PNC Bank 2015 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

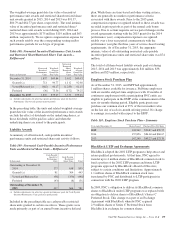

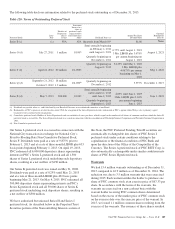

The following table discloses information related to the preferred stock outstanding as of December 31, 2015.

Table 120: Terms of Outstanding Preferred Stock

Preferred Stock

Issue

Date

Number of

Depositary

Shares

Issued

Fractional

Interest in a

share of

preferred stock

represented by

each Depositary

Share Dividend Dates (a)

Annual Per Share

Dividend Rate

Optional

Redemption

Date (b)

Series B (c) (c) N/A N/A Quarterly from March 10th $1.80 None

Series O (d) July 27, 2011 1 million 1/100th

Semi-annually beginning

on February 1, 2012

until August 1, 2021

Quarterly beginning on

November 1, 2021

6.75% until August 1, 2021

3 Mo. LIBOR plus 3.678%

per annum beginning on

August 1, 2021

August 1, 2021

Series P (d) April 24, 2012 60 million 1/4,000th

Quarterly beginning on

August 1, 2012

6.125% until May 1, 2022

3 Mo. LIBOR plus

4.0675% per annum

beginning on May 1,

2022

May 1, 2022

Series Q (d) September 21, 2012

October 9, 2012

18 million

1.2 million 1/4,000th Quarterly beginning on

December 1, 2012 5.375% December 1, 2017

Series R (d) May 7, 2013 500,000 1/100th

Semi-annually beginning

on December 1, 2013

until June 1, 2023

Quarterly beginning on

September 1, 2023

4.85% until June 1, 2023

3 Mo. LIBOR plus 3.04%

per annum beginning

June 1, 2023

June 1, 2023

(a) Dividends are payable when, as, and if declared by our Board of Directors or an authorized committee of our Board.

(b) Redeemable at PNC’s option on or after the date stated. With the exception of the Series B preferred stock, redeemable at PNC’s option within 90 days of a regulatory capital

treatment event as defined in the designations.

(c) Cumulative preferred stock. Holders of Series B preferred stock are entitled to 8 votes per share, which is equal to the number of full shares of common stock into which the Series B

preferred stock is convertible. The Series B preferred stock was issued in connection with the consolidation of Pittsburgh National Corporation and Provident National Corporation in

1983.

(d) Non-Cumulative preferred stock.

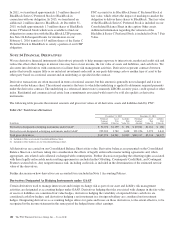

Our Series L preferred stock was issued in connection with the

National City transaction in exchange for National City’s

Fixed-to-Floating Rate Non-Cumulative Preferred Stock,

Series F. Dividends were paid at a rate of 9.875% prior to

February 1, 2013 and at a rate of three-month LIBOR plus 633

basis points beginning February 1, 2013. On April 19, 2013,

PNC redeemed all 6,000,000 depositary shares representing

interests in PNC’s Series L preferred stock and all 1,500

shares of Series L preferred stock underlying such depositary

shares, resulting in a net outflow of $150 million.

Our Series K preferred stock was issued on May 21, 2008.

Dividends were paid at a rate of 8.25% until May 21, 2013

and at a rate of three-month LIBOR plus 422 basis points

beginning May 21, 2013. On May 4, 2015, PNC redeemed all

500,000 depositary shares representing interests in PNC’s

Series K preferred stock and all 50,000 shares of Series K

preferred stock underlying such depositary shares, resulting in

a net outflow of $500 million.

We have authorized but unissued Series H and Series I

preferred stock. As described below in the Perpetual Trust

Securities portion of the Noncontrolling Interests section of

this Note, the PNC Preferred Funding Trust II securities are

automatically exchangeable into shares of PNC Series I

preferred stock under certain conditions relating to the

capitalization or the financial condition of PNC Bank and

upon the direction of the Office of the Comptroller of the

Currency. The Series A preferred stock of PNC REIT Corp. is

also automatically exchangeable under similar conditions into

shares of PNC Series H preferred stock.

Warrants

We had 13.4 million warrants outstanding as of December 31,

2015 compared to 16.9 million as of December 31, 2014. The

reduction was due to 3.5 million warrants that were exercised

during 2015. Each warrant entitles the holder to purchase one

share of PNC common stock at an exercise price of $67.33 per

share. In accordance with the terms of the warrants, the

warrants are exercised on a non-cash net basis with the

warrant holder receiving PNC common shares determined

based on the excess of the market price of PNC common stock

on the exercise date over the exercise price of the warrant. In

2015, we issued 1.1 million common shares resulting from the

exercise of the warrants. The issuance of these shares resulted

The PNC Financial Services Group, Inc. – Form 10-K 189