PNC Bank 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

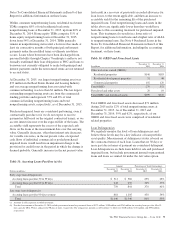

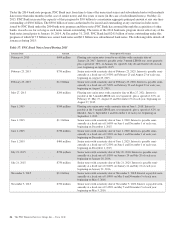

Total early stage loan delinquencies (accruing loans past due

30 to 89 days) decreased $82 million, or 10%, at

December 31, 2015 compared to December 31, 2014, driven

by reductions in consumer early stage delinquencies.

Accruing loans past due 90 days or more decreased $224

million, or 20%, at December 31, 2015 compared to

December 31, 2014 due to declines in government insured

residential real estate loans of $174 million, the majority of

which we took possession of and conveyed the real estate, or

are in the process of conveyance and claim resolution.

Accruing loans past due 90 days or more are referred to as late

stage loan delinquencies. These loans are not included in

nonperforming loans and continue to accrue interest because

they are well secured by collateral and are in the process of

collection, or are managed in homogenous portfolios with

specified charge-off timeframes adhering to regulatory

guidelines, or are certain government insured or guaranteed

loans.

On a regular basis our Special Asset Committee closely

monitors loans, primarily commercial loans, that are not

included in the nonperforming or accruing past due categories

and for which we are uncertain about the borrower’s ability to

comply with existing repayment terms. These loans totaled $.1

billion and $.2 billion at December 31, 2015 and

December 31, 2014, respectively.

See Note 1 Accounting Policies and Note 3 Asset Quality in

the Notes To Consolidated Financial Statements in Item 8 of

this Report for additional information regarding our

nonperforming loan and nonaccrual policies and further

information on loan delinquencies.

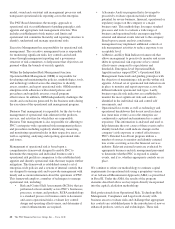

Home Equity Loan Portfolio

Our home equity loan portfolio totaled $32.1 billion as of

December 31, 2015, or 16% of the total loan portfolio. Of that

total, $18.8 billion, or 59%, was outstanding under primarily

variable-rate home equity lines of credit and $13.3 billion, or

41%, consisted of closed-end home equity installment loans.

Approximately 4% of the home equity portfolio was

purchased impaired and 3% of the home equity portfolio was

on nonperforming status as of December 31, 2015.

As of December 31, 2015, we are in an originated first lien

position for approximately 53% of the total outstanding

portfolio and, where originated as a second lien, we currently

hold or service the first lien position for an additional 2% of

the portfolio. The remaining 45% of the portfolio was secured

by second liens where we do not hold the first lien position.

The credit performance of the majority of the home equity

portfolio where we are in, hold or service the first lien

position, is superior to the portion of the portfolio where we

hold the second lien position but do not hold the first lien.

Lien position information is generally based upon original

LTV at the time of origination. However, after origination

PNC is not typically notified when a senior lien position that

is not held by PNC is satisfied. Therefore, information about

the current lien status of junior lien loans is less readily

available in cases where PNC does not also hold the senior

lien. Additionally, PNC is not typically notified when a junior

lien position is added after origination of a PNC first lien. This

updated information for both junior and senior liens must be

obtained from external sources, and therefore, PNC has

contracted with an industry-leading third-party service

provider to obtain updated loan, lien and collateral data that is

aggregated from public and private sources.

We track borrower performance monthly, including obtaining

original LTVs, updated FICO scores at least quarterly,

updated LTVs semi-annually, and other credit metrics at least

quarterly, including the historical performance of any

mortgage loans regardless of lien position that we do or do not

hold. This information is used for internal reporting and risk

management. For internal reporting and risk management we

also segment the population into pools based on product type

(e.g., home equity loans, brokered home equity loans, home

equity lines of credit, brokered home equity lines of credit).

As part of our overall risk analysis and monitoring, we

segment the home equity portfolio based upon the loan

delinquency, modification status and bankruptcy status, as

well as the delinquency, modification status and bankruptcy

status of any mortgage loan with the same borrower

(regardless of whether it is a first lien senior to our second

lien).

In establishing our ALLL for non-impaired loans, we

primarily utilize a delinquency roll-rate methodology for pools

of loans. In accordance with accounting principles, under this

methodology, we establish our allowance based upon incurred

losses, not lifetime expected losses. The roll-rate methodology

estimates transition/roll of loan balances from one

delinquency state (e.g., 30-59 days past due) to another

delinquency state (e.g., 60-89 days past due) and ultimately to

charge-off. The roll through to charge-off is based on PNC’s

actual loss experience for each type of pool. Each of our home

equity pools contains both first and second liens. Our

experience has been that the ratio of first to second lien loans

has been consistent over time and the charge-off amounts for

the pools, used to establish our allowance, include losses on

both first and second liens loans.

Generally, our variable-rate home equity lines of credit have

either a seven or ten year draw period, followed by a 20-year

amortization term. During the draw period, we have home

equity lines of credit where borrowers pay either interest or

principal and interest. We view home equity lines of credit

where borrowers are paying principal and interest under the

draw period as less risky than those where the borrowers are

paying interest only, as these borrowers have a demonstrated

ability to make some level of principal and interest payments.

The risk associated with the borrower’s ability to satisfy the

loan terms upon the draw period ending is considered in

74 The PNC Financial Services Group, Inc. – Form 10-K