PNC Bank 2015 Annual Report Download - page 236

Download and view the complete annual report

Please find page 236 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

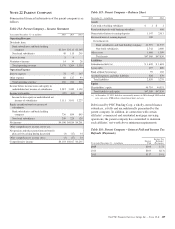

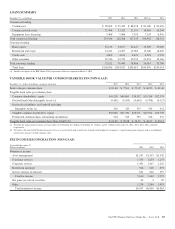

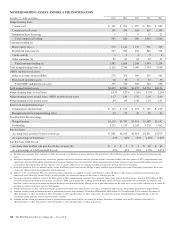

NONPERFORMING ASSETS AND RELATED INFORMATION

December 31 – dollars in millions 2015 2014 2013 2012 2011

Nonperforming loans

Commercial $ 351 $ 290 $ 457 $ 590 $ 899

Commercial real estate 187 334 518 807 1,345

Equipment lease financing 7 2 5 13 22

Total commercial lending 545 626 980 1,410 2,266

Consumer lending (a)

Home equity (b) (c) 977 1,112 1,139 951 529

Residential real estate (b) 549 706 904 845 726

Credit card (d) 33458

Other consumer (b) 52 63 61 43 31

Total consumer lending (e) 1,581 1,884 2,108 1,844 1,294

Total nonperforming loans (f) 2,126 2,510 3,088 3,254 3,560

OREO and foreclosed assets

Other real estate owned (OREO) 279 351 360 507 561

Foreclosed and other assets 20 19 9 33 35

Total OREO and foreclosed assets 299 370 369 540 596

Total nonperforming assets $2,425 $2,880 $3,457 $3,794 $4,156

Nonperforming loans to total loans 1.03% 1.23% 1.58% 1.75% 2.24%

Nonperforming assets to total loans, OREO and foreclosed assets 1.17 1.40 1.76 2.04 2.60

Nonperforming assets to total assets .68 .83 1.08 1.24 1.53

Interest on nonperforming loans

Computed on original terms $ 115 $ 125 $ 163 $ 212 $ 278

Recognized prior to nonperforming status 22 25 30 30 47

Troubled Debt Restructurings

Nonperforming $1,119 $1,370 $1,511 $1,589 $1,141

Performing 1,232 1,213 1,228 1,270 1,062

Past due loans

Accruing loans past due 90 days or more (g) $ 881 $1,105 $1,491 $2,351 $2,973

As a percentage of total loans .43% .54% .76% 1.26% 1.87%

Past due loans held for sale

Accruing loans held for sale past due 90 days or more (h) $ 4 $ 9 $ 4 $ 38 $ 49

As a percentage of total loans held for sale .29% .40% .18% 1.03% 1.67%

(a) Excludes most consumer loans and lines of credit, not secured by residential real estate, which are charged off after 120 to 180 days past due and are not placed on nonperforming

status.

(b) Pursuant to alignment with interagency supervisory guidance on practices for loans and lines of credit related to consumer lending in the first quarter of 2013, nonperforming home

equity loans increased $214 million, nonperforming residential mortgage loans increased $187 million and nonperforming other consumer loans increased $25 million. Charge-offs

were taken on these loans where the fair value less costs to sell the collateral was less than the recorded investment of the loan and were $134 million.

(c) In the first quarter of 2012, we adopted a policy stating that Home equity loans past due 90 days or more would be placed on nonaccrual status. Prior policy required that these loans

be past due 180 days before being placed on nonaccrual status.

(d) Effective in the second quarter 2011, the commercial nonaccrual policy was applied to certain small business credit card balances. This change resulted in loans being placed on

nonaccrual status when they become 90 days or more past due. We continue to charge off these loans at 180 days past due.

(e) Pursuant to regulatory guidance, issued in the third quarter of 2012, nonperforming consumer loans, primarily home equity and residential mortgage, increased $288 million in 2012

related to changes in treatment of certain loans classified as TDRs, net of charge-offs, resulting from bankruptcy where no formal reaffirmation was provided by the borrower and

therefore a concession has been granted based upon discharge from personal liability. Charge-offs have been taken where the fair value less costs to sell the collateral was less than the

recorded investment of the loan and were $128 million.

(f) Nonperforming loans exclude certain government insured or guaranteed loans, loans held for sale, loans accounted for under the fair value option and purchased impaired loans.

(g) Amounts include certain government insured or guaranteed consumer loans totaling $765 million, $996 million, $995 million, $2,236 million and $2,474 million at December 31,

2015, December 31, 2014, December 31, 2013, December 31, 2012 and December 31, 2011, respectively. Past due loan amounts exclude purchased impaired loans as they are

considered current loans due to the accretion of interest income.

(h) Amounts include certain government insured or guaranteed consumer loans held for sale totaling $4 million, $9 million, $4 million, zero, and $15 million at December 31,

2015, December 31, 2014, December 31, 2013, December 31, 2012 and December 31, 2011, respectively.

218 The PNC Financial Services Group, Inc. – Form 10-K