PNC Bank 2015 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

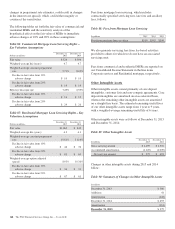

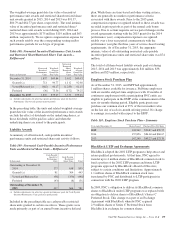

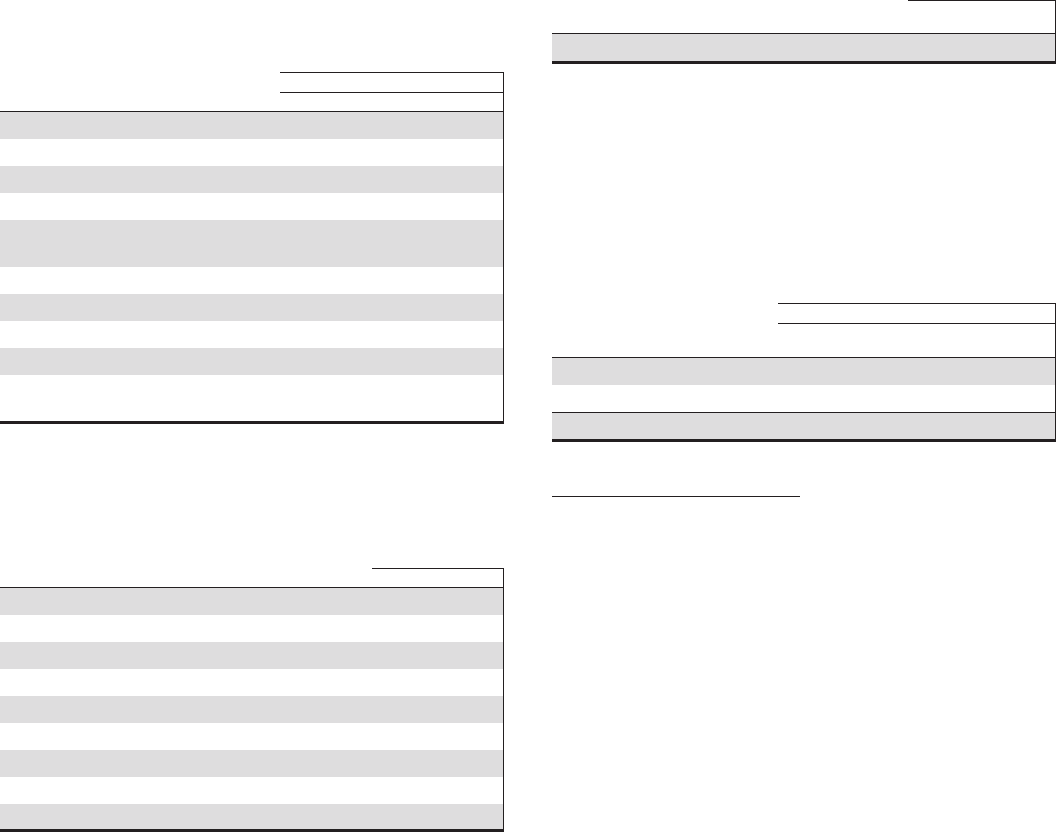

The weighted-average assumptions used (as of the beginning

of each year) to determine the net periodic costs shown above

were as follows.

Table 102: Net Periodic Costs – Assumptions

Net Periodic Cost Determination

Year ended December 31 2015 2014 2013

Discount rate

Qualified pension 3.95% 4.75% 3.80%

Nonqualified pension 3.65% 4.35% 3.45%

Postretirement benefits 3.80% 4.50% 3.60%

Rate of compensation increase

(average) 4.00% 4.00% 4.00%

Assumed health care cost trend rate

Initial trend 7.50% 7.75% 8.00%

Ultimate trend 5.00% 5.00% 5.00%

Year ultimate reached 2025 2025 2019

Expected long-term return on plan

assets 6.75% 7.00% 7.50%

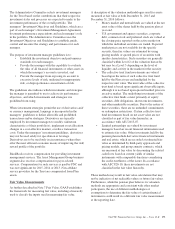

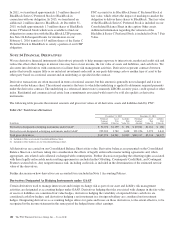

The weighted-average assumptions used (as of the end of each

year) to determine year end obligations for pension and

postretirement benefits were as follows.

