PNC Bank 2015 Annual Report Download - page 76

Download and view the complete annual report

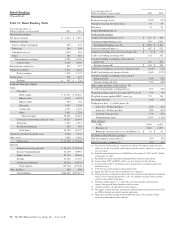

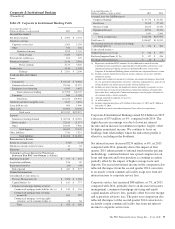

Please find page 76 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asset Management Group earned $194 million in 2015

compared to $181 million in 2014, an increase of $13 million,

or 7%. Earnings increased due to increases in net interest

income and noninterest income, partially offset by an increase

in noninterest expense.

Total revenue for 2015 increased $54 million compared to

2014. Noninterest income increased $51 million, or 6%,

primarily relating to the impact from a $30 million trust

settlement in the second quarter of 2015, new sales production

and stronger average equity markets. Net interest income

increased $3 million, or 1%, in 2015 compared to 2014,

primarily due to an increase in average loan and deposit

balances, partially offset by continued spread compression.

Noninterest expense increased by $25 million, or 3%, in 2015

compared to the prior year, primarily attributable to higher

compensation expense and investments in technology. Asset

Management Group remains focused on disciplined expense

management as it invests in strategic growth opportunities.

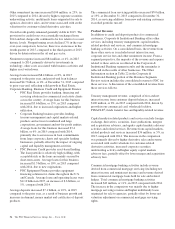

The core growth strategies of the business include increasing

sales sourced from other PNC lines of business, maximizing

front line productivity and optimizing market presence in high

opportunity markets. Wealth Management and Hawthorn have

over 100 offices operating in 7 out of the 10 most affluent

states in the U.S. with a majority co-located with retail

banking branches. The businesses’ strategies primarily focus

on growing client assets under management through

expanding relationships directly and through cross-selling

from PNC’s other lines of business.

Institutional Asset Management provides advisory, custody,

and retirement administration services to institutional clients

primarily within our banking footprint. The business also

offers PNC proprietary mutual funds and investment

strategies. Institutional Asset Management is strengthening its

partnership with Corporate and Institutional Banking and

other internal channels to drive growth and is focused on

building retirement capabilities and expanding product

solutions for all customers.

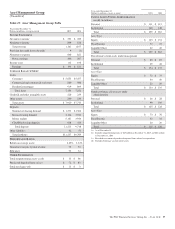

Assets under administration were $259 billion as of

December 31, 2015 compared to $263 billion as of

December 31, 2014, largely due to a decline in

nondiscretionary client assets under administration.

Discretionary client assets under management decreased $1

billion at December 31, 2015 compared to December 31,

2014, driven by lower equity markets on a spot basis, partially

offset by positive net flows, after adjustments for cyclical

client activities.

Average loan balances increased $.2 billion, or 3%, in 2015

compared to the prior year due to continued growth in the

consumer loan portfolio. Asset Management Group’s clients’

preference for liquidity in the form of a new line of credit

product has driven significant growth in the loan portfolio.

The line of credit product is primarily secured by the market

value of the client’s underlying investment management

account assets. Average deposits for 2015 increased $1.5

billion, or 15%, compared to the prior year, driven by an

increase in money market products.

58 The PNC Financial Services Group, Inc. – Form 10-K