PNC Bank 2015 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

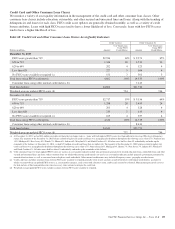

In the normal course of business, we originate or purchase loan products with contractual characteristics that, when concentrated,

may increase our exposure as a holder of those loan products. Possible product features that may create a concentration of credit

risk would include a high original or updated LTV ratio, terms that may expose the borrower to future increases in repayments

above increases in market interest rates, and interest-only loans, among others. We also originate home equity and residential real

estate loans that are concentrated in our primary geographic markets.

We originate interest-only loans to commercial borrowers. Such credit arrangements are usually designed to match borrower cash

flow expectations (e.g., working capital lines, revolvers). These products are standard in the financial services industry and product

features are considered during the underwriting process to mitigate the increased risk that the interest-only feature may result in

borrowers not being able to make interest and principal payments when due. We do not believe that these product features create a

concentration of credit risk.

At December 31, 2015, we pledged $20.2 billion of commercial loans to the Federal Reserve Bank (FRB) and $56.4 billion of

residential real estate and other loans to the Federal Home Loan Bank (FHLB) as collateral for the contingent ability to borrow, if

necessary. The comparable amounts at December 31, 2014 were $19.2 billion and $52.8 billion, respectively.

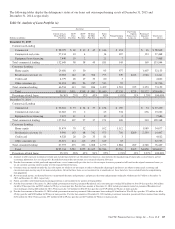

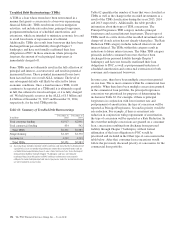

Table 55: Nonperforming Assets

Dollars in millions

December 31

2015

December 31

2014

Nonperforming loans

Total commercial lending $ 545 $ 626

Total consumer lending (a) 1,581 1,884

Total nonperforming loans (b) 2,126 2,510

OREO and foreclosed assets

Other real estate owned (OREO) 279 351

Foreclosed and other assets 20 19

Total OREO and foreclosed assets (c) 299 370

Total nonperforming assets $2,425 $2,880

Nonperforming loans to total loans 1.03% 1.23%

Nonperforming assets to total loans, OREO and foreclosed assets 1.17 1.40

Nonperforming assets to total assets .68 .83

Interest on nonperforming loans

Computed on original terms 115 125

Recognized prior to nonperforming status 22 25

(a) Excludes most consumer loans and lines of credit, not secured by residential real estate, which are charged off after 120 to 180 days past due and are not placed on nonperforming

status.

(b) Nonperforming loans exclude certain government insured or guaranteed loans, loans held for sale, loans accounted for under the fair value option and purchased impaired loans.

(c) The recorded investment of loans collateralized by residential real estate property that are in process of foreclosure was $.6 billion and $.8 billion at December 31, 2015 and

December 31, 2014, which included $.3 billion and $.5 billion, respectively, of loans that are government insured/guaranteed.

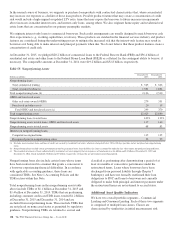

Nonperforming loans also include certain loans whose terms

have been restructured in a manner that grants a concession to

a borrower experiencing financial difficulties. In accordance

with applicable accounting guidance, these loans are

considered TDRs. See Note 1 Accounting Policies and the

TDR section within this Note.

Total nonperforming loans in the nonperforming assets table

above include TDRs of $1.1 billion at December 31, 2015 and

$1.4 billion at December 31, 2014. TDRs that are performing,

including consumer credit card TDR loans, totaled $1.2 billion

at December 31, 2015 and December 31, 2014 and are

excluded from nonperforming loans. These include TDRs that

are not placed on nonaccrual status as permitted by regulatory

guidance. Nonperforming TDRs are returned to accrual and

classified as performing after demonstrating a period of at

least six months of consecutive performance under the

restructured terms. Loans where borrowers have been

discharged from personal liability through Chapter 7

bankruptcy and have not formally reaffirmed their loan

obligations to PNC and loans to borrowers not currently

obligated to make both principal and interest payments under

the restructured terms are not returned to accrual status.

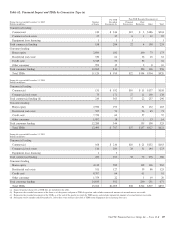

Additional Asset Quality Indicators

We have two overall portfolio segments – Commercial

Lending and Consumer Lending. Each of these two segments

is comprised of multiple loan classes. Classes are

characterized by similarities in initial measurement, risk

128 The PNC Financial Services Group, Inc. – Form 10-K