PNC Bank 2015 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

8G

OODWILL AND

I

NTANGIBLE

A

SSETS

Assets and liabilities of acquired entities are recorded at

estimated fair value as of the acquisition date.

Goodwill

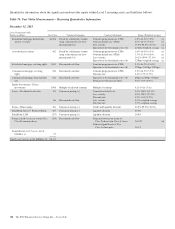

Changes in goodwill by business segment during 2015 and

2014 follow:

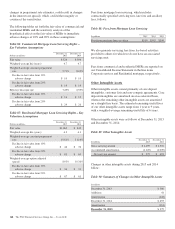

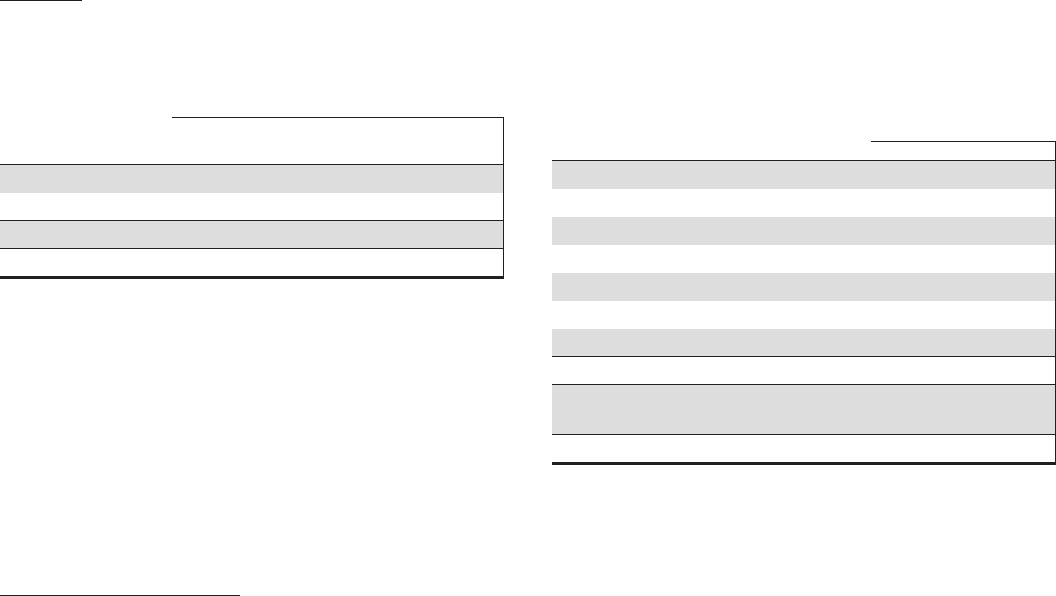

Table 82: Goodwill by Business Segment (a)

In millions

Retail

Banking

Corporate &

Institutional

Banking

Asset

Management

Group Total

December 31, 2013 $5,795 $3,215 $64 $9,074

Other 29 29

December 31, 2014 $5,795 $3,244 $64 $9,103

December 31, 2015 $5,795 $3,244 $64 $9,103

(a) The Residential Mortgage Banking, BlackRock and Non-Strategic Assets Portfolio

business segments did not have any goodwill allocated to them during 2015, 2014,

and 2013.

We conduct a goodwill impairment test on our reporting units

at least annually, in the fourth quarter, or more frequently if

events occur or circumstances have changed significantly

from the annual test date. The fair value of our reporting units

with goodwill is determined by using discounted cash flow

and, when applicable, market comparability methodologies.

Based on the results of our analysis, there were no impairment

charges related to goodwill in 2015 or 2014.

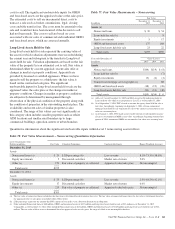

Mortgage Servicing Rights

We recognize the right to service mortgage loans for others as

an intangible asset. MSRs are purchased or originated when

loans are sold with servicing retained. MSRs totaled $1.6

billion and $1.4 billion at December 31, 2015 and

December 31, 2014, respectively, and consisted of loan

servicing contracts for commercial and residential mortgages

measured at fair value.

Commercial Mortgage Servicing Rights

As of January 1, 2014, PNC made an irrevocable election to

subsequently measure all classes of commercial MSRs at fair

value in order to eliminate any potential measurement

mismatch between our economic hedges and the commercial

MSRs. The impact of the cumulative-effect adjustment to

retained earnings was not material, and the valuation

allowance associated with the commercial MSRs was

reclassified to the gross carrying amount of commercial

MSRs. We recognize gains/(losses) on changes in the fair

value of commercial MSRs as a result of the election.

Commercial MSRs are subject to declines in value from actual

or expected prepayment of the underlying loans and defaults

as well as market driven changes in interest rates. We manage

this risk by economically hedging the fair value of commercial

MSRs with securities and derivative instruments which are

expected to increase (or decrease) in value when the value of

commercial MSRs declines (or increases).

The fair value of commercial MSRs is estimated by using a

discounted cash flow model incorporating inputs for

assumptions as to constant prepayment rates, discount rates

and other factors determined based on current market

conditions and expectations.

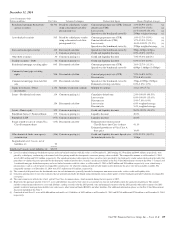

Changes in the commercial MSRs accounted for at fair value

during 2015 and 2014, follow:

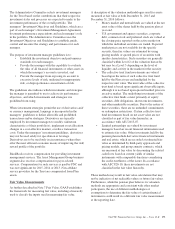

Table 83: Commercial Mortgage Servicing Rights Accounted

for at Fair Value

In millions 2015 2014

January 1 $ 506 $ 552

Additions:

From loans sold with servicing retained 63 53

Purchases 55 43

Changes in fair value due to:

Time and payoffs (a) (89) (89)

Other (b) (9) (53)

December 31 $ 526 $ 506

Related unpaid principal balance at

December 31 $145,823 $143,738

Servicing advances at December 31 $ 251 $ 299

(a) Represents decrease in MSR value due to passage of time, including the impact from

both regularly scheduled loan principal payments and loans that were paid down or

paid off during the period.

(b) Represents MSR value changes resulting primarily from market-driven changes in

interest rates.

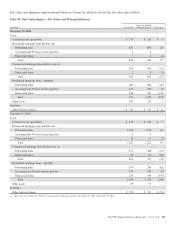

Prior to 2014, commercial MSRs were initially recorded at

fair value and subsequently accounted for at the lower of

amortized cost or fair value. These rights were substantially

amortized in proportion to and over the period of estimated

net servicing income of 5 to 10 years. Commercial MSRs

were periodically evaluated for impairment. For purposes of

impairment, the commercial MSRs were stratified based on

asset type, which characterized the predominant risk of the

underlying financial asset. If the carrying amount of any

individual stratum exceeded its fair value, a valuation reserve

was established with a corresponding charge to Corporate

services on our Consolidated Income Statement.

166 The PNC Financial Services Group, Inc. – Form 10-K