PNC Bank 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Competition also intensified in 2015, coming not only

from our industry peers but also from the technology

sector. Recent investments by venture capitalists

in financial technology (FinTech) firms, as well as

established social media and communications firms,

are creating new offerings against which we have to

compete. And these companies aim to disintermediate

banks by moving aggressively to cater to consumers’

desires for less complexity, greater speed of delivery

and ubiquitous platforms that work independently of

clients’ primary banking relationships.

The FinTech boom we are witnessing today is not

entirely unlike the dot-com revolution of the 1990s.

There are legitimate questions about the ability of

many of these companies to withstand a downturn or

even to create a revenue model that supports their

development and marketing costs. In addition, many

of them represent significant security concerns for

consumers and our industry. Many of these services

require that customers provide their online banking

login credentials, and they have gained or seek to gain

access to the payments system despite the fact that

they are not subject to the same regulatory oversight

as banks.

Still, it is clear that FinTech is changing the way our

customers want to bank and, like the Internet, will

ultimately have a profound impact on the way we

interact with and serve our clients.

While perhaps daunting, there are clear opportunities

for banks that have the resources and risk

management systems to meet these FinTech

companies in the marketplace and offer a better,

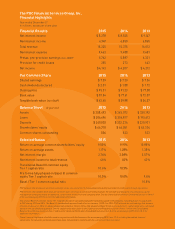

PNC’s stock reached an all-time-high share price in 2015, finishing the year

4 percent higher than at the close of 2014. And over the three-year period

ending December 31, 2015, PNC ranked first among our peer group in total

shareholder return.

In addition, we continued to grow tangible book value in 2015, with an increase of

6 percent over the prior year, and maintained strong capital and liquidity positions

even as we returned more capital to shareholders through repurchases and

higher dividends. Repurchases for the full year totaled 22.3 million common

shares for $2.1 billion, and we raised the quarterly dividend on our common stock

6 percent to 51 cents per share in the second quarter. Our capital levels have allowed us to support the growth of

the business and meet regulatory requirements while also delivering strong capital returns to our shareholders.

After years of historically low interest rates that have

squeezed net interest margins for institutions across

the industry, persistent concerns about the global

economy further delayed Federal Reserve action

until December, when we finally saw the first rate

increase since 2006.

Meanwhile, the pressures of new and expanded

regulations persisted, requiring substantial

investments of energy and capital. Across the bank,

we changed loan pricing and deposit strategies to

align them with the new liquidity coverage ratio

rules. We continued to refine and improve our

Comprehensive Capital Analysis and Review models

and processes. And we achieved a major milestone

with the announcement in June that PNC Bank,

N.A. had satisfied all of its requirements under the

Office of the Comptroller of the Currency’s mortgage

consent orders.

Steady Progress in a Challenging Time

The Next Frontier of Innovation and Competition

Three-Year

Total Return

Peer

Group PNCS&P 500

Stock price change and dividend

reinvestment. Three years ended

December 31, 2015.

13%

15%

21%

No. 1

Among

Peer Group

Creating Long-Term Value and Returning

Capital to Our Shareholders