PNC Bank 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes To Consolidated Financial Statements in Item 8 of this

Report for additional information on these loans.

Within consumer nonperforming loans, residential real estate

TDRs comprise 68% of total residential real estate

nonperforming loans at December 31, 2015, up from 60% at

December 31, 2014. Home equity TDRs comprise 51% of

home equity nonperforming loans at December 31, 2015,

down from 54% at December 31, 2014. TDRs generally

remain in nonperforming status until a borrower has made at

least six consecutive months of both principal and interest

payments under the modified terms or ultimate resolution

occurs. Loans where borrowers have been discharged from

personal liability through Chapter 7 bankruptcy and have not

formally reaffirmed their loan obligations to PNC and loans to

borrowers not currently obligated to make both principal and

interest payments under the restructured terms are not returned

to accrual status.

At December 31, 2015, our largest nonperforming asset was

$33 million in the Real Estate, Rental and Leasing Industry

and our average nonperforming loan associated with

commercial lending was less than $1 million. The ten largest

outstanding nonperforming assets are from the commercial

lending portfolio and represent 37% and 8% of total

commercial lending nonperforming loans and total

nonperforming assets, respectively, as of December 31, 2015.

Purchased impaired loans are considered performing, even if

contractually past due (or if we do not expect to receive

payment in full based on the original contractual terms), as we

accrete interest income over the expected life of the loans. The

accretable yield represents the excess of the expected cash

flows on the loans at the measurement date over the carrying

value. Generally decreases, other than interest rate decreases

for variable rate notes, in the net present value of expected

cash flows of individual commercial or pooled purchased

impaired loans would result in an impairment charge to the

provision for credit losses in the period in which the change is

deemed probable. Generally increases in the net present value

first result in a recovery of previously recorded allowance for

loan losses, to the extent applicable, and then an increase to

accretable yield for the remaining life of the purchased

impaired loans. Total nonperforming loans and assets in the

tables above are significantly lower than they would have

been due to this accounting treatment for purchased impaired

loans. This treatment also results in a lower ratio of

nonperforming loans to total loans and a higher ratio of ALLL

to nonperforming loans. See Note 4 Purchased Loans in the

Notes To Consolidated Financial Statements in Item 8 of this

Report, for additional information, including the accounting

treatment, on these loans.

