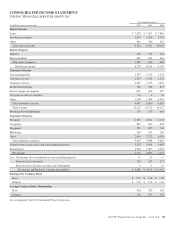

PNC Bank 2015 Annual Report Download - page 112

Download and view the complete annual report

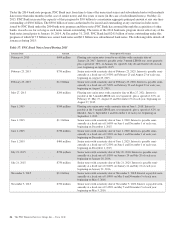

Please find page 112 of the 2015 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Loans Held For Sale

Loans held for sale totaled $2.3 billion at both December 31,

2014 and December 31, 2013.

For commercial mortgages held for sale designated at fair

value, the balance relating to these loans was $893 million at

December 31, 2014 compared to $586 million at

December 31, 2013. For commercial mortgages held for sale

carried at lower of cost or fair value, we sold $3.5 billion in

2014 compared to $2.8 billion in 2013. Total gains of $80

million were recognized on the valuation and sale of

commercial mortgage loans held for sale, net of hedges, in

2014, and $79 million in 2013.

Residential mortgage loan origination volume was $9.5 billion

in 2014 compared to $15.1 billion in 2013. The majority of

such loans were originated under agency or Federal Housing

Administration (FHA) standards. We sold $8.3 billion of loans

and recognized loan sales revenue of $420 million in 2014.

The comparable amounts for 2013 were $14.7 billion and

$568 million, respectively.

Asset Quality

Overall asset quality trends in 2014 improved from 2013.

Nonperforming assets decreased $.6 billion, or 17%, to $2.9

billion at December 31, 2014 compared to December 31,

2013. Nonperforming assets to total assets were 0.83% at

December 31, 2014, compared to 1.08% at December 31,

2013. Overall loan delinquencies of $1.9 billion at

December 31, 2014 decreased $.5 billion, or 22%, compared

with December 31, 2013. Net charge-offs of $.5 billion in

2014 declined 51% compared to net charge-offs of $1.1

billion for 2013. Net charge-offs were 0.27% of average loans

in 2014 and 0.57% of average loans in 2013.

The net charge-off comparisons above were impacted by

alignment with interagency guidance in the first quarter of

2013 on practices for loans and lines of credit related to

consumer lending. In the first quarter 2013, this alignment had

the overall effect of (i) accelerating charge-offs, (ii) increasing

nonperforming loans and (iii) in the case of loans accounted

for under the fair value option, increasing nonaccrual loans.

The ALLL was $3.3 billion, or 1.63% of total loans and 133%

of nonperforming loans, as of December 31, 2014, compared

to $3.6 billion, or 1.84% of total loans and 117% of

nonperforming loans, as of December 31, 2013.

At December 31, 2014, our largest nonperforming asset was

$35 million in the Real Estate, Rental and Leasing Industry

and our average nonperforming loans associated with

commercial lending were under $1 million.

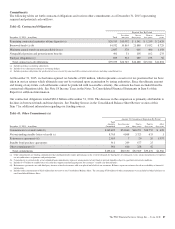

Funding Sources

Total funding sources increased $22.0 billion to $289.0 billion

at December 31, 2014 compared with December 31, 2013.

Total deposits increased $11.3 billion to $232.2 billion at

December 31, 2014 compared with December 31, 2013 due to

strong growth in demand and money market, partially offset

by lower retail certificates of deposit. Interest-bearing deposits

represented 68% of total deposits at both December 31, 2014

and December 31, 2013.

Average total deposits increased $10.8 billion to $222.9

billion in 2014 compared with the prior year. Higher average

money market deposits, average noninterest-bearing deposits,

and average interest-bearing demand deposits drove the

increase in both commercial and consumer average deposits.

These increases were partially offset by a decrease of $2.6

billion in average retail certificates of deposit attributable to

runoff of maturing accounts. Average total deposits

represented 68% of average total assets for 2014 and 69% for

2013.

Total borrowed funds increased $10.7 billion to $56.8 billion

at December 31, 2014 compared with December 31, 2013 as

higher Federal Home Loan Bank (FHLB) borrowings and

issuances of bank notes and senior debt and subordinated debt

were partially offset by a decline in federal funds purchased

and repurchase agreements.

Average borrowed funds were $48.8 billion in 2014 compared

with $40.0 billion in 2013. The increase was primarily due to

increases in average FHLB borrowings, average bank notes

and senior debt, and average subordinated debt, in part to

enhance our liquidity position. These increases were partially

offset by a decline in average commercial paper.

94 The PNC Financial Services Group, Inc. – Form 10-K