PNC Bank 2015 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

presented in other comprehensive income, 2) clarifies that an

entity should consider deferred tax assets related to available-

for-sale securities when evaluating the need for a valuation

allowance on deferred tax assets, 3) eliminates the

requirement for entities to disclose the methods and

significant assumptions used to estimate disclosed fair values

for financial instruments measured at amortized cost, 4)

requires that the disclosed fair values represent an exit price,

and 5) requires that financial assets and liabilities be presented

by measurement category and form of instrument on the

balance sheet or within the accompanying notes to the

financial statements. The ASU is effective for annual periods,

and interim periods within those annual periods, beginning

after December 15, 2017 and should be applied through a

cumulative-effect adjustment to the balance sheet, except for

the amendment related to equity securities without readily

determinable fair values, which should be applied

prospectively. We plan to adopt all provisions consistent with

the effective date and are currently evaluating the impact of

this ASU on our results of operations and financial position.

Recently Adopted Accounting Pronouncements

See Note 1 Accounting Policies in the Notes To the

Consolidated Financial Statements in Item 8 of this Report

regarding the impact of new accounting pronouncements

which we have adopted.

S

TATUS OF

Q

UALIFIED

D

EFINED

B

ENEFIT

P

ENSION

P

LAN

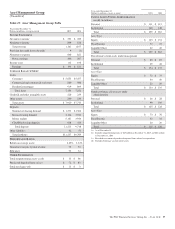

We have a noncontributory, qualified defined benefit pension

plan (plan or pension plan) covering eligible employees.

Benefits are determined using a cash balance formula where

earnings credits are applied as a percentage of eligible

compensation. Pension contributions are based on an

actuarially determined amount necessary to fund total benefits

payable to plan participants. Consistent with our investment

strategy, plan assets are primarily invested in equity

investments and fixed income instruments. Plan fiduciaries

determine and review the plan’s investment policy, which is

described more fully in Note 12 Employee Benefit Plans in

the Notes To Consolidated Financial Statements in Item 8 of

this Report.

We calculate the expense associated with the pension plan and

the assumptions and methods that we use include a policy of

reflecting plan assets at their fair market value. On an annual

basis, we review the actuarial assumptions related to the

pension plan. The primary assumptions used to measure

pension obligations and costs are the discount rate, mortality,

compensation increase and expected long-term return on plan

assets. Among these, the compensation increase assumption

does not significantly affect pension expense.

ASC 715-30 and ASC 715-60 stipulate that each individual

assumption, including mortality, should reflect the plan

sponsor’s best estimate. PNC has historically utilized a

version of the Society of Actuaries’ (SOA) published

mortality tables in developing its best estimate of mortality.

On October 27, 2014, the SOA published a new study on

mortality rates that included updated mortality tables and

mortality improvement scale, which both reflect longer life

expectancy. Based on an evaluation of the mortality

experience of PNC’s qualified pension plan participants in

conjunction with the updated SOA mortality study, PNC

adopted an adjusted version of the SOA’s new mortality table

and improvement scale for purposes of measuring the plan’s

benefit obligations at December 31, 2014. During 2015, the

SOA released an updated mortality improvement scale that

generally validated the information that was considered when

setting the current assumption, which remains unchanged

from the mortality assumption adopted in 2014.

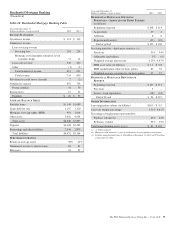

The discount rate used to measure pension obligations is

determined by comparing the expected future benefits that

will be paid under the plan with yields available on high

quality corporate bonds of similar duration. The impact on

pension expense of a .5% decrease in discount rate in the

current environment is an increase of $18 million per year.

This sensitivity depends on the economic environment and

amount of unrecognized actuarial gains or losses on the

measurement date.

The expected long-term return on assets assumption also has a

significant effect on pension expense. The expected return on

plan assets is a long-term assumption established by

considering historical and anticipated returns of the asset

classes invested in by the pension plan and the asset allocation

policy currently in place. For purposes of setting and

reviewing this assumption, “long term” refers to the period

over which the plan’s projected benefit obligations will be

disbursed. We review this assumption at each measurement

date and adjust it if warranted. Our selection process

references certain historical data and the current environment,

but primarily utilizes qualitative judgment regarding future

return expectations.

To evaluate the continued reasonableness of our assumption,

we examine a variety of viewpoints and data. Various studies

have shown that portfolios comprised primarily of U.S. equity

securities have historically returned approximately 9%

annually over long periods of time, while U.S. debt securities

have returned approximately 6% annually over long periods.

Application of these historical returns to the plan’s allocation

ranges for equities and bonds produces a result between 6.50%

and 7.25% and is one point of reference, among many other

factors, that is taken into consideration. We also examine the

plan’s actual historical returns over various periods and

consider the current economic environment. Recent

experience is considered in our evaluation with appropriate

consideration that, especially for short time periods, recent

returns are not reliable indicators of future returns. While

annual returns can vary significantly (actual returns for 2015,

66 The PNC Financial Services Group, Inc. – Form 10-K