PNC Bank 2015 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

7F

AIR

V

ALUE

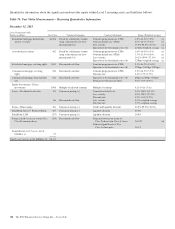

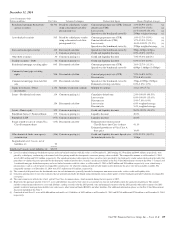

Fair Value Measurement

PNC measures certain financial assets and liabilities at fair

value in accordance with GAAP. Fair value is defined in

GAAP as the price that would be received to sell an asset or

the price that would be paid to transfer a liability on the

measurement date. GAAP focuses on the exit price in the

principal or most advantageous market for the asset or liability

in an orderly transaction between market participants. GAAP

also establishes a fair value hierarchy to maximize the use of

observable inputs when measuring fair value and defines the

three levels of inputs as noted below.

Level 1

Fair value is determined using a quoted price in an active

market for identical assets or liabilities. Level 1 assets and

liabilities may include debt securities, equity securities and

listed derivative contracts that are traded in an active exchange

market and certain U.S. Treasury securities that are actively

traded in over-the-counter markets.

Level 2

Fair value is estimated using inputs other than quoted prices

included within Level 1 that are observable for assets or

liabilities, either directly or indirectly. The majority of Level 2

assets and liabilities include debt securities, equity securities

and listed derivative contracts with quoted prices that are

traded in markets that are not active, and certain debt and

equity securities and over-the-counter derivative contracts

whose fair value is determined using a pricing model without

significant unobservable inputs.

Level 3

Fair value is estimated using unobservable inputs that are

significant to the fair value of the assets or liabilities. Level 3

assets and liabilities include financial instruments whose value

is determined using pricing models and discounted cash flow

methodologies, or similar techniques for which the significant

valuation inputs are not observable and the determination of

fair value requires significant management judgment or

estimation.

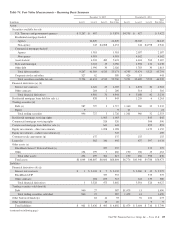

Certain assets which have been adjusted due to impairment are

accounted for at lower of amortized cost or fair value on a

nonrecurring basis and consist primarily of certain nonaccrual

loans, OREO and foreclosed assets and long-lived assets held

for sale. These assets, which are generally classified as

Level 3, are included in Table 77 in this Note 7.

We characterize active markets as those where transaction

volumes are sufficient to provide objective pricing

information, with reasonably narrow bid/ask spreads and

where dealer quotes received do not vary widely and are based

on current information. Inactive markets are typically

characterized by low transaction volumes, price quotations

that vary substantially among market participants or are not

based on current information, wide bid/ask spreads, a

significant increase in implied liquidity risk premiums, yields,

or performance indicators for observed transactions or quoted

prices compared to historical periods, a significant decline or

absence of a market for new issuance, or any combination of

the above factors. We also consider nonperformance risks

including credit risk as part of our valuation methodology for

all assets and liabilities measured at fair value.

Any models used to determine fair values or to validate dealer

quotes based on the descriptions below are subject to review

and independent testing as part of our model validation and

internal control testing processes. Our Model Risk

Management Committee reviews significant models on at

least an annual basis. In addition, the Valuation Committee

approves valuation methodologies and reviews the results of

independent valuation reviews and processes for assets and

liabilities measured at fair value on a recurring basis.

Assets and liabilities measured at fair value, by their nature,

result in a higher degree of financial statement volatility.

Assets and liabilities classified within Level 3 inherently

require the use of various assumptions, estimates and

judgments when measuring their fair value. As observable

market activity is commonly not available to use when

estimating the fair value of Level 3 assets and liabilities, we

must estimate fair value using various modeling techniques.

These techniques include the use of a variety of inputs/

assumptions including credit quality, liquidity, interest rates or

other relevant inputs across the entire population of our

Level 3 assets and liabilities. Changes in the significant

underlying factors or assumptions (either an increase or a

decrease) in any of these areas underlying our estimates may

result in a significant increase/decrease in the Level 3 fair

value measurement of a particular asset and/or liability from

period to period.

The PNC Financial Services Group, Inc. – Form 10-K 149