PNC Bank 2015 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

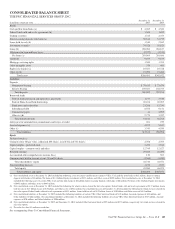

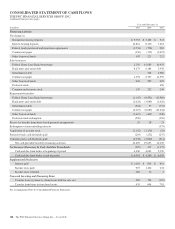

CONSOLIDATED BALANCE SHEET

THE PNC FINANCIAL SERVICES GROUP, INC.

In millions, except par value

December 31

2015

December 31

2014

Assets

Cash and due from banks (a) $ 4,065 $ 4,360

Federal funds sold and resale agreements (b) 1,369 1,852

Trading securities 1,726 2,353

Interest-earning deposits with banks (a) 30,546 31,779

Loans held for sale (b) 1,540 2,262

Investment securities 70,528 55,823

Loans (b) 206,696 204,817

Allowance for loan and lease losses (2,727) (3,331)

Net loans (a) 203,969 201,486

Goodwill 9,103 9,103

Mortgage servicing rights 1,589 1,351

Other intangible assets 379 493

Equity investments (a) 10,587 10,728

Other (a) (b) 23,092 23,482

Total assets $358,493 $345,072

Liabilities

Deposits

Noninterest-bearing $ 79,435 $ 73,479

Interest-bearing 169,567 158,755

Total deposits 249,002 232,234

Borrowed funds

Federal funds purchased and repurchase agreements 1,777 3,510

Federal Home Loan Bank borrowings 20,108 20,005

Bank notes and senior debt 21,298 15,750

Subordinated debt 8,556 9,151

Commercial paper 14 4,995

Other (c) (d) 2,779 3,357

Total borrowed funds 54,532 56,768

Allowance for unfunded loan commitments and letters of credit 261 259

Accrued expenses (c) 4,975 5,187

Other (c) 3,743 4,550

Total liabilities 312,513 298,998

Equity

Preferred stock (e)

Common stock ($5 par value, authorized 800 shares, issued 542 and 541 shares) 2,708 2,705

Capital surplus – preferred stock 3,452 3,946

Capital surplus – common stock and other 12,745 12,627

Retained earnings 29,043 26,200

Accumulated other comprehensive income (loss) 130 503

Common stock held in treasury at cost: 38 and 18 shares (3,368) (1,430)

Total shareholders’ equity 44,710 44,551

Noncontrolling interests 1,270 1,523

Total equity 45,980 46,074

Total liabilities and equity $358,493 $345,072

(a) Our consolidated assets at December 31, 2015 included the following assets of certain variable interest entities (VIEs): Cash and due from banks of $11 million, Interest-earning

deposits with banks of $4 million, Net loans of $1.3 billion, Equity investments of $183 million, and Other assets of $402 million. Our consolidated assets at December 31, 2014

included the following assets of certain VIEs: Cash and due from banks of $6 million, Interest-earning deposits with banks of $6 million, Net loans of $1.6 billion, Equity investments

of $492 million, and Other assets of $483 million.

(b) Our consolidated assets at December 31, 2015 included the following for which we have elected the fair value option: Federal funds sold and resale agreements of $137 million, Loans

held for sale of $1.5 billion, Loans of $.9 billion, and Other assets of $521 million. Our consolidated assets at December 31, 2014 included the following for which we have elected the

fair value option: Federal funds sold and resale agreements of $155 million, Loans held for sale of $2.2 billion, Loans of $1.0 billion, and Other assets of $412 million.

(c) Our consolidated liabilities at December 31, 2015 included the following liabilities of certain VIEs: Other borrowed funds of $148 million, Accrued expenses of $44 million, and

Other liabilities of $202 million. Our consolidated liabilities at December 31, 2014 included the following liabilities of certain VIEs: Other borrowed funds of $347 million, Accrued

expenses of $70 million, and Other liabilities of $206 million.

(d) Our consolidated liabilities at December 31, 2015 and December 31, 2014 included Other borrowed funds of $93 million and $273 million, respectively, for which we have elected the

fair value option.

(e) Par value less than $.5 million at each date.

See accompanying Notes To Consolidated Financial Statements.

The PNC Financial Services Group, Inc. – Form 10-K 105