PNC Bank 2015 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

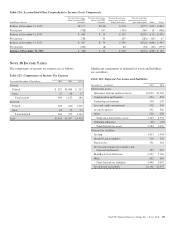

A reconciliation between the statutory and effective tax rates

follows:

Table 127: Reconciliation of Statutory and Effective Tax

Rates

Year ended December 31 2015 2014 2013

Statutory tax rate 35.0% 35.0% 35.0%

Increases (decreases) resulting from

State taxes net of federal benefit 1.4 1.2 1.1

Tax-exempt interest (2.3) (2.2) (1.9)

Life insurance (1.7) (1.7) (1.7)

Dividend received deduction (1.7) (1.5) (1.2)

Tax credits (3.9) (4.4) (3.7)

Other (2.0)(a) (1.3) (1.7)

Effective tax rate 24.8% 25.1% 25.9%

(a) Includes tax benefits associated with settlement of acquired entity tax contingencies.

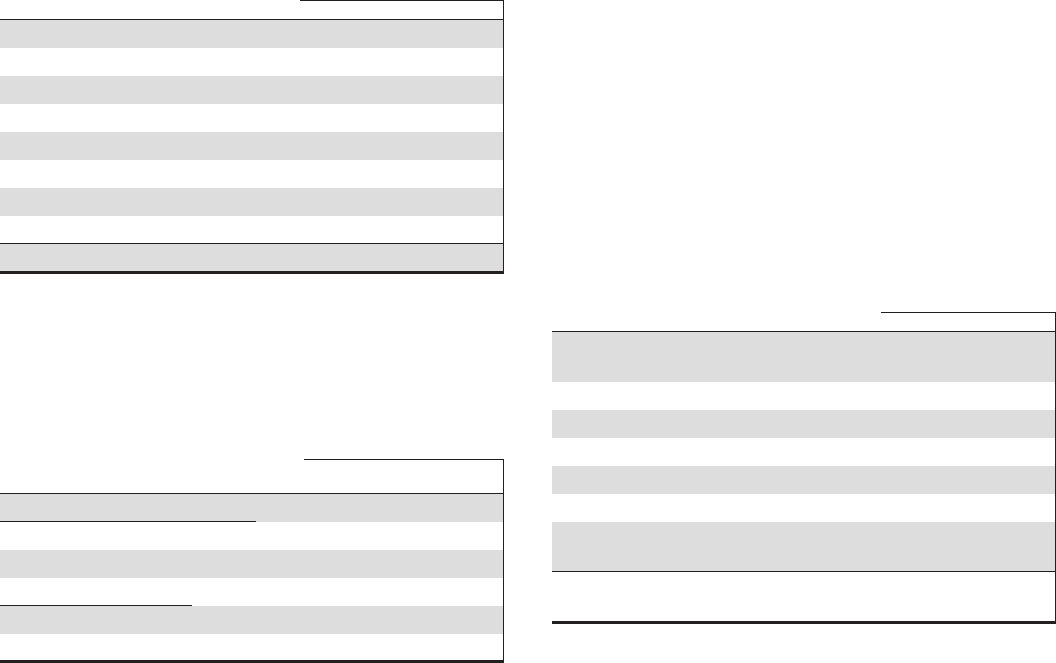

The net operating loss carryforwards at December 31, 2015

and 2014 follow:

Table 128: Net Operating Loss Carryforwards and Tax

Credit Carryforwards

In millions

December 31

2015

December 31

2014

Net Operating Loss Carryforwards:

Federal $ 878 $ 997

State $2,272 $2,594

Tax Credit Carryforwards:

Federal $ 64 $ 35

State $ 3 $ 7

The federal net operating loss carryforwards expire in 2032.

The state net operating loss carryforwards will expire from

2016 to 2035. The majority of the tax credit carryforwards

expire in 2032.

All federal and most state net operating loss and credit

carryforwards are from acquired entities and utilization is

subject to various statutory limitations. It is anticipated that

the company will be able to fully utilize its carryforwards for

federal tax purposes, but a valuation allowance of $61 million

has been recorded against certain state tax carryforwards as of

December 31, 2015. If select uncertain tax positions were

successfully challenged by a state, the state net operating

losses listed above could be reduced by $60 million.

As of December 31, 2015, PNC had approximately $110

million of earnings attributed to foreign subsidiaries that have

been indefinitely reinvested for which no incremental U.S.

income tax provision has been recorded. If a U.S. deferred tax

liability were to be recorded, the estimated tax liability on

those undistributed earnings would be approximately $34

million.

Retained earnings at both December 31, 2015 and

December 31, 2014 included $117 million in allocations for

bad debt deductions of former thrift subsidiaries for which no

income tax has been provided. Under current law, if certain

subsidiaries use these bad debt reserves for purposes other

than to absorb bad debt losses, they will be subject to Federal

income tax at the current corporate tax rate.

PNC had unrecognized tax benefits of $26 million at

December 31, 2015 and $77 million at December 31, 2014. At

December 31, 2015, these unrecognized tax benefits, if

recognized, would favorably impact the effective income tax

rate by $20 million.

A reconciliation of the beginning and ending balance of

unrecognized tax benefits is as follows:

Table 129: Change in Unrecognized Tax Benefits

In millions 2015 2014 2013

Balance of gross unrecognized tax benefits at

January 1 $ 77 $110 $176

Increases:

Positions taken during a prior period 17 11

Decreases:

Positions taken during a prior period (9) (27) (22)

Settlements with taxing authorities (52) (1) (48)

Reductions resulting from lapse of statute

of limitations (7) (5) (7)

Balance of gross unrecognized tax benefits at

December 31 $ 26 $ 77 $110

It is reasonably possible that the balance of unrecognized tax

benefits could increase or decrease in the next twelve months

due to completion of tax authorities’ exams or the expiration

of statutes of limitations. Management estimates that the

balance of unrecognized tax benefits could decrease by $4

million within the next twelve months.

PNC is subject to U.S. federal income tax as well as income

tax in most states and some foreign jurisdictions.

Examinations were completed for PNC’s consolidated federal

income tax returns for 2007 through 2010 and National City’s

consolidated federal income tax returns through 2008 and

were settled with the IRS. The IRS is currently examining

PNC’s consolidated federal income tax returns for 2011

through 2013. In addition, we are under continuous

examinations by various state taxing authorities. With few

exceptions, we are no longer subject to state and local and

foreign income tax examinations by taxing authorities for

periods before 2010. For all open audits, any potential

adjustments have been considered in establishing our

unrecognized tax benefits as of December 31, 2015.

Our policy is to classify interest and penalties associated with

income taxes as income tax expense. For 2015, we had a

194 The PNC Financial Services Group, Inc. – Form 10-K