PNC Bank 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

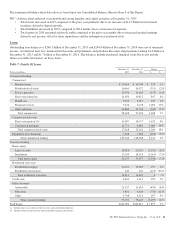

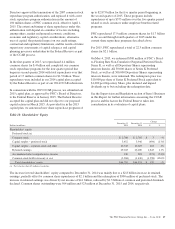

We sold $4.4 billion of commercial mortgage loans to

agencies during 2015 compared to $3.5 billion during 2014.

Total revenue of $99 million was recognized on the valuation

and sale of commercial mortgage loans held for sale, net of

hedges, during 2015 and $80 million in 2014. These amounts

are included in Other noninterest income on the Consolidated

Income Statement.

Residential mortgage loan origination volume was $10.5

billion during 2015 compared to $9.5 billion during 2014. The

majority of such loans were originated under agency or

Federal Housing Administration (FHA) standards. We sold

$8.1 billion of loans and recognized loan sales revenue of

$342 million during 2015. The comparable amounts for 2014

were $8.3 billion and $420 million, respectively. These loan

sales revenue amounts are included in Residential mortgage

noninterest income on the Consolidated Income Statement.

Interest income on loans held for sale was $90 million and $99

million during 2015 and 2014, respectively. These amounts

are included in Other interest income on the Consolidated

Income Statement.

Additional information regarding our loan sale and servicing

activities is included in Note 2 Loan Sale and Servicing

Activities and Variable Interest Entities and Note 7 Fair Value

in our Notes To Consolidated Financial Statements included

in Item 8 of this Report.

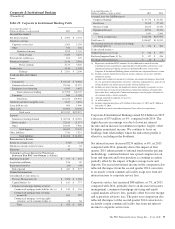

Funding Sources

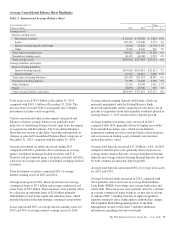

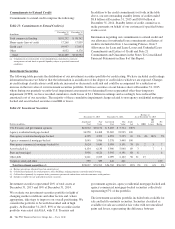

Table 17: Details Of Funding Sources

Dollars in millions

December 31

2015

December 31

2014

Change

$%

Deposits

Money market $118,079 $115,438 $ 2,641 2%

Demand 90,038 82,829 7,209 9%

Savings 20,375 12,571 7,804 62%

Retail certificates of deposit 17,405 18,544 (1,139) (6)%

Time deposits in foreign offices and other time deposits 3,105 2,852 253 9%

Total deposits 249,002 232,234 16,768 7%

Borrowed funds

Federal funds purchased and repurchase agreements 1,777 3,510 (1,733) (49)%

FHLB borrowings 20,108 20,005 103 1%

Bank notes and senior debt 21,298 15,750 5,548 35%

Subordinated debt 8,556 9,151 (595) (7)%

Commercial paper 14 4,995 (4,981) (100)%

Other 2,779 3,357 (578) (17)%

Total borrowed funds 54,532 56,768 (2,236) (4)%

Total funding sources $303,534 $289,002 $14,532 5%

See the Liquidity Risk Management portion of the Risk

Management section of this Item 7 for additional information

regarding our 2015 capital and liquidity activities.

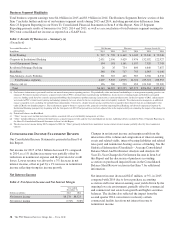

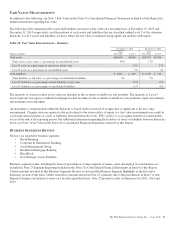

Total deposits increased in the comparison due to strong

growth in savings, demand, and money market deposits,

partially offset by a decline in retail certificates of deposit.

Interest-bearing deposits represented 68% of total deposits at

both December 31, 2015 and December 31, 2014.

Total borrowed funds decreased in the comparison as declines

in commercial paper, federal funds purchased, repurchase

agreements and subordinated debt were partially offset by

higher net issuances of bank notes and senior debt. The changes

in the composition of funding sources are attributable to PNC’s

actions to enhance its funding structure in light of regulatory

liquidity standards and a rating agency methodology change.

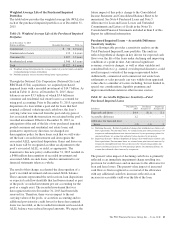

Capital

We manage our funding and capital positions by making

adjustments to our balance sheet size and composition, issuing

debt, equity or other capital instruments, executing treasury

stock transactions and capital redemptions, managing dividend

policies and retaining earnings.

We repurchase shares of PNC common stock under common

stock repurchase authorizations approved from time to time by

PNC’s Board of Directors and consistent with capital plans

submitted to, and accepted by, the Federal Reserve. Through

the first quarter of 2015, we repurchased stock under our 2007

common stock repurchase program authorization that

permitted us to purchase up to 25 million shares of PNC

common stock on the open market or in privately negotiated

transactions. Effective as of March 31, 2015, PNC’s Board of

46 The PNC Financial Services Group, Inc. – Form 10-K