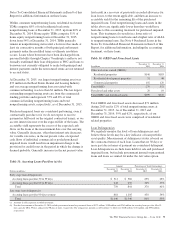

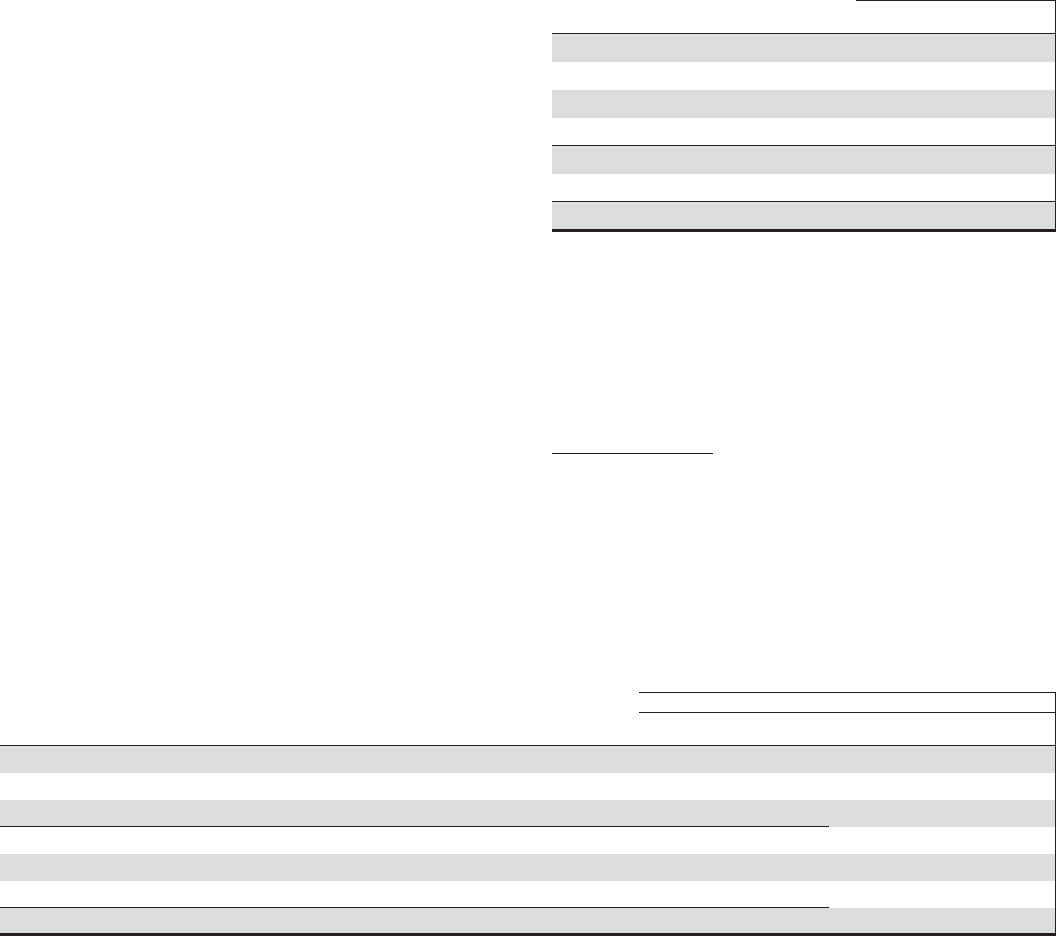

Table 30: OREO and Foreclosed Assets

In millions

December 31

2015

December 31

2014

Other real estate owned (OREO):

Residential properties $146 $183

Residential development properties 31 48

Commercial properties 102 120

Total OREO 279 351

Foreclosed and other assets 20 19

Total OREO and foreclosed assets $299 $370

Total OREO and foreclosed assets decreased $71 million

during 2015 and is 12% of total nonperforming assets at

December 31, 2015. As of December 31, 2015 and

December 31, 2014, 59% and 62%, respectively, of our

OREO and foreclosed assets were comprised of residential

related properties.

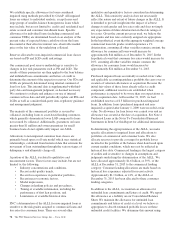

Loan Delinquencies

We regularly monitor the level of loan delinquencies and

believe these levels may be a key indicator of loan portfolio

asset quality. Measurement of delinquency status is based on

the contractual terms of each loan. Loans that are 30 days or

more past due in terms of payment are considered delinquent.

Loan delinquencies exclude loans held for sale and purchased

impaired loans, but include government insured or guaranteed

loans and loans accounted for under the fair value option.

Table 31: Accruing Loans Past Due (a) (b)

Amount Percentage of Total Outstandings

Dollars in millions

December 31

2015

December 31

2014

December 31

2015

December 31

2014

Early stage loan delinquencies

Accruing loans past due 30 to 59 days $ 511 $ 582 .25% .28%

Accruing loans past due 60 to 89 days 248 259 .12% .13%

Total 759 841 .37% .41%

Late stage loan delinquencies

Accruing loans past due 90 days or more 881 1,105 .43% .54%

Total $1,640 $1,946 .80% .95%

(a) Amounts in table represent recorded investment.

(b) Past due loan amounts at December 31, 2015 include government insured or guaranteed loans of $172 million, $120 million, and $765 million for accruing loans past due 30 to 59

days, past due 60 to 89 days, and past due 90 days or more, respectively. The comparative amounts as of December 31, 2014 were $220 million, $136 million, and $996 million,

respectively.

The PNC Financial Services Group, Inc. – Form 10-K 73