PNC Bank 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

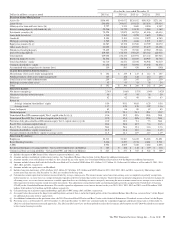

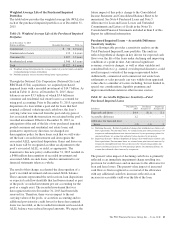

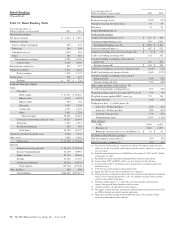

Weighted Average Life of the Purchased Impaired

Portfolios

The table below provides the weighted average life (WAL) for

each of the purchased impaired portfolios as of December 31,

2015.

Table 11: Weighted Average Life of the Purchased Impaired

Portfolios

As of December 31, 2015

Dollars in millions Recorded Investment WAL (a)

Commercial $ 36 2.0 years

Commercial real estate 133 1.6 years

Consumer (b) 1,407 3.9 years

Residential real estate 1,946 4.5 years

Total $3,522 4.1 years

(a) Weighted average life represents the average number of years for which each dollar

of unpaid principal remains outstanding.

(b) Portfolio primarily consists of nonrevolving home equity products.

Through the National City Corporation (National City) and

RBC Bank (USA) acquisitions, we acquired purchased

impaired loans with a recorded investment of $14.7 billion. As

noted in Table 11 above, at December 31, 2015, those

balances are now $3.5 billion, of which $3.4 billion in

consumer and residential real estate loans is accounted for

using pool accounting. Prior to December 31, 2015, upon final

disposition of a loan within a pool and for loans that had

nominal collateral value/expected cash flows, the loan’s

carrying value was removed from the pool and any gain or

loss associated with the transaction was retained in the pool’s

recorded investment. Effective December 31, 2015, in

anticipation of the end of the life of our purchased impaired

pooled consumer and residential real estate loans, and

pursuant to supervisory direction, we changed our

derecognition policy for these loans such that we will write-

off the loan’s recorded investment and derecognize the

associated ALLL upon final disposition. Gains and losses on

such loans will be recognized as either an adjustment to the

pool’s associated ALLL, or yield, as appropriate. The

transition to this new policy on December 31, 2015 resulted in

a $468 million derecognition of recorded investment and

associated ALLL on such loans, which is immaterial to our

financial statements taken as a whole.

The result of this change accelerated the derecognition of a

pool’s recorded investment and associated ALLL balance.

These amounts represented the net loss from loan dispositions

or expected cash flow shortfalls that had been retained as part

of the pools’ recorded investment per our accounting for the

pool as a single asset. The recorded investment that was

derecognized effective December 31, 2015 had been fully

reserved for. Therefore, there was no impact to the net

carrying values of the pools, or accretion accounting and no

additional provision for credit losses for these derecognized

loans was recorded, as the recorded investment and associated

ALLL balance were reduced in equal amounts. We expect the

future impact of this policy change to the Consolidated

Income Statement and Consolidated Balance Sheet to be

immaterial. See Note 4 Purchased Loans and Note 5

Allowance for Loan and Lease Losses and Unfunded

Commitments and Letters of Credit in the Notes To

Consolidated Financial Statements included in Item 8 of this

Report for additional information.

Purchased Impaired Loans – Accretable Difference

Sensitivity Analysis

The following table provides a sensitivity analysis on the

Total Purchased Impaired Loans portfolio. The analysis

reflects hypothetical changes in key drivers for expected cash

flows over the life of the loans under declining and improving

conditions at a point in time. Any unusual significant

economic events or changes, as well as other variables not

considered below (e.g., natural or widespread disasters), could

result in impacts outside of the ranges represented below.

Additionally, commercial and commercial real estate loan

settlements or sales proceeds can vary widely from appraised

values due to a number of factors including, but not limited to,

special use considerations, liquidity premiums and

improvements/deterioration in other income sources.

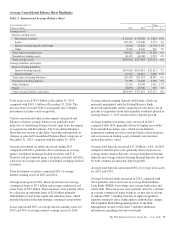

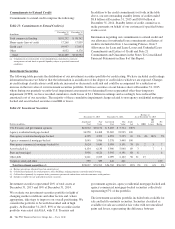

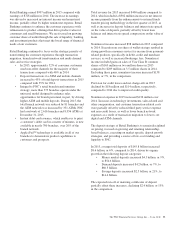

Table 12: Accretable Difference Sensitivity—Total

Purchased Impaired Loans

In billions

December 31,

2015

Declining

Scenario (a)

Improving

Scenario (b)

Expected cash flows $4.4 $(.1) $.1

Accretable difference 1.2 – –

Allowance for loan and lease

losses (.3) (.1) .1

(a) Declining Scenario – Reflects hypothetical changes that would decrease future cash

flow expectations. For consumer loans, we assume home price forecast decreases by

ten percent and unemployment rate forecast increases by two percentage points; for

commercial loans, we assume that collateral values decrease by ten percent.

(b) Improving Scenario – Reflects hypothetical changes that would increase future cash

flow expectations. For consumer loans, we assume home price forecast increases by

ten percent, unemployment rate forecast decreases by two percentage points and

interest rate forecast increases by two percentage points; for commercial loans, we

assume that collateral values increase by ten percent.

The present value impact of declining cash flows is primarily

reflected as an immediate impairment charge resulting in a

provision for credit losses and an increase to the allowance for

loan and lease losses. The present value impact of increased

cash flows is first recognized as a reversal of the allowance

with any additional cash flow increases reflected as an

increase in accretable yield over the life of the loan.

The PNC Financial Services Group, Inc. – Form 10-K 43