December 31, 2015 and December 31, 2014, respectively. See

the Credit Risk Management portion of the Risk Management

section of this Item 7 for additional information regarding our

loan portfolio.

Total loans above include purchased impaired loans of $3.5

billion, or 2% of total loans, at December 31, 2015, and $4.9

billion, or 2% of total loans, at December 31, 2014.

Our loan portfolio continued to be diversified among

numerous industries, types of businesses and consumers

across our principal geographic markets.

For the first quarter of 2016, we expect total loans to be stable

with the fourth quarter of 2015.

Allowance for Loan and Lease Losses (ALLL)

Information regarding our higher risk loans and ALLL is

included in the Credit Risk Management portion of the Risk

Management section of this Item 7 and Note 1 Accounting

Policies, Note 3 Asset Quality and Note 5 Allowances for

Loan and Lease Losses and Unfunded Loan Commitments and

Letters of Credit in our Notes To Consolidated Financial

Statements included in Item 8 of this Report.

Purchase Accounting Accretion and Valuation of

Purchased Impaired Loans

Information related to purchase accounting accretion and

accretable yield for 2015 and 2014 follows. Additional

information on our policies for ALLL for purchased impaired

loans is provided in Note 1 Accounting Policies in the Notes

To Consolidated Financial Statements included in Item 8 of

this Report. A description of our purchased impaired loan

accounting and loan data is included in Note 4 Purchased

Loans in the Notes To Consolidated Financial Statements

included in Item 8 of this Report.

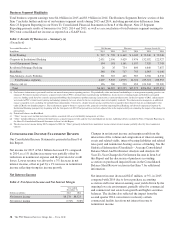

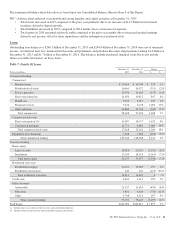

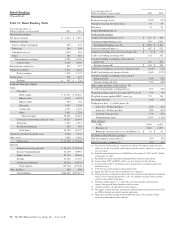

Table 8: Accretion – Purchased Impaired Loans

In millions 2015 2014

Accretion on purchased impaired loans

Scheduled accretion $ 360 $ 460

Reversal of contractual interest on impaired loans (217) (253)

Scheduled accretion net of contractual interest 143 207

Excess cash recoveries (a) 106 127

Total $ 249 $ 334

(a) Relates to excess cash recoveries for purchased impaired commercial loans.

Table 9: Purchased Impaired Loans – Accretable Yield

In millions 2015 2014

January 1 $1,558 $2,055

Accretion (including excess cash recoveries) (466) (587)

Net reclassification to accretable from non-

accretable and other activity 226 208

Disposals (68) (118)

December 31 (a) $1,250 $1,558

(a) As of December 31, 2015, we estimate that the reversal of contractual interest on

purchased impaired loans will total approximately $0.7 billion in future periods.

This will offset the total net accretable interest in future interest income of $1.2

billion on purchased impaired loans.

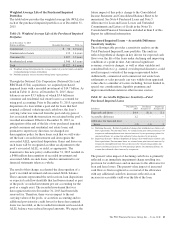

Information related to the valuation of purchased impaired loans at December 31, 2015 and December 31, 2014 follows.

Table 10: Valuation of Purchased Impaired Loans

December 31, 2015 December 31, 2014

Dollars in millions Balance Net Investment Balance Net Investment

Total purchased impaired loans:

Outstanding balance $3,933 $5,007

Recorded investment (a) $3,522 $4,858

Allowance for loan losses (a) (310) (872)

Net investment/Carrying value $3,212 82% $3,986 80%

(a) The December 31, 2015 amounts were impacted by the change in derecognition policy for purchased impaired pooled consumer and residential real estate loans as of December 31,

2015. For additional information, see the discussion below, as well as Note 4 Purchased Loans in the Notes To Consolidated Financial Statements in Item 8 of this Report.

At December 31, 2015, our largest individual purchased impaired loan had a recorded investment of $8 million. We currently

expect to collect total cash flows of $4.4 billion on purchased impaired loans, representing the $3.2 billion net investment at

December 31, 2015 and the accretable net interest of $1.2 billion shown in Table 9.

42 The PNC Financial Services Group, Inc. – Form 10-K