PNC Bank 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Certain loans transferred to the Agencies contain removal of

account provisions (ROAPs). Under these ROAPs, we hold an

option to repurchase at par individual delinquent loans that

meet certain criteria. In other limited cases, the U.S.

Department of Housing and Urban Development (HUD) has

granted us the right to repurchase current loans when we

intend to modify the borrower’s interest rate under established

guidelines. When we have the unilateral ability to repurchase

a loan, effective control over the loan has been regained and

we recognize an asset (in either Loans or Loans held for sale)

and a corresponding liability (in Other borrowed funds) on the

balance sheet regardless of our intent to repurchase the loan.

At December 31, 2015 and December 31, 2014, these assets

and liabilities both totaled $120 million and $136 million,

respectively.

The Agency and Non-agency mortgage-backed securities

issued by the securitization SPEs that are purchased and held

on our balance sheet are typically purchased in the secondary

market. PNC does not retain any credit risk on its Agency

mortgage-backed security positions as FNMA, FHLMC, and

the U.S. Government (for GNMA) guarantee losses of

principal and interest.

We also have involvement with certain Agency and Non-

agency commercial securitization SPEs where we have not

transferred commercial mortgage loans. These SPEs were

sponsored by independent third-parties and the loans held by

these entities were purchased exclusively from other third-

parties. Generally, our involvement with these SPEs is as

servicer with servicing activities consistent with those

described above.

We recognize a liability for our loss exposure associated with

contractual obligations to repurchase previously transferred

loans due to breaches of representations and warranties and

also for loss sharing arrangements (recourse obligations) with

the Agencies. Other than providing temporary liquidity under

servicing advances and our loss exposure associated with our

repurchase and recourse obligations, we have not provided nor

are we required to provide any type of credit support,

guarantees, or commitments to the securitization SPEs or

third-party investors in these transactions. See Note 21

Commitments and Guarantees for further discussion of our

repurchase and recourse obligations.

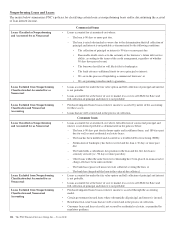

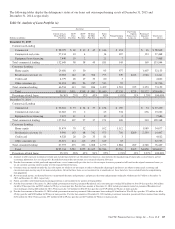

The following table provides cash flows associated with PNC’s loan sale and servicing activities:

Table 50: Cash Flows Associated with Loan Sale and Servicing Activities

In millions

Residential

Mortgages

Commercial

Mortgages (a)

Home Equity

Loans/Lines (b)

CASH FLOWS – Year ended December 31, 2015

Sales of loans (c) $8,121 $4,398

Repurchases of previously transferred loans (d) 580 $135

Servicing fees (e) 339 120 15

Servicing advances recovered/(funded), net 90 48 3

Cash flows on mortgage-backed securities held (f) 1,458 184

CASH FLOWS – Year ended December 31, 2014

Sales of loans (c) $8,344 $3,469

Repurchases of previously transferred loans (d) 744 $ 14

Servicing fees (e) 346 132 19

Servicing advances recovered/(funded), net 70 113 (20)

Cash flows on mortgage-backed securities held (f) 934 308

(a) Represents cash flow information associated with both commercial mortgage loan transfer and servicing activities.

(b) These activities were part of an acquired brokered home equity lending business in which PNC is no longer engaged.

(c) Gains/losses recognized on sales of loans were insignificant for the periods presented.

(d) Includes residential mortgage government insured or guaranteed loans eligible for repurchase through the exercise of our ROAP option, and loans repurchased due to alleged breaches

of origination covenants or representations and warranties made to purchasers. Includes home equity lines of credit repurchased at the end of their draw periods due to contractual

requirements.

(e) Includes contractually specified servicing fees, late charges and ancillary fees.

(f) Represents cash flows on securities we hold issued by a securitization SPE in which PNC transferred to and/or services loans. The carrying value of such securities held were $6.6

billion in residential mortgage-backed securities and $1.3 billion in commercial mortgage-backed securities at December 31, 2015 and $3.4 billion in residential mortgage-backed

securities and $1.3 billion in commercial mortgage-backed securities at December 31, 2014.

122 The PNC Financial Services Group, Inc. – Form 10-K