Table 103: Other Pension Assumptions

Year ended December 31 2015 2014

Discount rate

Qualified pension 4.25% 3.95%

Nonqualified pension 3.95% 3.65%

Postretirement benefits 4.15% 3.80%

Rate of compensation increase (average) 3.50% 4.00%

Assumed health care cost trend rate

Initial trend 7.25% 7.50%

Ultimate trend 5.00% 5.00%

Year ultimate reached 2025 2025

The discount rates are determined independently for each plan

by comparing the expected future benefits that will be paid

under each plan with yields available on high quality

corporate bonds of similar duration. For this analysis, 10% of

bonds with the highest yields and 40% with the lowest yields

were removed from the bond universe.

The expected return on plan assets is a long-term assumption

established by considering historical and anticipated returns of

the asset classes invested in by the pension plan and the

allocation strategy currently in place among those classes. We

review this assumption at each measurement date and adjust it

if warranted.

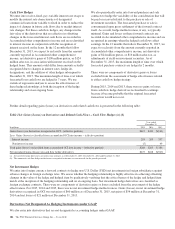

The health care cost trend rate assumptions shown in the

preceding tables relate only to the postretirement benefit

plans. A one-percentage-point change in assumed health care

cost trend rates would have the following effects.

Table 104: Effect of One Percent Change in Assumed

Health Care Cost

Year ended December 31, 2015

In millions Increase Decrease

Effect on year end benefit obligation $10 (9)

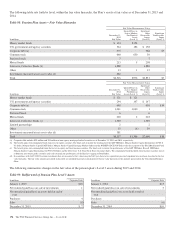

Unamortized actuarial gains and losses and prior service costs

and credits are recognized in AOCI each December 31, with

amortization of these amounts through net periodic benefit

cost. The estimated amounts that will be amortized in 2016 are

as follows.

Table 105: Estimated Amortization of Unamortized

Actuarial Gains and Losses – 2016

2016 Estimate

Year ended December 31

In millions

Qualified

Pension

Nonqualified

Pension

Postretirement

Benefits

Prior service (credit) $ (7) $(1)

Net actuarial loss 45 $4

Total $38 $4 $(1)

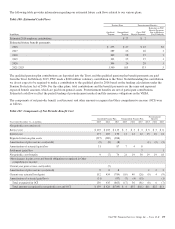

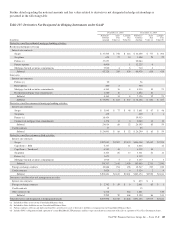

Defined Contribution Plans

The PNC Incentive Savings Plan (ISP) is a qualified defined

contribution plan that covers all eligible PNC employees.

Effective January 1, 2015, newly-hired full time employees

and part-time employees who became eligible to participate in

the ISP after that date are automatically enrolled in the ISP

with a deferral rate equal to 4% of eligible compensation in

the absence of an affirmative election otherwise. Employee

benefits expense related to the ISP was $126 million in 2015,

$108 million in 2014 and $120 million in 2013, representing

cash contributed to the ISP by PNC.

Under the ISP, employee contributions up to 4% of eligible

compensation as defined by the ISP are matched 100% once

an employee has reached match-eligibility, subject to IRS

Code limitations. PNC will contribute a minimum matching

contribution up to $2,000 annually for eligible employees who

contribute at least 4% of eligible compensation every pay

period he or she is eligible during the year. This amount is

prorated for certain employees, including part-time employees

and those who are eligible for the company match for less than

a full year. Additionally, PNC makes an annual true-up

matching contribution to ensure that eligible participants

receive the full company match available. Effective January 1,

2012, in the case of both the minimum and true-up matching

contributions, eligible employees must remain employed on

the last day of the applicable plan year in order to receive the

contribution. Employees hired prior to January 1, 2010,

became 100% vested in employer matching contributions

immediately, while employees hired on or after January 1,

2010, generally become 100% vested in employer matching

contributions after three years of service. Minimum matching

contributions made with respect to the 2014 and 2013 plan

years are immediately 100% vested.

176 The PNC Financial Services Group, Inc. – Form 10-K