PNC Bank 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

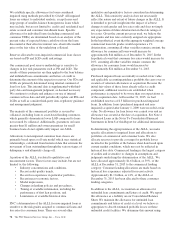

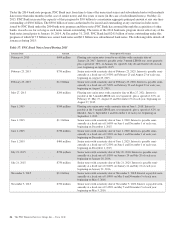

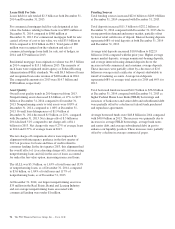

Commitments

The following tables set forth contractual obligations and various other commitments as of December 31, 2015 representing

required and potential cash outflows.

Table 42: Contractual Obligations

Payment Due By Period

December 31, 2015 – in millions Total

Less than

one year

One to

three years

Four to

five years

After five

years

Remaining contractual maturities of time deposits (a) $20,510 $15,092 $ 1,541 $ 1,249 $ 2,628

Borrowed funds (a) (b) 54,532 10,863 21,888 13,052 8,729

Minimum annual rentals on noncancellable leases 2,687 378 665 486 1,158

Nonqualified pension and postretirement benefits 491 51 105 102 233

Purchase obligations (c) 859 361 289 153 56

Total contractual cash obligations $79,079 $26,745 $24,488 $15,042 $12,804

(a) Includes purchase accounting adjustments.

(b) Includes basis adjustment relating to accounting hedges.

(c) Includes purchase obligations for goods and services covered by noncancellable contracts and contracts including cancellation fees.

At December 31, 2015, we had unrecognized tax benefits of $26 million, which represents a reserve for tax positions that we have

taken in our tax returns which ultimately may not be sustained upon examination by taxing authorities. Since the ultimate amount

and timing of any future cash settlements cannot be predicted with reasonable certainty, this estimate has been excluded from the

contractual obligations table. See Note 18 Income Taxes in the Notes To Consolidated Financial Statements in Item 8 of this

Report for additional information.

Our contractual obligations totaled $82.0 billion at December 31, 2014. The decrease in the comparison is primarily attributable to

declines in borrowed funds and time deposits. See Funding Sources in the Consolidated Balance Sheet Review section of this

Item 7 for additional information regarding our funding sources.

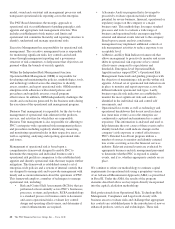

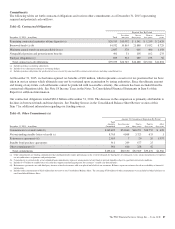

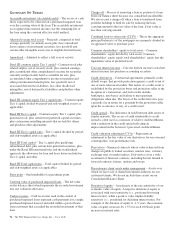

Table 43: Other Commitments (a)

Amount Of Commitment Expiration By Period

December 31, 2015 – in millions

Total

Amounts

Committed

Less than one

year

One to

three years

Four to

five years

After

five years

Commitments to extend credit (b) $142,489 $54,840 $48,291 $38,750 $ 608

Net outstanding standby letters of credit (c) 8,765 4,808 3,323 633 1

Reinsurance agreements (d) 2,010 7 20 26 1,957

Standby bond purchase agreements 911 209 677 25

Other commitments (e) 966 666 258 42

Total commitments $155,141 $60,530 $52,569 $39,476 $2,566

(a) Other commitments are funding commitments that could potentially require performance in the event of demands by third parties or contingent events. Loan commitments are reported

net of syndications, assignments and participations.

(b) Commitments to extend credit, or net unfunded loan commitments, represent arrangements to lend funds or provide liquidity subject to specified contractual conditions.

(c) Includes $4.7 billion of standby letters of credit that support remarketing programs for customers’ variable rate demand notes.

(d) Reinsurance agreements are with third-party insurers related to insurance sold to or placed on behalf of our customers. Balances represent estimates based on availability of financial

information.

(e) Includes other commitments of $216 million that were not on our Consolidated Balance Sheet. The remaining $750 million of other commitments were included in Other liabilities on

our Consolidated Balance Sheet.

The PNC Financial Services Group, Inc. – Form 10-K 87