PNC Bank 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Asset Quality Overview

Asset quality trends improved overall during 2015.

• Nonperforming assets at December 31, 2015

decreased $455 million compared with December 31,

2014 as a result of improvements in both consumer

lending and commercial lending nonperforming

loans. Consumer lending nonperforming loans

decreased $303 million and commercial lending

nonperforming loans decreased $81 million.

Nonperforming assets were 0.68% of total assets at

December 31, 2015 compared with 0.83% at

December 31, 2014.

• Overall loan delinquencies totaled $1.6 billion at

December 31, 2015, a decrease of $306 million, or

16%, from year-end 2014. The reduction was due in

large part to a reduction in accruing government

insured residential real estate loans past due 90 days

or more of $174 million, the majority of which we

took possession of and conveyed the real estate, or

are in the process of conveyance and claim

resolution.

• Net charge-offs were $386 million in 2015, down

27%, or $145 million, from net charge-offs in 2014.

• Provision for credit losses for the year ended

December 31, 2015 declined to $255 million

compared to $273 million for the year ended

December 31, 2014.

• The level of ALLL decreased to $2.7 billion at

December 31, 2015 as compared to $3.3 billion at

December 31, 2014, primarily due to a change to our

derecognition policy effective December 31, 2015 for

purchased impaired pooled consumer and residential

real estate loans.

Nonperforming Assets and Loan Delinquencies

Nonperforming Assets, including OREO and Foreclosed Assets

Nonperforming assets include nonperforming loans and leases

for which ultimate collectability of the full amount of

contractual principal and interest is not probable and include

nonperforming troubled debt restructurings (TDRs), OREO

and foreclosed assets. Loans held for sale, certain government

insured or guaranteed loans, purchased impaired loans and

loans accounted for under the fair value option are excluded

from nonperforming loans. Additional information regarding

our nonperforming loans and nonaccrual policies is included

in Note 1 Accounting Policies in the Notes To Consolidated

Financial Statements in Item 8 of this Report. A summary of

the major categories of nonperforming assets are presented in

Table 28. See Note 3 Asset Quality in the Notes To

Consolidated Financial Statements in Item 8 of this Report for

further detail of nonperforming asset categories.

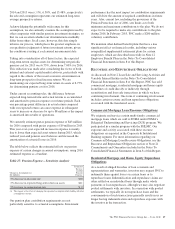

Table 28: Nonperforming Assets By Type

Dollars in millions

December 31

2015

December 31

2014

Nonperforming loans

Commercial lending $ 545 $ 626

Consumer lending (a)(b) 1,581 1,884

Total nonperforming loans (c) 2,126 2,510

OREO and foreclosed assets 299 370

Total nonperforming assets $2,425 $2,880

Amount of TDRs included in

nonperforming loans $1,119 $1,370

Percentage of total nonperforming loans 53% 55%

Nonperforming loans to total loans 1.03% 1.23%

Nonperforming assets to total loans,

OREO and foreclosed assets 1.17 1.40

Nonperforming assets to total assets .68 .83

Allowance for loan and lease losses to

total nonperforming loans (d) 128 133

(a) Excludes most consumer loans and lines of credit, not secured by residential real

estate, which are charged off after 120 to 180 days past due and are not placed on

nonperforming status.

(b) The recorded investment of loans collateralized by residential real estate property

that are in process of foreclosure was $.6 billion and $.8 billion at December 31,

2015 and December 31, 2014, respectively, and included $.3 billion and $.5 billion,

respectively, of loans that are government insured/guaranteed.

(c) Nonperforming loans exclude certain government insured or guaranteed loans, loans

held for sale, loans accounted for under the fair value option and purchased impaired

loans.

(d) The December 31, 2015 ratio was impacted by the change in derecognition policy

for purchased impaired pooled consumer and residential real estate loans as of

December 31, 2015. For additional information see Note 4 Purchased Loans in the

Notes To Consolidated Financial Statements in Item 8 of this Report.

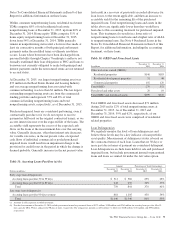

Table 29: Change in Nonperforming Assets

In millions 2015 2014

January 1 $2,880 $ 3,457

New nonperforming assets 1,459 2,127

Charge-offs and valuation adjustments (499) (585)

Principal activity, including paydowns and

payoffs (687) (1,001)

Asset sales and transfers to loans held for sale (364) (570)

Returned to performing status (364) (548)

December 31 $2,425 $ 2,880

Nonperforming assets decreased $455 million at

December 31, 2015 compared to December 31, 2014.

Consumer lending nonperforming loans decreased $303

million and commercial lending nonperforming loans

decreased $81 million. As of December 31, 2015,

approximately 90% of total nonperforming loans were secured

by collateral which lessens reserve requirements and is

expected to reduce credit losses in the event of default. As of

December 31, 2015, commercial lending nonperforming loans

were carried at approximately 62% of their unpaid principal

balance, due to charge-offs recorded to date, before

consideration of the ALLL. See Note 3 Asset Quality in the

72 The PNC Financial Services Group, Inc. – Form 10-K