PNC Bank 2015 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

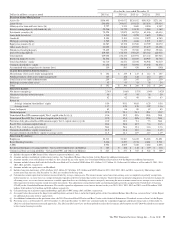

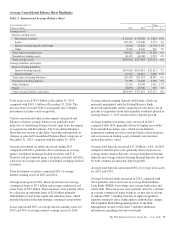

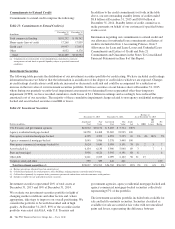

Business Segment Highlights

Total business segment earnings were $4.0 billion in 2015 and $3.9 billion in 2014. The Business Segments Review section of this

Item 7 includes further analysis of our business segment results during 2015 and 2014, including presentation differences from

Note 23 Segment Reporting in our Notes To Consolidated Financial Statements in Item 8 of this Report. Note 23 Segment

Reporting presents results of businesses for 2015, 2014 and 2013, as well as a reconciliation of total business segment earnings to

PNC total consolidated net income as reported on a GAAP basis.

Table 3: Results Of Businesses – Summary (a)

(Unaudited)

Year ended December 31 Net Income Revenue Average Assets (b)

In millions 2015 2014 2015 2014 2015 2014

Retail Banking $ 907 $ 728 $ 6,449 $ 6,049 $ 73,240 $ 75,046

Corporate & Institutional Banking 2,031 2,106 5,429 5,476 132,032 122,927

Asset Management Group 194 181 1,161 1,107 7,920 7,745

Residential Mortgage Banking 26 35 734 800 6,840 7,857

BlackRock 548 530 717 703 6,983 6,640

Non-Strategic Assets Portfolio 301 367 445 587 6,706 8,338

Total business segments 4,007 3,947 14,935 14,722 233,721 228,553

Other (c) (d) (e) 136 260 290 653 121,243 99,300

Total $4,143 $4,207 $15,225 $15,375 $354,964 $327,853

(a) Our business information is presented based on our internal management reporting practices. We periodically refine our internal methodologies as management reporting practices are

enhanced. Net interest income in business segment results reflects PNC’s internal funds transfer pricing methodology. Assets receive a funding charge and liabilities and capital

receive a funding credit based on a transfer pricing methodology that incorporates product repricing characteristics, tenor and other factors. In the first quarter of 2015, enhancements

were made to PNC’s funds transfer pricing methodology primarily for costs related to the new regulatory short-term liquidity standards. The enhancements incorporate an additional

charge assigned to assets, including for unfunded loan commitments. Conversely, a higher transfer pricing credit has been assigned to those deposits that are accorded higher value

under LCR rules for liquidity purposes. These adjustments apply to business segment results, primarily favorably impacting Retail Banking and adversely impacting Corporate &

Institutional Banking, prospectively beginning with the first quarter of 2015. Prior periods have not been adjusted due to the impracticability of estimating the impact of the change for

prior periods.

(b) Period-end balances for BlackRock.

(c) “Other” average assets include investment securities associated with asset and liability management activities.

(d) “Other” includes differences between the total business segment financial results and our total consolidated net income. Additional detail is included in Note 23 Segment Reporting in

the Notes To Consolidated Financial Statements in Item 8 of this Report.

(e) The decrease in net income during 2015 compared to 2014 for “Other” primarily reflected lower noninterest income and net interest income, partially offset by lower noninterest

expense.

C

ONSOLIDATED

I

NCOME

S

TATEMENT

R

EVIEW

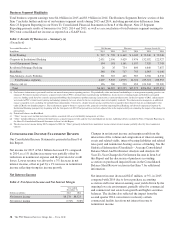

Our Consolidated Income Statement is presented in Item 8 of

this Report.

Net income for 2015 of $4.1 billion decreased 2% compared

to 2014, as a 1% decline in revenue was partially offset by

reductions in noninterest expense and the provision for credit

losses. Lower revenue was driven by a 3% decrease in net

interest income, offset in part by a 1% increase in noninterest

income reflecting strong fee income growth.

Net Interest Income

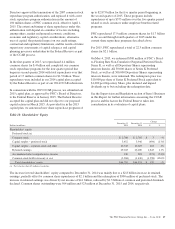

Table 4: Net Interest Income and Net Interest Margin

Year ended

December 31

Dollars in millions 2015 2014

Net interest income $8,278 $8,525

Net interest margin 2.74% 3.08%

Changes in net interest income and margin result from the

interaction of the volume and composition of interest-earning

assets and related yields, interest-bearing liabilities and related

rates paid, and noninterest-bearing sources of funding. See the

Statistical Information (Unaudited) – Average Consolidated

Balance Sheet And Net Interest Analysis and Analysis Of

Year-To-Year Changes In Net Interest Income in Item 8 of

this Report and the discussion of purchase accounting

accretion on purchased impaired loans in the Consolidated

Balance Sheet Review section in this Item 7 for additional

information.

Net interest income decreased $247 million, or 3%, in 2015

compared with 2014 due to lower purchase accounting

accretion and lower interest-earning asset yields driven by the

ongoing low rate environment, partially offset by commercial

and commercial real estate loan growth and higher securities

balances. The decline also reflected the impact from the

second quarter 2014 correction to reclassify certain

commercial facility fees from net interest income to

noninterest income.

38 The PNC Financial Services Group, Inc. – Form 10-K